1st Qtr Newsletter – 2019

Is Intuition a Liability or Asset in Investing?

One emotion the rollercoaster financial markets of the fourth quarter produced in excess was gut reactions to the uncertainty of future market direction. Was it time to take cover or look for buying opportunities? Were stocks over-valued or over-sold? Depending on one’s viewpoint, there were plenty of news articles and analyst opinions to support any conclusion an investor might want to reach. The right answer and the best reactions to the turmoil of the quarter will be known only through hindsight.

But it does bring up a very important question. Can investors trust their gut reactions or intuition in times of uncertainty? The answer is … it depends.

It helps to understand what is and isn’t intuition. Intuition is typically defined as knowing without knowing how you know. Daniel Kahneman, a Nobel Memorial Prize-winning behavioral economist, takes a bit different approach to intuition defining it as “thinking that you know without knowing why you do.” In Kahneman’s definition is the reality that intuition is not always correct.

Intuition can be a very beneficial shortcut to making decisions when a person is under stress or doesn’t have much time to think through all the implications of what is happening, particularly when facing complex problems. In situations where there is a large amount of information involved that swamps our ability to process quickly, intuition often results in the right answer for the moment.

But…and there is always a but, intuition works best when we are dealing with a decision where we have past knowledge. An intuitive decision is more likely to be correct when you’ve had considerable experience in making a certain judgment – i.e. evaluating and selecting investments. It also helps, according to Kahnman, when there is some regularity in the world that someone can pick up and learn, providing a subconscious knowledge or background that can be tapped by an intuitive decision. Then one needs to have a lot of practice making intuitive judgments and almost immediately knowing whether or not one’s intuition is right or wrong. Immediate feedback hones future intuition.

Fear can masquerade as intuition. When we are fearful, we are more likely to make rash decisions or believe that we are following our intuition because of the fear-enhanced strength of our mental voice. Cultural surroundings, prejudices and emotions can adversely influence intuition.

To make intuition as asset rather than a liability in investing, it helps to take a moment and slow down.

- Write down what you intuitively feel is the right action.

- List your fears surrounding the decision. Making your fears visible will help you to determine whether the action you are considering is driven by fear or clear knowing.

- Ask yourself if you have experience in making similar decisions in the past. The more experience you have had in the same issue, the more likely your intuition is providing the right decision.

- If you have time, move the decision to the “back burner,” and let the thought bubble in your subconscious. This can allow you to relax, consider new perspectives and open yourself more to your intuitive knowing.

- Realize the intuition is never the only solution. Provided we have time, there are situations where conscious reasoning is a better tool for making decisions.

Intuition is real. There are far too many instances in life where making an instantaneous, intuitive decision has saved lives and changed the course of history. But there have also been intuitive decisions that have turned out very badly.

When it comes to investing, a rules-based approach to quick decisions typically outperforms “gut” reactions. These rules are the underlying basics of active investment management.

While past performance is not an indication of future returns, history and markets tend follow patterns and cycles. A risk-managed approach to investing looks at when those past patterns have been favorable for investing and designs rules to support investing in strong markets and retreating to more conservative positions when similar market conditions have been negative for investors in the past. While no investment strategy is without risk, having a plan and rules to follow relieves investors of the need to worry about the right strategy for the moment and lessens dependence on gut reactions or fear responses.

Digital Fraud Is Intensifying

Digital access is transforming our world. But with all the positives come a host of negatives that are increasingly putting our privacy and financial wellbeing at risk. A healthy dose of paranoia is warranted.

Most hacking exploits and computer scams rely on human error. The best virus protection software can’t help when scams rely on tricking the user. Fear, greed, sex and cluelessness are the hacker’s most important tools.

