1st Qtr Newsletter – 2024

The Confidence Factor - One of the Uncertainties of Investing

Investing is a relatively simple concept. Put your money to work, so that someday you won’t have to work. For most investors, that comes down to:

- Purchase fractional ownership in a business by owning the stock of good companies and sharing their future increase in value as well as payouts to shareholders.

- Loan money to good companies (or government entities) that will repay their debts and allow you to build net worth through interest payments or speculation on the future direction of interest rates.

There’s lots of good advice on how to pick the right companies and when to loan money. But at times, even the best investment plan goes awry. The investment is doing everything it should, but prices lag or fall. Or they soar well above fair valuation.

It’s times like these that help to recall Warren Buffett’s quote, “Remember that the stock market is a manic depressive.”

As much as investors would like to believe markets are efficient, efficiency tends to occur only over the long run, and even that doesn’t help if one has to sell into a declining market.

Economist John Maynard Keynes was one of the foremost economists of his day and his Keynesian economic theory was common college fare up through the 1980s. In 1919, at the age of 36, he decided to become independently wealthy by speculating in currency trends using margin to leverage his investment. By April 1920, he considered himself a wealthy man. A month later he was broke and in debt when the U.S. dollar failed to rise, and the Deutschmark refused to fall. From that experience came one of Keynes’ best remembered quotes, “Markets can remain irrational longer than you can remain solvent.”

Every investment is based on an expectation of how the future will play out over time. Sometimes that future doesn’t work out due to changing circumstances. But often consumer confidence is an intervening factor, influencing short-term values and market volatility. Investors may lose confidence in management, in demand for the product, in the economy, in the outcome of geopolitical events and a host of other factors. Confidence that a rising market will continue and the belief that this time is different can cause prices to keep rising well beyond fundamental expectations, driving more investor demand and excess valuation.

Source: The Conference Board. Shaded areas indicate recessions.

What often matters the most is not the reported confidence index number but the trend. Are investors and consumers growing more conservative or more exuberant? Is this trend one you want to invest in or avoid? Over the short term, great fundamentals can be overwhelmed by a loss of consumer and investor confidence.

New Year Checklist – Essential Documents

The start of a new year is a good time to review your essential documents to make certain they are up-to-date and reflect your current wishes. It’s also a good idea to make sure you have the following documents in the event of a health issue or accident.

- Up-to-date beneficiaries on your retirement accounts, life insurance and transfer-on-death accounts. To check your current beneficiaries, contact your financial institutions.

- If you have used transfer-on-death deeds to property or automobiles, make certain those are up to date as well. Property deeds should be on file with your county. Your automobile title will indicate any transfer on death instructions. Not every state allows transfer-on-death titles for real estate or vehicles, but if available they are very handy for keeping property out of probate. These designations take priority over your will. It doesn’t matter what your will states or your intentions, if an account has a designated beneficiary that is who inherits.

- Durable Power of Attorney – This document designates someone to make legal decisions if you are no longer competent to do so. Make certain any existing Durable Power of Attorney designation names someone you trust and who is capable of making decisions on your behalf.

- Power of Attorney for Healthcare – This document designates someone to make healthcare decisions for you in the event you are not able to represent yourself.

- Living Will – This puts in writing what you want done when it comes to healthcare decisions in the event you cannot speak for yourself. A living will also provides binding guidelines for your Healthcare Power of Attorney designate to follow.

- Last Will and Testament – Should you die, this states who you want to receive your personal property and belongings. Without a Will, your assets will be distributed according to state law through probate.

- Funeral Planning Declaration. If you have specific preferences as to what happens to your remains should you die and the type of services you want, these should be in your Funeral Planning Declaration. If you have made pre-paid arrangements, this declaration should include those details.

Share these documents with family members and your Power of Attorney designees. Often doctors would like a copy of your living will. It doesn’t do any good to have these documents if no one knows about them when they are needed.

