4th Qtr Newsletter – 2024

Risk On, Risk Off Investment Strategies

Portfolio diversification and fixed allocation investment strategies such as Modern Portfolio Theory’s 60% equities 40% bonds portfolio have taken a beating in the financial news the last two years. The 60/40 portfolio had one of its worst years in 2022 when bonds tanked as a result of the rapid increase in interest rates by the Federal Reserve. In 2023, a 60/40 portfolio based on the FTSE Global All Cap Index and the Bloomberg U.S. Aggregate Float Adjusted Index(1) would have lagged the S&P 500 Index(2) by 46% while diversified portfolios struggled to match the Artificial-Intelligence-turbo-charged S&P 500.

But both investment strategies are doing exactly what they were designed for – minimizing risk.

Diversified portfolios hold investments designed to offset losses in one asset class by gains in another, reducing the risk of a total portfolio meltdown. As a result, a portion of the portfolio is typically underperforming higher return assets, making it unlikely the overall portfolio will mirror index returns such as the S&P 500. This is good in market downturns but discouraging in rising markets. The cost of reducing risk tends to be reduced returns over the long term but also reduced portfolio volatility and smaller drawdowns in declining markets.

That doesn’t mean investors passively accept lower returns. Perhaps the most common complaint investment advisors hear is ‘Why is my portfolio underperforming the S&P 500?’

The same critics of diversification and 60/40 portfolio theory will quickly point out that other investment tactics also fail:

- market timing doesn’t work because no one can successfully predict market tops and bottoms,

- superior stock selectors are so rare as to be almost nonexistent,

- mutual funds and ETFs are more likely to underperform than outperform the S&P 500,

- technical analysis is fallible,

- individual investors tend to buy high and sell low,

- and that, all in all, humans are not very good investors.

Stay Calm, Carry On Investing

Before you throw in the towel on investing and decide your only option is to ride out the S&P 500’s volatility, it helps to step back and think why you are investing, what you need to achieve, and how you might be able to maintain the confidence to invest for the long run.

Investing at its most basic is buying ownership shares in a business so you can share the rewards of its growth or loaning money in exchange for the return of your principal and a known interest rate. It’s a means of making money from your savings to keep up with the erosion of inflation and taxes so that you will have more money when you need it. How much money you will need depends on how much you have to invest, your time horizon and the volatility of the financial markets over your investing horizon.

The problem with trying to anticipate future returns is the human tendency towards extremes, creating cycles where economies, asset values and inflation move from highs to lows and back again. There’s also a dismaying tendency towards starting wars and the reality that disasters can happen, wiping out a significant portion of the value of our investments. For many people, the pain of losing not just money, but the plans they had for that money, stops them from investing in the market for months and sometimes years.

Insurance is one means of limiting losses on hard assets and one’s life. We have home insurance, auto insurance, personal property insurance, health insurance, life and disability insurance, etc. While investments such as rental property can be insured, portfolio insurance is a different matter. Every insurer knows that the odds of the entire market falling 25% or more roughly every five years are pretty high.

Active investment strategies ask how do we reduce the risk of crippling market losses and keep clients invested for the long run?

Risk On, Risk Off is one of the tools to do so. Risk On is taking greater risks in pursuit of higher returns. Risk Off is when we prioritize capital preservation and avoid higher risk investments.

Historically, investor sentiment has been one of the key determinants of how willing investors are to take greater risks or to protect their capital through lower risk investments. Today, Risk On, Risk Off decisions are far more likely to be based on fundamental and technical market indicators. One of the more exciting applications of Artificial Intelligence (AI), is the ability to analyze prior markets and look for common indicators preceding changes in market direction. The same indicators can then be used to monitor current markets for similar patterns and discover new patterns. It is true that markets never follow precisely the same pattern, and global factors are always changing, however, there tend to be recuring behaviors in market cycles that indicate increasing risk.

As indicators signal increased risk, the portfolio moves to a Risk Off allocation. When market indicators are positive, Risk On becomes the allocation driver as the portfolio takes on more risk in its investments.

While it is impossible to predict turning points in markets, it is possible to monitor for signs of risk and adjust portfolios in response. If, by moving to a more conservative portfolio and muting the impact market downturns, drawdowns are reduced, the portfolio has greater leverage (i.e. more money) to profit from market recoveries.

Investors cannot invest directly in the indexes mentioned in this article. Diversification, asset allocation strategies and risk on risk off strategies do not ensure a profit and may not protect against losses in a declining market.