Received a threatening email from a hacker claiming to have accessed your computer and threatening to expose your data if a bitcoin ransom is not received? Is Microsoft calling to alert you to a software or licensing problem? Are the IRS or utility companies sending collection agents to your door? These are all SCAMS. Nigerians offering millions in exchange for your assistance are not real. The overdue invoice emailed to you for immediate attention should not be opened, much less the link to correct a problem with your account.

Online is a hostile jungle with predators happy to take advantage of you if you stray into their territory. If you are not sure is something is true or not; scam or real, research it. Search the internet for similar phrasing and see what comes up in the search results. Visit key sites such as:

https://www.usa.gov/scams-and-frauds

https://www.bbb.org/scamtracker/us/

https://www.consumer.ftc.gov/features/scam-alerts

https://www.snopes.com

Paranoia can be a very prudent emotion. Use it.

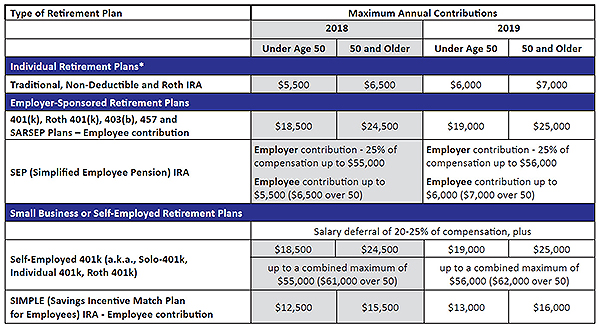

Optimize Your Retirement Contributions for 2018 and 2019

Retirement account contribution limits are on the rise in 2019, with IRAs experiencing their first increase since 2013. The numbers below are the maximum amounts employees can contribute to their retirement plan. Remember to fully fund your account(s) for 2018 by April 15th and start funding your 2019 contributions as soon as possible to take advantage of compounding.

*The income limit for taking a full deduction for contributions to a traditional IRA while participating in a workplace retirement increases to $64,000 for singles, and $103,000 for married filing jointly or qualifying widow(er) in 2019. The deduction completely phases out when income goes above $74,000 for singles and $123,000 for married filing jointly or qualifying widow(er). 2019 income limits for full contributions to Roth IRAs are $122,000 single, head of household, or married filing separately IF you didn’t live with your spouse during the year, phasing out completely at $137,000. Married filing jointly or qualifying widow or widower can make full contributions if their income is below $193,000. Partial contributions phase out completely once income exceeds $203,000.

The start of the year is also a good time to check and make certain your beneficiary designations are correct. Beneficiary designations spell out who—or what trust—is going to inherit the retirement account when the account holder dies. These designations take precedence over any provisions made in the will.

Stealth Wealth and the FIRE Movement

It never pays to underestimate the younger generation. Today’s 20- and 30-yea- olds have come up with a new movement with the potential to change life as we know it – the Financial Independence/Retire Early, or FIRE, movement. The idea is relatively simple – save like crazy so you can retire early. It requires forgoing material goods, such as the house, new cars and latest electronis; living frugally and finding work that will generate the biggest paycheck. Rather than wait until your late 60s to have the time to live the way you want, retirement begins in one’s 40s and 50s at the peak of one’s potential health, energy and mental capacity.

Rather than focusing on a career one is passionate about, regardless of the paycheck, the idea is to buy oneself the freedom to spend more time doing what one is passionate about in the relatively near future without worrying about money.

Rather than focusing on a career one is passionate about, regardless of the paycheck, the idea is to buy oneself the freedom to spend more time doing what one is passionate about in the relatively near future without worrying about money.

Given enough discipline to stick with frugality and saving every dollar one can, is there a downside to FIRE? The biggest challenge may be the need to withstand significant criticism of one’s life when a person retires early. Explains one early retiree, “It really brings the ‘haters’ out of the woodwork.” This in turn is creating a new stealth wealth trend, made easier given the early retiree’s habit of a frugal lifestyle.

