2nd Qtr Newsletter – 2023

Does the Presidential Cycle Mean an Up Market for 2023?

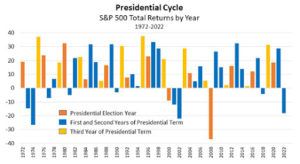

The Presidential cycle is a curious, but remarkably persistent trend. The stock market has not closed down in the third year of a president’s term since 1939.

Why would this trend persist? One theory is that while there are limits to presidential power and to the ability of the party in power to influence the economy, there is also a strong incentive for individuals in power to do all they can to influence financial markets and the economy to support their re-election. Thus, actions that might have a negative impact on the markets are taken early in the term, followed by actions to support strong market prices nearer the next election. And it does appear that weak markets in the second year of the president’s term are almost always followed by strong years.

Another trend favoring good performance in 2023 is the rarity of back-to-back down markets. Since WWII, back-to-back down markets have occurred only in 1973-74, 2000-02.

With that said, past performance is not indicative of future returns. Black swans, those unpredictable events which disrupt expectations, are a very real threat to the best market predictions and trends. In 1939, Hitler invaded Poland, sending markets down worldwide. Investing is never without risk.

Do You Trust Your Phone a Little Too Much?

Most cell phones contain enough data to allow scammers to steal your identity, access your financial accounts to engage in credit card fraud or even empty your bank accounts. Passwords, PINs, login IDs, account information, etc. are valuable currency for hackers. Using your personal phone for work could even give a hacker access to your company’s data and networks.

Android devices tend to be more vulnerable to hackers, but iOS devices can also be hacked, and hackers don’t have to steal your phone to do so. Fake Wi-Fi networks can redirect you to malicious sites. Phishing emails or texts can contain malicious links. SIM card swaps can transfer your phone number to the hacker’s device and provide access to your accounts.

Some basic steps to protect your phone:

- Keep phone and apps updated.

- Use a Virtual Private Network (VPN) to create a secure tunnel between your device and the internet.

- Turn off Wi-Fi and Bluetooth when not in use.

- Avoid public charging stations. Use portable power packs if you need to charge while traveling.

- Lock your SIM card.

- Avoid downloading apps from third-party app stores.

- Keep your phone safe from theft.

- Use strong unique passwords.

For more information on fraud defense, read the last article in this newsletter.

The IRS May Consider You a Small Business

Taxpayers are required by law to accurately report ALL income in the form of money, property, or services, whether or not they receive a Form 1099-K or other information return. But (no surprise), tax compliance is higher when amounts are subject to reporting, such as Form 1099-K.

The American Rescue Plan of 2021 set out to increase compliance and tax revenue by changing the 1099-K reporting standard for third-party settlement organizations (TPSOs) from $20,000 or more than 200 transactions per year to $600 in transactions. TPSOs include PayPal, Venmo, Cash App, Square, Amazon, payment card networks (credit/debit cards, online wallets, gift cards) and others. If you receive $600 or more through a TPSO, the firm is required to report it to the IRS and send you a 1099-K form. The $600 requirement is not supposed to apply to personal transactions such as sharing the cost of a purchase, a car ride or meal, birthday or holiday gifts, or paying a family member or other for a household bill.

IRS Form 1099-K reporting was supposed to become effective with your 2022 tax filings. Due to the complexity of compliance, the IRS delayed the start date for reporting third-party settlement transactions to those made in 2023 and on.

What does this mean for you if you use a TPSO?

If you actively use settlement services for total transactions in excess of $600 a year, congratulations, you may be a small business to the IRS. Every TPSO 1099-K form will need to be accounted for on your 2023 tax return. You MUST keep good records of all transactions, including the costs associated with the goods and/or services you sell even if it is second-hand clothing. Your 1099-K will show only the total transaction amount for the year. You will need to provide on your tax forms the cost of goods or services sold including whether you made a profit or loss. If you are audited, you will need documentation to prove your costs.

If you currently mingle personal transactions and business settlements, label transactions clearly when you make them to avoid having personal transactions reported as revenue. You might want to set up two different accounts to separate income from personal transactions. You still need to keep good records for all TPSO accounts in the event personal transactions are reported as income on your 1099-Ks and you are audited by the IRS.

