Forecast survey: Expect Fed to slash interest rates near zero in 2020 to battle coronavirus fallout

The Federal Reserve’s first emergency rate cut since the 2008 financial crisis likely won’t be the last reduction this year, according to the nation’s leading U.S. central banking experts.

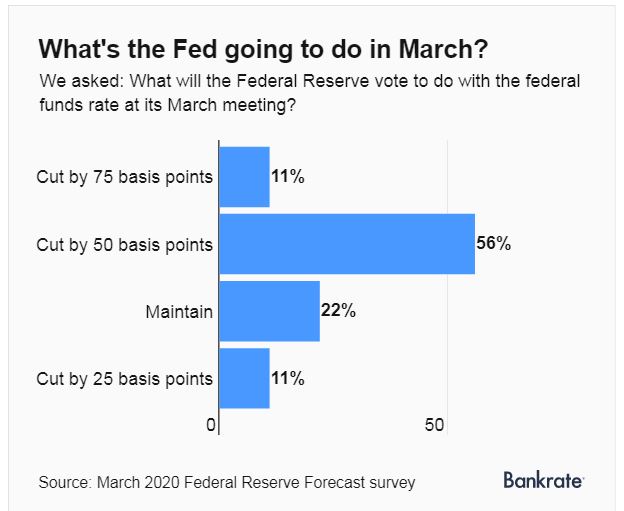

The Fed is widely expected to trim interest rates by half a percentage point – matching the size of its unscheduled March 3 cut – when it concludes its next two-day meeting Wednesday, according to economists polled for Bankrate’s March 2020 Federal Reserve Forecast survey. After that, the Fed is largely expected to cut at least one more time, respondents reported.

Experts were split between two forecast ranges for the federal funds rate by year-end. A third are predicting that the fed funds rate will be in a target range between 0.25-0.5 percent by year-end, meaning just one quarter-point cut is left before hitting zero, while a third are betting rates will actually be at zero. At any rate, this means borrowing costs are expected to be at their lowest since the U.S. economy plummeted into the depths of the Great Recession.

In addition, one respondent indicated that the Fed would have to take further measures to juice the economy, mainly by growing its balance sheet through quantitative easing. Another participant indicated that the Fed wouldn’t be able to end its Treasury bill purchases – a move designed to prevent funding shortfalls in financial markets – by the second quarter of this year, as it had originally planned.

What’s causing the Fed to take its policy route on such a massive U-turn? It’s due to the economic fallout from the coronavirus. Massive quarantines intended to stop the spread of the contagion have altered global supply chains, halted business and travel activity, while also roiling Treasury and stock markets.

“Going into 2020, the Fed was convinced the current level of policy was appropriate,” says Lindsey Piegza, Ph.D., chief economist at Stifel. “Amid rising fears of the coronavirus and ample market volatility, however, come March, the Fed is likely to remove the ‘appropriate’ language and reiterate a commitment to act as needed to keep the economy on track.”

(Note: Bankrate’s survey polled nine experts for their forecasts between March 2-10. Given that the situation is evolving quickly and highly volatile, experts reported an average confidence level of 62 percent.)

Fed’s main dilemma: When and how quickly should rates fall to zero?

The Fed under Chair Jerome Powell hasn’t made any cuts larger than 50 basis points, meaning the March reduction that Bankrate’s experts are penciling in could be classified as an aggressive move.

Still, it might be a disappointment to markets. The majority of investors are betting that officials will lower rates to zero at the March meeting, while a mere 2.2 percent are betting on a 75 basis point cut, according to CME Group’s FedWatch. If those bets come true, it means the federal funds rate is expected to be in a target range of 0-0.25 percent, levels that haven’t been seen since 2015.

It seems drastic, but investors might not be that far from the curve. Some Wall Street economists have joined the clarion call for zero interest rates in light of the coronavirus, including J.P. Morgan Chase’s chief economist Mike Feroli and chief economist Jan Hatzius of Goldman Sachs.

Fed research suggests that, in a low-rate environment, officials should act quickly and aggressively to ward off any economic contagions. You want to “vaccinate against further ills,” as Federal Reserve Bank of New York President John Williams said in a July 2018 speech.

Coronavirus derails Fed’s ‘make-no-move’ policy stance

That economic contagion, in this case, is an actual contagion. After cutting rates three times in 2019 as an act of insurance, Fed officials kicked off the year pledging to be patient, echoing that interest rates were in an appropriate place to sustain economic growth through the election year.