- The FTSE Global All Cap Index is a free-float-adjusted, market-capitalization-weighted index designed to measure the market performance of large-, mid-, and small-capitalization stocks of companies located around the world. The index includes approximately 7,400 stocks of companies located in 47 countries, including both developed and emerging markets.

The Bloomberg U.S. Aggregate Float Adjusted Index is an unmanaged benchmark representing the broad, investment-grade U.S. bond market. The fund invests in taxable investment-grade corporate, U.S. Treasury, mortgage-backed, and asset-backed securities with short, intermediate, and long maturities in excess of one year, resulting in a portfolio of intermediate duration.

- The S&P 500 Index or Standard & Poor’s 500 Index is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

A Salute to the U.S. Constitution

The ability to achieve financial security, to own property, to start a business and benefit from the protection of the law is a direct benefit of the Constitution of the United States, the most amazing document in our country’s history.

Written in 1787 and approved by 12 of the original colonies in the following year (Rhode Island held out until 1790 and 11 attempts to ratify the Constitution within the state), it has been the highest law of the land for 236 years.

A major objective of the 1787 drafters was to prevent the tyranny of the majority and provide a voice for minority opinions. The brilliance of the Constitution is also the characteristic that most frustrates political parties and would-be leaders – the balance/division of powers between the legislature, the executive branch and the judicial.

If there was one thought the drafters of the Constitution shared, it was a distrust of a too powerful government and those who would seek power through government. The Constitution is more than a document on how our government is structured, it is also a means of assuring representation of the people, limiting the power of the legislative and executive branches and ensuring conformance to the principles of the Constitution through an independent Judiciary.

While the Constitution can be changed, and has been, the process is difficult. Over the past two centuries, more than 11,600 amendments to the Constitution have been proposed; 33 have been sent to the states for ratification and 27 have been approved.

Stock Markets Evolve and Change

One of the more misleading ways to analyze the U.S. stock market is to look at the past 100 to 200 years and anticipate that market returns will in some fashion reflect the past. But today’s stock market is very different than the stock market in 1990, 2000, or even 2020, to say nothing of 50 years ago.

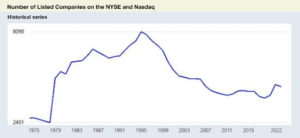

One of the most significant changes has been in the composition of the equities market. The number of public companies in the U.S. has declined since peaking in the mid-1990s. Domestic companies listed on Nasdaq and the New York Stock Exchange numbered 4,315 in 2023, compared to more than 7,300 listed domestic companies in 1996, according to research company Statista.

The Wilshire 5000 Total Market Index was designed as a market-capitalization-weighted index of the market value of all American stocks actively traded in the United States. As of December 31, 2023, the index held not 5,000, but 3,403 components.

SOURCE: Data from TheGlobalEconomy.com – Includes listed domestic companies and foreign companies which are exclusively listed, and have shares listed on an exchange at the end of the year. https://www.theglobaleconomy.com/USA/Listed_companies/

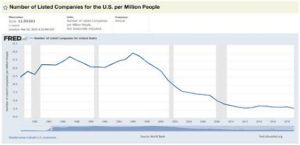

As the population of the U.S. increased, the number of publicly traded companies available to investors decreased dramatically in the last 28 years, illustrated by data from the St. Louis Federal Reserve Economic Data (FRED).

SOURCE: Source: Federal Reserve Economic Data, St. Louis Federal Reserve – https://fred.stlouisfed.org/series/DDOM01USA644NWDB

Why is that concerning? According to the Wall Street Journal(3), by 2017, microcap, small-cap and midcap stocks all but disappeared from U.S. exchanges, while the average age and average size of listed stocks increased. More mature businesses have difficulty achieving the return potential of smaller, faster growing companies.

There’s no shortage of small and growing businesses in the U.S. The U.S. Small Business Administration estimates show 33.2 million small businesses with revenue ranging from $1 million to over $40 million and an employee workforce of under 500. There are an estimated 350,000 middle-market companies in the United States accounting for more than 33% of U.S. GDP. The ‘middle market’ includes businesses that are valued between $10 million and $1 billion. The good news for many of these companies with innovative products and ideas and the desire to grow their businesses is a proliferation of private financing.

Emerging companies have found financing easier to obtain through private capital from venture funds and private portfolios, without the exposure to activist shareholders, SEC disclosure requirements, shareholder lawsuits, and the costs created by a public listing. The number of initial public offerings fell from 845 in 1996 to 154 in 2023. Most individual investors are locked out of private equity investments by ‘accredited’ investor rules which require certain criteria be met to show the investor is able to bear the risks of investments that lack the normal disclosure requirements that come with SEC registration.