There are circumstances where wills and named beneficiaries don’t count. Married spouses are automatically entitled to 401(k) assets on the death of the account holder unless they formally waive that right. The waiver must be notarized.

Defined contribution plans are commonly written so that protections apply to surviving spouses.

With respect to Individual Retirement Accounts (IRAs), in most states, the account holder can name someone other than their spouse as an account beneficiary without getting a waiver from the spouse. In a community property state, the accountholder must get a waiver from the spouse.

While no one likes to think about death or illness, it is a kindness to family and heirs to have these documents in place. Without them, you lose control over these decisions. Estates without a will in place are subject to probate in accordance with the state’s probate laws and incur legal expenses in the process.

Reality Check from Charlie Munger

Charles T. Munger, vice chairman of Berkshire Hathaway and Warren Buffett’s closest associate, died November 28, 2023, at age 99. A remarkable man, who lived a remarkable life, Charlie left behind advice that we have tried hard to take to heart. Shared below are thoughts from Charlie Munger well worth remembering:

- “You have to keep learning if you want to become a great investor. When the world changes, you must change.”

- “Live within your income and save so that you can invest. Learn what you need to learn.”

- “Another thing, of course, is life will have terrible blows, horrible blows, unfair blows. Doesn’t matter. And some people recover, and others don’t. And there I think the attitude of Epictetus is the best. He thought that every mischance in life was an opportunity to behave well. Every mischance in life was an opportunity to learn something and your duty was not to be submerged in self-pity, but to utilize the terrible blow in a constructive fashion. That is a very good idea.”

- “The idea of caring that someone is making money faster [than you are] is one of the deadly sins. Envy is a really stupid sin because it’s the only one you could never possibly have any fun at. There’s a lot of pain and no fun. Why would you want to get on that trolley?”

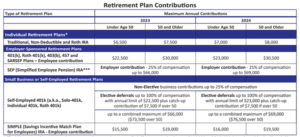

Inflation Adjustments from the IRS Affect Retirement Accounts, Estate Taxes, and More

While the rate of inflation may be moderating, it is still causing multiple changes in everything from Social Security and benefit programs to retirement plans, income tax brackets and estate tax exemptions.

The Individual Retirement Account (IRA) was pegged to inflation in 2001. Effective 2024, the contribution limit is $7,000, with an annual $1,000 catch up contribution for individuals over 55. As a result of inflation, the income ranges for determining eligibility to make deductible contributions to traditional Individual Retirement Accounts and to contribute to Roth IRAs all increased for 2024.*

* The 2024 income phase-out range for taxpayers making contributions to a Roth IRA is increased to between $146,000 and $161,000 for singles and heads of household, up from between $138,000 and $153,000 in 2023. For married couples filing jointly, the 2024 income phase-out range is increased to between $230,000 and $240,000, up from between $218,000 and $228,000 in 2023. The ability to make tax-deductible contributions to a traditional IRA while participating in a workplace retirement account is also subject to income limits that vary based on filing status and participating or non-participating spouse. Make certain you review and understand income limitations prior to making contributions.

Estate Tax Inflation Adjustments

The federal estate tax exemption increases in 2024 to $13.61 million (up from $12.92 million) for individuals. For married couples, the combined exemption amount increases to $27.22 million.

Typically, one’s heirs will not pay the federal estate tax unless the value of the estate exceeds the exemption amount. Estate values in excess of the exemption will incur federal estate taxes starting at 18% for up to $10,000 to 40% for asset values in excess of $1 million.

A number of states impose their own estate taxes with varying exemption amounts. There are also a handful with an inheritance tax, which can impact even small estates.

The bad news for large estates is that effective 2026 the basic estate exemption amount is set to drop back down to around $7 million ($5 million adjusted for inflation).

For individuals with large estates who fully expect to live beyond 2025, it is possible to take advantage of the higher gift and estate tax exclusion in effect through 2025 and not be adversely impacted after 2025.

