1st Qtr Newsletter – 2023

Inflation Brings IRS Changes to Tax Brackets and Much More

Effective 2023, the IRS has made automatic inflation adjustments to key tax code parameters in accordance with formulas set by Congress to prevent inflation from increasing taxes. While automatic inflation adjustments are set annually, the 2023 adjustments are the largest adjustments to take effect since many tax rates were originally indexed to inflation in 1985.

The adjustments apply to more than 60 tax provisions for tax year 2023. Changes are based on 6 – 7% inflation, depending upon the formula set by legislation. For the IRS’ take on the changes, view Revenue Procedure 2022-38.

While many changes (such as higher income levels for various individual tax rate brackets and thresholds and capital gains tax adjustments) will not impact individuals until they file their 2023 tax returns, there are some important changes you can take advantage of now:

- Retirement account contribution limits have increased, as well as income levels for eligibility and deductibility – see page 3 for contribution changes.

- Individuals can make gifts up to $17,000 in 2023 (up from $16,000 for 2022) without incurring gift tax consequences or utilizing their lifetime gift tax exemption. There’s no limit to the number of people to which you can make annual gifts.

- The federal estate tax exemption increases to $12,920,000 in 2023, up from $12.060,000 for 2022. This also increases the lifetime gift tax exemption.

- Contribution limits for Health Savings Accounts (HSAs) increase to self-only coverage $3,850, and Family Coverage $7,750.

- Annual deductibles and maximum out-of-pocket expenses increase for Medical Savings Accounts.

- There are even increases in monthly limitations for the qualified transportation fringe benefit and qualified parking.

The preceding information should not be taken as individual tax planning advice. The rules for your personal situation may vary, as tax laws are highly situation-specific. Given the scope and impact of the changes, consult your accountant or financial advisor before making any plans.

Complications Abound for 2023 Market Outlook

After a crazy, volatile year end for financial markets in 2022, market forecasts for 2023 are expected to touch every extreme. The problem is that it really is different this time. Monetary policy since 2020 has created extremes that we’ve never seen before.

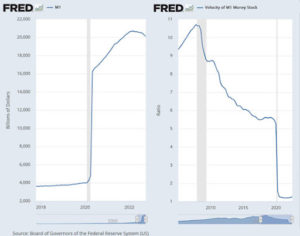

The coronavirus pandemic saw the most aggressive financial intervention in our country’s history. The U.S. money supply, measured by M1, increased from $4,000 billion to in excess of $20,000 billion; the velocity of money, or the rate at which money is spent, nosedived. Graphs from the Federal Reserve highlight how dramatic the changes have been.

M1 is the narrowest measure of the money supply, comprising the currency in circulation plus demand deposits or checking account balances. Beginning May 2020, M1 consists of (1) currency outside the U.S. Treasury, Federal Reserve Banks, and the vaults of depository institutions; (2) demand deposits at commercial banks (excluding those amounts held by depository institutions, the U.S. government, and foreign banks and official institutions) less cash items in the process of collection and Federal Reserve float; and (3) other liquid deposits, consisting of OCDs and savings deposits (including money market deposit accounts).

The velocity of money measures the number of times that the average unit of currency is used to purchase goods and services within a given time period. More money in the system was expected to help maintain economic activity. High monetary velocity is one of the variables that determine inflation.

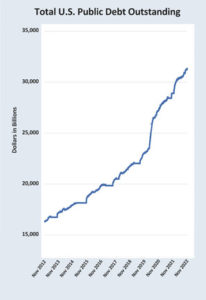

By March of 2022, the U.S. government approved more than $5.2 trillion in response to the coronavirus (COVID-19) pandemic, including $931 billion in direct payments to individuals. The money was anything but free as U.S. government public debt increased in excess of 50% over the two-year period. At the same time, the Federal Reserve spiked its assets under management to exceed $232 billion, flooding the financial system with money.

Source: U.S. Treasury Dept (http://fiscaldata.treasury.gov/datasets/historical-debt-outstanding/)

What will it take to bring the flood of excesses back into some form of normalcy and dampen the impact of too much money and too much debt? Only hindsight is going to answer that question. In the meanwhile, 2023 is going to be an interesting year for investors and a tough year for retirees with limited tools to cope with market volatility and inflation.

As the year gets underway, take some time to set up an appointment to meet with us and discuss your finances, how we are approaching 2023 with respect to investing opportunities and changes you can make in your own life to weather financial market uncertainty.

The views stated in this piece should not be construed directly or indirectly as investment advice. Due to uncertainty within the financial markets mentioned, opinions are subject to change without notice. Past performance is NOT indicative of future performance. Work with a qualified financial advisor. Ask questions before you make any major moves. And always have a plan to change directions if the scenario you are anticipating doesn’t materialize. For a comprehensive review of your personal situation, always consult with a tax or legal advisor.

Beware of Promissory Note Fraud

The Securities and Exchange Commission (SEC) and North American Securities Administrators Association (NASAA) have named promissory note fraud as one of the greatest threats to investors in 2023.

Promissory notes are a form of debt a company may issue to raise money. Typically, investors agree to loan money to a company for a set period of time and the company promises to pay the investor a fixed return on the loan. While promissory notes can be legitimate investments, those marketed to individual investors are often scams.

Red flags that indicate a promissory note is a scam:

- The note is offered to individual investors. Legitimate corporate promissory notes tend to be sold privately to sophisticated buyers.

- No registration. A promissory note is considered a security and as such must be registered.

- An unlicensed seller. The seller must be properly licensed to sell securities. Insurance agents, for example, can’t sell securities – including promissory notes – without a securities license.

- The note is marketed as ‘risk free,’ ‘insured,’ or ‘guaranteed returns.’ No investment is risk-free.

- The interest rate is too good to be true.

Invest in a fraudulent promissory note, and there is NO way to recover your money. Investing always has risk. ