1st Qtr Newsletter – 2022

Greenwashing Among Risks of ESG Investing

Willie Sutton, born in 1901, was one of the most notorious bank robbers of the 20th century in New York. But today he is best remembered for his answer to why he robbed banks. Sutton replied, “Because that’s where the money is.”

Within every investing fad and hot stock category, fraud proliferates for a very simple reason, “That’s where the money is.” When people become willing to pay more for a name, a sentiment, an investment theory or a get-rick quick scheme, there’s someone more than willing to exploit that desire with everything from misleading statements to inventive fakes.

Ironically, environmental, social, and governance (ESG) investments have become a prime example. ESG investing criteria are designed to select stocks based on how a company acts as a steward of nature, manages relationships with employees, suppliers, customers, and its communities, and the ethical conduct of company leadership and policies. Demand for ESG and “sustainable” funds are fueling the 21st century’s biggest investing trend, according to the Forum for Sustainable and Responsible Investment.

The concept of ESG investing is admirable. Demand for ESG mutual funds and companies is on the rise, and therein lies the problem. Welcome to greenwashing and an expanding host of green fakes.

Successfully portraying a public company as “green” and sustainable has become a means of increasing stock value. Mutual fund companies who have rebranded themselves as “sustainable” report increased inflows. Greenwashing is also a means of marketing private companies to investors who want their funds invested in socially responsible companies.

There is no standardized system for assessing “green” or sustainable investments, much less ESG investments. Virtuous statements may be no more than feel-good promotions to help boost demand for a company’s stock. There’s also the dilemma of the ends justifying the means. Does producing batteries for electric vehicles offset the environmental impact of obtaining the raw materials?

ESG investing is anything but simple. It requires knowing exactly what you consider an acceptable investment and then researching to make certain that you are buying companies that truly represent your views and are not just greenwashing their operations with platitudes that sound good but have little application to the business.

It is also important to remember that you are INVESTING for your future. The socially responsible investment needs to have:

- a viable product or service

- demand for that product or service,

- good management that can run a financially sound company,

- a plan for growing the value of the company,

- the financial and intellectual capacity to make that plan reality.

If the company cannot meet just one of those criteria, you might not be investing, but instead making a financial contribution to an idea that may never offer you a return.

While ESG investing may be a morally appropriate approach to your investment portfolio, there are very real risks if you don’t take the time to thoroughly vet your investments or work with a financial adviser experienced in analyzing and selecting good companies and mutual funds. Con artists go where the money is. And right now, that includes “green,” “sustainable,” “ESG” investments.

Hide Your Home Online!

Every time you give a hotel clerk, merchant, online seller, or raffle organizer your home address you also give them the ability to see exactly where you live through street-level 360º photos available on Google Maps and competing mapping services. Sometimes that’s a little too much information, and definitely more information than they need.

The good news is you can hide your home on the online mapping services.

Google Maps:

Open Google Maps; search for your address. Click the image on the left with the little 360 º arrow to open StreetView and select the image where your house is visible. Click the three vertical dots icon in the top-left corner. Select Report a problem. This opens a page where you can select the area to blur. Click and drag on the image to point the red square towards your house. Under Request blurring, select My home. Share your email address, check the captcha box, and click Submit.

Apple Maps:

Apple’s version of Google StreetView is a feature called Look Around. If your house appears in this service, you can send an email to MapsImageCollection@apple.com and describe your problem in detail, including the exact location of your home, a screen capture of the image and why you want the image hidden. Apple will review your request and hide your house from its service if it deems your request appropriate.

Microsoft Bing Maps:

Open Bing Maps and search for your address. In the left pane, scroll down and click any image with the StreetSide label to open a 360º view of the area. Click Report a privacy concern with this image in the lower-left corner. This opens a new page where you can select House next to the question “What kind of a concern do you have?” Select your house in the image (a red dot appears on the image). Click Submit to report the image to Microsoft and ask the company to remove the image.