In November 2019, the Treasury Department and the Internal Revenue Service issued final regulations confirming that individuals taking advantage of the increased gift and estate tax exclusion amounts in effect from 2018 to 2025 will not be adversely impacted after 2025 when the exclusion amount is scheduled to drop to pre-2018 levels. To address concerns that an estate tax could apply to gifts exempt from gift tax by the increased basic exemption amount (BEA), the final regulations provide a special rule that allows the estate to compute its estate tax credit using the higher of the BEA applicable to gifts made during life or the BEA applicable on the date of death.

IRS 1099-K Requirement Changes

The American Rescue Plan Act of 2021 requires Form 1099-K to be issued by third-party payment networks – including Venmo, Zelle, eBay, PayPal, etc. – for any accounts whose annual business transactions exceed $600. Enforcement was to begin as early as 2022. Prior to adoption of the legislation, the IRS reporting threshold was $20,000 and 200 or more transactions. The new legislation was expected to cause the distribution of an estimated 44 million Forms 1099-K in 2023.

The IRS had already pushed back reporting enforcement through 2023. In its most recent announcement, enforcement in 2024 will start at $5,000, with lower thresholds phased in over future years.

Creating Money Smart Teens

Today’s kids are growing up in a very different financial world than their parents. They may never use a checkbook, rarely handle cash, and face more ways to get in trouble financially than earlier generations ever imagined. That’s not to say they don’t understand many of the basics of budgeting and planning ahead to achieve goals. Digital gamesmanship can be a great teacher in some ways. While it would be nice to think that teens are taught money smarts at school, the truth is you had better be prepared to share that knowledge at home.

Today’s kids are growing up in a very different financial world than their parents. They may never use a checkbook, rarely handle cash, and face more ways to get in trouble financially than earlier generations ever imagined. That’s not to say they don’t understand many of the basics of budgeting and planning ahead to achieve goals. Digital gamesmanship can be a great teacher in some ways. While it would be nice to think that teens are taught money smarts at school, the truth is you had better be prepared to share that knowledge at home.

Among the most critical concepts to teach teens and even younger children include:

The importance of a budget and living within your means. How much money do you have, what are the necessary costs you have to cover and how do you divide the remaining sum between non-essentials and savings?

Why savings are so important as a safety net. Without savings an unexpected cost or loss of income can become a financial disaster. Bad things happen to good people who are doing their best. Savings help one bounce back from auto repairs, thefts, disasters, a medical problem, and so much more.

The high cost of using credit cards to borrow money. Failing to pay credit card bills in full every month and carrying balances is one of the worst financial practices. With many cards, users end up paying interest on interest, entering an unending debt cycle.

What a credit score is and why it matters.

Keeping your money safe when making online transactions and avoiding scammers and ID theft. This is not your parents’ financial world. Our dependence on the internet has created vulnerabilities that can empty bank accounts and destroy our financial security. Too many people trust technology and fail to take precautions to protect their accounts.

The reality of taxes. An hourly wage or salary is not the amount they will take home. Social Security and Medicare taxes impact even the smallest paychecks. Depending upon where one works, there may be head taxes, and other fees. Having too little withdrawn for income taxes can mean an unexpected cost when taxes are filed.

The importance of charity. It may seem contradictory to focus on creating savings on one hand and giving away money on the other, but studies have shown that people who make charitable donations tend to be happier with their lives. Maybe it is the reward of being nice, or it may be the realization that there is always someone with more money problems than you. But if it works, use it.

Unsure where to start talking money smarts with your teen? There are a number of online resources that may help. Many of these are designed for classroom use, but the information applies to home use as well.

https://www.fidelity.com/learning-center/financial-literacy

https://www.weareteachers.com/money-skills-teens/

https://www.consumerfinance.gov/consumer-tools/money-as-you-grow/teen-young-adult/

https://www.businessinsider.com/personal-finance/teaching-teens-about-money

https://www.ala.org/pla/resources/tools/youth-services/teen-financial-literacy