If you believe the information on a Form 1099-K, is incorrect, the form has been issued in error, or you have a question relating to the form, you will need to first contact the filer, whose name and contact information appears in the upper left corner on the front of the form and request an amended 1099-K. You may also contact the payment settlement entity whose name and phone number are shown in the lower left side of the form.

According to the IRS guidelines, “If you cannot get the form corrected, the error should be reported on Form 1040, Schedule 1, Part I, Additional Income, Line 8z, Other Income, with an offsetting entry in Part II, Adjustments to Income, Line 24z, Other Adjustments.”

Yep, this is going to make your tax accountant richer and more frustrated. It will also impose significant reporting costs on the TPSOs, costs that can be expected to be reflected in your fees to use the TPSO. Time will tell whether the $600 threshold reporting requirement actually creates more revenue for the federal government once IRS costs to process more complex tax returns and conduct audits are considered.

Keep good records. And be prepared to include more 1099-K forms on your 2023 tax returns.

The Details Matter - SECURE 2.0 Act

SECURE 2.0 Act of 2022, signed into law on December 29, 2022, is designed to substantially improve retirement savings options. The Act contains 92 new provisions to promote savings, boost incentives for businesses to offer retirement accounts, and offer more flexibility to those saving for retirement. A few of the more actionable items are mentioned below. Before you act to take advantage of provisions of the Act, however, you need to read the details and verify the dates provisions of the Act become effective. They range from immediately to 10 years.

- $35,000 in unused contributions and gains in a 529 plan can be rolled over to a Roth IRA in the 529 plan beneficiary’s name.

- This provision affects distributions from 529 plans after Dec. 31, 2023.

- The 529 plan must have been maintained for 15 years prior to distribution to the Roth IRA.

- The amount converted can’t exceed the aggregate amount contributed to the 529 plan (plus earnings attributable) before the five-year period ending on the date of the distribution.

- The amount, when added to any eligible regular traditional and Roth IRA contribution made for the 529 plan’s beneficiary for the year, can’t exceed the IRA contribution limit in effect for the year.

- The transfer must be directly from the 529 plan to the Roth IRA (trustee to trustee).

Account stuffing in the five years before distribution is ineffective. The annual distribution from the 529 plan is limited to the individual’s contribution limit in effect that year, less all other contributions to IRA and Roth IRA’s during the year. If the rollover is the only IRA contribution, the individual is limited to rolling over $6,500, plus $1,500 if over age 50, under current contribution limits.

- Increased age for Minimum Required Distributions

- 73 as of Jan. 1, 2023,

- 75 as of Jan. 1, 2033 – 10 years later

- Lower penalty for missing Required Minimum Distributions (RMD)

- Effective Jan. 1, 2023, the excise tax of 50% if an individual fails to take their RMD from a retirement plan, is reduced to 25%.

- The excise tax is further reduced to 10%, if the individual: (1) receives all their past-due RMDs; and, (2) files a tax return paying such tax before receiving notice of assessment of the RMD excise tax and within two years after the year of the missed RMD.

- Elimination of RMD for Roth 401(k) and 403(b) plans

- Starting in 2024, no minimum distributions will be required from Roth accounts in workplace retirement plans.

- Starter 401k Plan, effective 2024

- Permits an employer that does not sponsor a retirement plan to offer a starter 401(k) plan (or safe harbor 403(b) plan).

- Requires that all employees be default enrolled in the plan at a 3% to 15% of compensation deferral rate.

- No employer contributions permitted.

- The limit on annual deferrals is $6,000 with an additional $1,000 in catch-up contributions beginning at age 50. Indexed after 2024. (This is below the current IRA limit)

- No ADP or top-heavy testing required. Can exclude union, non-resident aliens, and age/service excludable.

- Employers of any size are eligible to adopt a Starter 401(k) or 403(b) plan, provided they do not offer any other retirement plan.

- Automatic Retirement Plan Enrollment, effective 2025

- Beginning in 2025, employers are required to automatically enroll eligible employees in new 401(k) or 403(b) plans with a participation amount of at least 3% but no more than 10%.

- The contribution escalates at the rate of 1% per year up to a minimum of 10% and a maximum of 15%.