Stagflation and Why It has Economists Worried

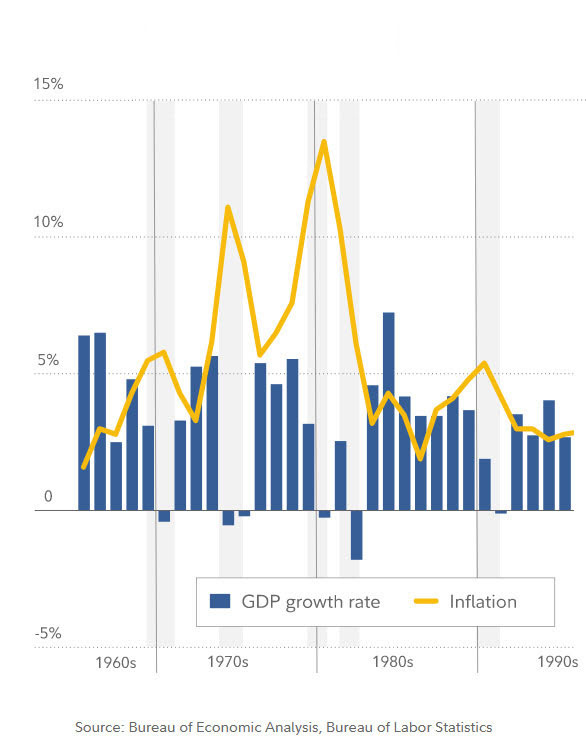

The term “stagflation” was coined roughly 50 years ago during the 1970s to describe the period from 1966 through 1982 marked by stagnant growth, higher inflation (reaching more than 14% in 1980) and high unemployment. Over the 17-year period, the Consumer Price Index was 6.8% annualized, while real GDP grew at a 2.2% annualized rate.

In part, historians believe that stagflation was prolonged by expectations. Expecting continued increases in the cost of goods, people bought more and increased demand pushed prices higher. This led to demands for increased wages, which pushed prices higher yet. Labor contracts and government benefits such as Social Security began to include cost of living increases, further fueling inflation. The federal government’s need for funds increased government borrowing, which increased the budget deficit, which pushed up interest rates, which increased costs for businesses and consumers further.

During the period, the U.S. economy suffered another jolt in October 1973, when the Organization of the Petroleum Exporting Countries (OPEC) declared an oil shipping embargo to the United States and Israel’s European allies in response to Western support of Israel during the Yom Kippur War. The embargo caused oil prices to jump by over 300%.

Combined with high energy prices, business investment stalled, and unemployment increased. The stock market performed exceptionally poorly in period, lagging intermediate-term bonds.

Stagflation ended in a deep recession between 1980 and 1982. A primary cause was the disinflationary monetary policy adopted by the Federal Reserve.

On a theoretical basis, stagflation should not happen. In a normal market economy, slow growth prevents inflation. Consumer demand drops enough to keep prices from rising. The developing theory after the 1970s was that stagflation can only occur if government policies disrupt normal market functioning. Regardless of cause, stagflation makes it harder for many to meet basic needs, especially those among the unemployed. For those who are employed, stagflation can lead to risks of job losses and lower wages, which would decrease consumer confidence and purchasing power.

Is stagflation possible in today’s economy? No one really knows.

Our current inflation originated in higher demand for goods, possibly fueled by government Covid subsidies and the shutdown of service industries. That demand ran head on into supply disruptions from shuttered economies during the first year of Covid, a broken supply chain, and a lack of employees to meet production demands. Rising inflation fueled demands for higher pay and triggered cost of living increases. Higher wages and cost of living increases are unlikely to go away as the economy recovers, adding fuel to the inflation spiral.

Unemployment is another puzzle. Yes there are jobs, but millions of people are missing from the employment market. They have not returned to work as the economy recovered. Where are they and will they return?

An estimated 3 million of the disproportionate number of older Americans pushed out of the workforce by the combined health crisis and economic downturn retired earlier than expected.

Millions of women have not returned to the workforce. With the loss of daycare and closed schools, many found their time demanded at home with children. While most schools have reopened, others continue remote learning because of a shortage of teachers. The unpredictability of Covid policies and quarantining of children at home have also made it difficult for women to return to work.

According to the Brookings Institute, around 7 million American men between the ages of 25 and 54 – mostly too old to be in school and too young to retire – are neither working nor looking for work.

The loss of workers adds pressure to wage increases and reduces the productivity of businesses who are unable to staff up to meet demand, slowing growth and fueling inflation.

That brings us to government policies disrupting normal market functioning. Has government intervention gone too far or not far enough? One way or another, we are going to find out in the coming years.

Replacing “Retirement” with the Goal of “Financial Independence”

All too often financial planning revolves around the idea of retirement. Retiring comfortably becomes the purpose for saving. Retire and stress disappears. Retire and you can do what you want. Retire and you don’t have to take anyone’s orders again. But retirement comes with its own share of problems. For some, age has taken the fun out activities they’ve waited to enjoy. Others find themselves drifting without a purpose. And often money is still a worry.