While the number of public companies is shrinking, the Investment Company Institute(4) reports that as of December 2023, the total number of index-based and actively managed mutual funds exceeded 9,300, including equity, bond, money market and hybrid funds. More than 3,000 Exchange Traded Funds (ETFs), including commodity ETFs, are domiciled in the United States.

As a result, today’s financial markets are dominated not by public companies, but by investment products. Is this good or bad? It is not necessarily either, but it does change the dynamics of the financial market and competition for gains in an increasingly limited equity market. Market values are more likely to fluctuate in response to fund flows rather than fundamentals. With the potential for greater AI computerized trading, market reactions and volatility may be very different than 50 or even 10 years ago.

Recognizing that time changes financial markets helps investors view markets based on contemporary factors, not expectations created by historical data. There are no guarantees when it comes to investing, particularly with respect to the age-old caution, past performance is not indicative of future returns.

- Where Have All the Public Companies Gone? by Jason M. Thomas, Wall Street Journal, Nov. 16, 2017.

- https://icifactbook.org/

When It's Time to Spend Down Your Assets

After a lifetime of saving and investing, it’s hard to spend down assets. It took a lot of work to accumulate your net worth and whittling it down can be disturbing. Then there’s the worry of running out of money or encountering unexpected expenses that take a chunk out of your financial security net. At the same time, this is your opportunity to finally relax and enjoy new activities.

It’s time for some planning.

First Steps

Your starting point needs to be understanding how much money you need to keep daily expenses covered. This includes loan payments, utilities, insurance, property taxes, medical expenses, travel requirements, memberships, food and more depending upon your lifestyle and family commitments.

Next is determining how much money is available to you on a regular basis. This goes beyond investment income to Social Security, pensions, annuities, rental income, Required Minimum Distributions (RMDs) from retirement accounts, and known interest and dividend income. The difference between the money you need and the income you have is where liquidating assets begins.

No Simple Rules

There’s an inclination in the financial industry to look for simple answers. In 1994, financial advisor William Bengen published a paper in the Journal of Financial Planning, “Determining Withdrawal Rates Using Historical Data,” that found retirees could safely spend about 4% of their retirement savings in the first year of retirement, adjusting subsequent annual withdraws by the rate of inflation.

The major flaw with this approach is the sequence of returns. If investors encounter a bear market early their retirement years, withdrawing a fixed amount from a sinking portfolio could exhaust their financial assets much sooner than expected. The rate of inflation will also impact spending needs, to say nothing of a medical emergency or disaster.

The problem with simple answers is that retirement situations vary enormously. One retiree may opt for a very simple lifestyle, another may have family priorities or a bucket list of desired experiences. Lifestyles also change over your retirement years. You may want to travel while you can or spend more time with family. Later years may require assistance with living requirements.

A comfortable retirement requires planning, but it also requires flexibility. A lot of changes can take place over the next five or 10 years. While it can be very helpful to work with a financial advisor or estate planner, there are general rules you should follow:

- Have a cash reserve. This provides a cushion from having to liquidate assets at a loss.

- Be very wary of helping others out and incurring financial risk for yourself.

- Adjust spending in response to economic conditions.

- Minimize borrowing and eliminate costs you don’t need to incur, such as subscriptions that are rarely used.

- Think about what makes you happy and find ways to build that experience into your life. Retirement is more than not going to work. It is a time to pursue interests you have not been able to find time for before, to try new things or to become more expert at what you do enjoy.

- Socialize. Find a tribe, a social group you enjoy, volunteer, meet neighbors and interact with others. Loneliness is the greatest threat to a good retirement. It’s not just about the money.

Bored? Retiring and Not Sure What To Do? Take Advantage of the Lifetime Learning Credit

The federal Lifetime Learning Credit is a tax break available for qualifying tuition and fee payments you make to a post-secondary school (after high school). The maximum credit you can claim is 20% of up to $10,000 in eligible costs, for a maximum credit of $2,000. You need to:

- Be enrolled or taking courses at an eligible educational institution

- Be taking higher education course(s) to get a degree, a recognized education credential (like a teaching license, for example), or improve job skills

- Be enrolled for at least one academic period beginning in the tax year

Once you qualify for the lifelong learning credit, have your educational institution send you a Form 1098-T at the end of the year showing information about the tuition and fees paid to the school. Then enter the figures from the Form 1098-T on IRS Form 8863 and include it with your tax return to the IRS.