In today’s political environment, FIRE makes a lot of sense. If you accept that taxes may well be at their lowest level we will ever see again, given the growing burden of social welfare programs, underfunded public pension plans and the spending objectives of a new generation of liberal legislators, take home pay as a percent of earnings may be at a long-term high. Better to optimize earnings now than later when taxes take a bigger bite. Saving that pay like crazy could also be one of the best investments one will ever make. Most early retirees tend to develop sideline activities that produce some income, reducing reliance on savings to meet living expenses and giving assets a longer investment horizon.

What could go wrong? Fortunately, most people are unlikely to have the discipline to stick with a FIRE lifestyle, otherwise the cost to society could become very interesting. If too many young workers retire early who will pay the taxes necessary to support welfare programs and fund public employee pensions? With too many frugal FIRE advocates, consumer spending would be impacted, reducing economic growth with all of its accompanying side effects. On the positive side, who knows what all that time and energy might create if not consumed by the need to report to work every day?

As trends go, FIRE will be a very interesting one to follow, both as an observer and a participant.

Turning 65 Triggers an Important Deadline

There is a very narrow window for future retirees to enroll in Medicare or face lifelong delayed enrollment penalties. The initial Medicare enrollment period covers just seven months, the three months before you turn 65, your birthday month and three months after you turn 65. If you do NOT sign up during that time, your costs for Medicare coverage could be higher for the rest of your life. If you miss the initial enrollment period, you must wait until the next general enrollment period that occurs every January through March for coverage beginning July 1.

The exception is if you retire early and claim Social Security benefits before you are 65, in which case you are automatically enrolled in Medicare – although there’s still a lot to be decided to optimize your coverage. If at age 65 you are still employed and covered by group insurance through a current employer, you can delay enrolling in Medicare penalty-free for up to eight months after your job or group insurance ends but make certain you have dotted the right “i”s and crossed the right “t”s to avoid delayed enrollment penalties.

The delayed enrollment penalty for missing the initial enrollment period is an additional 10% tacked onto the monthly premium for Part B for every 12 full months the individual was eligible to enroll in Medicare Part B but did not. Miss the deadline by two full years and the penalty increases to 20%. Miss by three full years and 30% is added to the premium. The higher premiums continue for as long as the individual is enrolled in Medicare Part B.

It’s best not to wait until the last minute to sign up because Medicare coverage is increasingly complex and the financial impact of having insufficient coverage can be considerable. Only during the initial enrollment period or special enrollment period can new retirees choose a supplemental Medigap plan without medical underwriting. These plans are health insurance policies that offer standardized benefits that work with original Medicare (not a Medicare Advantage Plan).

Medicare has four parts. Part A covers hospitalization and is free for most people. Part B covers outpatient services and doctors’ fees. In 2018, the monthly premium for Part B was $134 for most enrollees, rising to $135.50 in 2019. Higher-income retirees, i.e. individuals with modified adjusted gross incomes above $85,000 and married couples with joint incomes of more than $170,000, pay more. Medicare Part D covers prescription drugs and is also subject to high-income surcharges. Medicare Part C is a less expensive all-inclusive plan, also known as Medicare Advantage, which may offer additional benefits not provided by original Medicare, such as dental and vision care, and often includes prescription drug coverage.

Medigap plans pay part or all of certain costs, such as deductibles, coinsurance and copayments. Where you live will influence which of up to 10 different Medigap policies you will have to choose from: A, B, C, D, F, G, K, L, M and N, with Massachusetts, Minnesota and Wisconsin offering policies under different names.

Because unanticipated medical costs are one of the greatest risks individuals face in retirement, it’s not unreasonable to start researching your options and costs when you turn 64, rather than waiting until you are eligible to enroll. Make certain your present doctor accepts Medicare if you wish to continue with the provider, or research alternative health providers, particularly if you are considering the lower cost Medicare Advantage Plan.

There’s a lot more to retiring than kicking off your shoes and relaxing. You have work to do before you can take it easy!