- Employees can opt out of the plan if they wish.

- Small businesses (with 10 or fewer employees), new businesses (fewer than three years old), church plans, and government plans are exempted from the provision.

- Easier access to retirement funds

- Starting in 2024, up to $1,000 can be withdrawn from a retirement account for personal or family emergencies. Funds must be replaced within the next three years before a similar withdrawal can be made.

- Starting in 2024, survivors of domestic abuse may withdraw the lesser of $10,000 or 50% of their retirement account without penalty.

- Effective with passage of SECURE 2.0 Act, victims of a qualified, federally declared natural disaster may withdraw up to $22,000 from their retirement account without penalty. Withdrawal is treated as gross income over three years without penalty.

- Effective 2024, employers can set up a separate emergency savings fund alongside their retirement accounts for non-highly compensated employees (who make under $150,000 in 2023) to set aside up to $2,500 per participant.

These are just a few of the changes created by the SECURE 2.0 Act. Among the other 80+ other changes, you might find of interest is the increased amount individuals can move to a qualified longevity annuity contract. One provision encourages people over age 70 to make distributions from their IRA directly to qualifying charities (a QCD) up to $100,000 per year. A one-time $50,000 Qualified Charitable Distribution can be directed to either a charitable remainder trust or a charitable gift annuity. SIMPLE and SEP Retirement plans are now Roth permitted.

Before you act to take advantage of any of the provisions noted above or other benefits of the Act, work with a qualified professional advisor. There are a considerable number of details in the SECURE Act and those details matter a great deal.

Preventing Fraud Can Save You from Financial Disaster

There are a lot of people out there who think they have just as much a right to your money as you do. And they have no hesitation hacking into your accounts or defrauding you in person. Your digital phone may be your greatest vulnerability. If you notice anything unusual happening with your phone – excessive data or battery use, poor or bizarre performance, unrecognized text messages or apps on your phone or apps opening and closing unexpectedly, it’s time to get very worried.

There has been a tremendous surge in financial fraud, so once again we are cautioning clients, family and friends that they must take steps to protect their financial assets.

- Understand what phishing attacks are and never, ever give account numbers, login IDs or passwords in response to emails, phone calls, or internet alerts. Contact your financial institution, the IRS or whoever the contact claims to be directly to verify any suspicious contacts.

- Use two or multi-factor authentication to log into financial accounts, credit cards, and companies such as Amazon or PayPal that have your payment information.

- Only download verified apps from reputable websites, such as the App Store or Google Play.

- PIN protect the SIM card in your phone. Do not allow a salesperson to change the SIM card or use a new one sent to you in the mail. Contact your provider if you have questions.

- Set email and/or text alerts to monitor bank and investment accounts for fraudulent activity.

- Use unique, strong passwords for each financial provider and change them periodically.

- Do not save financial passwords on your phone.

- Use your device’s security functions to protect data – including the ability to track your stolen device, disable it and wipe it remotely.

- Consider using a Virtual Private Network (VPN). With a VPN no one can see what you are doing online and no one will know who you are or where you live.

- Don’t share too much personal information on social media, such as vacation plans, major purchases, etc, that open the door for a fraudulent approach.

If you do nothing else, set account alerts! The sooner you can detect a problem the faster you can shut accounts and devices. Use both text and email alerts depending upon the importance of the alert.

Make certain your financial advisor verifies any transaction instructions with a personal contact and NEVER include account information when emailing instructions to your advisor.

Remember you have NO PROTECTION if your debit card is hacked. Once money is withdrawn from your account it is gone. Credit cards do have protection against fraudulent charges, but you need to understand the limits of that protection.

If you think you have been hacked, contact your banks, financial accounts, and credit cards to freeze your accounts. Close accounts with access to bank and credit card accounts such as Venmo, PayPal, Amazon, etc. Let trusted friends and family know you have been hacked and to alert them to watch for suspicious messages or activity. Delete programs you do not recognize or from third-party sources.

Don’t count on help from law enforcement or the government to recover funds lost to digital fraud. It is too prevalent and too sophisticated in many instances for their abilities to trace or identify the source.

Technology is a wonderful tool, but it can also be used against you. You are responsible to take steps to prevent hacking and financial fraud.