But then the coronavirus came along, and it forced the Fed to act again. It’s expected to shave nearly half of a percentage point off of first quarter growth, according to Bankrate’s First-Quarter Economic Indicator survey. Firms such as Apple and Toyota have ceased production in China, leading to supply chain disruptions and outright shortages of products. Meanwhile, air travel is expected to face its worst year for revenue on record, amid massive restrictions and fears. President Donald Trump announced in an address to the nation Wednesday that he’d be restricting travel with Europe for 30 days.

“The Fed set a precedent last year of providing ‘insurance rate cuts’ rather than basing its rate cut decisions on data,” says Kristina Hooper, chief global market strategist at Invesco. “There is now an expectation that the Fed will do the same this year, and it has helped that expectation by providing the 50 basis point emergency cut the other day.”

But by how much the Fed decides to act is still up in the air. Williams’ research suggests that the Fed might not want to wait for too long before responding. But there’s an argument supporting a more conservative response as well. What happens if you give up all your available stimulus to shelter an economy from a recession, before the recession starts? Up in the air is also how much Congress is willing to respond, and of course, how quickly the U.S. economy could bounce back.

Forecasts: Expect at least one more cut, rates near zero

Similar to this diversity of viewpoints, Bankrate’s Fed Forecast survey found that economists were split on where the fed funds rate would be by the end of 2020. Nearly 44 percent said the Fed would make at least one cut, while another 33 percent said the Fed would make at least two.

Two respondents said the Fed would choose to maintain rates after its March meeting. That’s largely because the Fed has limited ammunition left and would prefer to hold onto its most effective form of stimulus – rate cuts – for as long as it can.

“If the economy can remain stable, the Fed would probably like to stay on hold rather than race toward zero,” says Yung-Yu Ma, chief investment strategist at BMO Wealth Management. “If the economic environment deteriorates further, the Fed will cut again, but it is unlikely to follow Europe into negative interest rate territory, so the Fed knows that it is running out of room and doesn’t want to expend that unless necessary.”

Experts’ implied predictions for the federal funds rate at year-end differed as well. Respondents were evenly split between the federal funds rate being in a target range of 0.25-0.5 percent by the end of 2020, versus 0-0.25 percent, the effective zero-lower bound.

“The downside risks to the economy are significant enough that I expect the Fed to use its remaining policy ammunition to ward off a recession,” says Steven Friedman, senior economist at Mackay Shields, who formerly worked for the New York Fed, one of those respondents who is predicting rates will hit zero this year.

What this means for you

The Fed’s policy path moving forward means something different for everyone, whether you’re a borrower, saver or retiree.

Borrowers will find that time is on their side this year, given that the Fed is expected to lower rates to some of their lowest levels ever. Over the next few months, use cheaper borrowing costs to your advantage by paying off debt, specifically high-cost credit card debt. And with the 10-year Treasury yield also at an all-time low, homeowners and would-be homebuyers can take advantage of historically low mortgage rates by either refinancing or purchasing a home now.

Savers and retirees, however, likely won’t celebrate where rates are expected to head over the next 12 months. Retirees live on fixed income, which is sensitive to interest rate adjustments. Meanwhile, savers will find that their yields will likely fall even more. However, you can take solace in the fact that inflation is low for now, meaning whatever amount you decide to put away won’t be massively chipped away by building price pressures.

But no one – not even officials at the Fed – expected this kind of precarious economic situation in 2020. Preparing for the unexpected should be at the top of your priority. Consider opening a high-yield savings account, which still offers rates at about 18 times the national average, to store nearly three to six months’ worth of expenses for a rainy day. Opening a certificate of deposit (CD) before rates fall is another wise option, if you can afford to lock your funds away for a certain period of time.

“Looking back on my Fed forecast for 2020: ‘Man plans, God laughs,'” says Paul Schatz, president and chief investment officer at Heritage Capital. “The Fed will likely go into pre-recession mode in a few weeks. For sure, Germany, Italy and the rest of Europe are either in recession now or close. China’s output has fallen off a cliff. There is no way for the U.S. to escape unscathed.”

Methodology

Bankrate’s March 2020 Federal Reserve Forecast survey of economists and financial experts was conducted from March 2-10 via an online poll. Survey requests were emailed to potential respondents nationwide, and responses were submitted voluntarily via a website. Responding were: Richard F. Moody, SVP and chief economist, Regions Financial Corporation; Kristina Hooper, chief global market strategist, Invesco; Paul Schatz, president, Heritage Capital; Yung-Yu Ma, chief investment strategist; BMO Wealth Management; Peter Earle, research fellow, American Institute for Economic Research; Dan North, chief economist, Euler Hermes North America; Lindsey Piegza, Ph.D., chief economist, Stifel; Sal Guatieri, director and senior economist, BMO Capital Markets; and Steven Friedman, senior economist, Mackay Shields.