Covid and the pandemic lockdowns gave a lot of people a chance to stop and question what they wanted out of life in the long run. For many, the answer wasn’t years of work with retirement when Social Security payments become available, but rather the financial independence to live a more meaningful life. Instead of working to build retirement savings, their plan changed to building financial independence to live the way they want now.

Financial independence doesn’t necessarily mean never having to work another day in your life. What is does mean is building sufficient financial resources that you have a safety net that allows you to take chances with your career and with your life. Maybe you want to change careers, invest in a business, take a sabbatical, focus on writing a book. Having sufficient funds to refocus your life is one form of financial independence.

How do you achieve financial independence? It helps to have an idea where you want to go…what you want those funds to give you an opportunity to do. Then you need an idea of how much money you might need. If you want to purchase rental property, start a business, learn a new career, or live off the land, there’s always a cost. You are far more likely to achieve your goal if you know how much funding you will need to accumulate.

Then it’s time to act. The first step is to LIVE BELOW YOUR MEANS. If you spend every dollar you make, you will never be able to accumulate financial wealth. You need to determine how much money you really need to live, and where you can economize to increase your rate of saving. Can you take a side job to add to your savings? Are there possessions you might sell to raise funds to invest?

At this point, if you have a partner or spouse, it is essential to make certain they are willing to commit to the same strategy. Achieving financial independence is hard work, particularly if you are in a hurry to do so. There’s a reason many people fail to accumulate wealth even with substantial income. Your priorities need to change from having the latest, greatest entertainments, toys and vacations to planning for the future.

As you accumulate funds, you want them to be working for you. This is where a good financial advisor can be of assistance, particularly if you are not experienced at investing. While you may be in a hurry to achieve financial independence, get-rich-quick schemes and can’t-fail investments are incredibly risky. Slow and steady tends to be a much surer road to wealth accumulation than chasing hot investments.

If the past two years have made you question what you really want out of life, then let’s talk about how you can achieve your new goals and what it will take for you to create financial independence long before you might want to retire.

Inflation is Changing the Numbers for Benefits and Federal Taxes

Inflation is making itself felt in more than daily prices. The Social Security Administration has reported that approximately 70 million Americans will see a 5.9% increase in their Social Security benefits and Supplemental Security Income (SSI) payments in 2022 as cost-of-living increases.

The IRS is not as generous in its increases, which take effect with the 2022 tax year. While the pending “Build Back Better” legislation, with its slew of tax increases, may change the following, so far the IRS is planning on the following:

- The annual exclusion for gifts increases to $16,000 for calendar year 2022, up from $15,000 for calendar year 2021.

- Die during 2022 and an individual’s estate has a basic federal estate tax exclusion amount of $12,060,000, up from a total of $11,700,000 for estates of individuals who died in 2021.

- Barring changes from the Build Back Better Bill now before Congress, there are no changes in the income tax rates, but income tax brackets adjust upward 3.3% for the lowest bracket and 3.1% for the higher brackets.

- The Alternative Minimum Tax exemption amount for tax year 2022 is $75,900 for individuals, up 3.25%, and begins to phase out at $539,900 ($118,100 for married couples filing jointly, for whom the exemption begins to phase out at $1,079,800).

- The Standard Deduction rises to $25,900, for married couples filing jointly for tax year 2022, up 3% from the prior year. For single taxpayers and married individuals filing separately, the standard deduction rises to $12,950 for 2022. For heads of households, the standard deduction will be $19,400 for tax year 2022, up $600.

- There is NO increase to maximum contribution limits for IRAs.

- However, IRA income eligibility limits for employees with a retirement plan available from their employer increase a little over 3% for individuals and married couples filing jointly or qualified widow(er) for full and partial contributions to an IRA account.

- Roth IRA account income eligibility limits for individuals with a retirement plan available from their employer increase $4,000 for individuals and $6,000 for married filing jointly couples or qualified widow(er) for full and partial contributions to an IRA account.

- There are increases to maximum contributions to 401(k), 403(b), most 457 plans, the federal government’s Thrift Savings Plan, and SIMPLE IRA plans, but catch-up contributions remain fixed at 2021 levels.

This is just a quick overview of the many changes that will take place for benefits and taxes indexed to inflation. After years of minimal if any changes, it’s easy to assume that income brackets and amounts are the same. They aren’t. Review the new tax brackets and other indexed accounts as you begin planning for 2022.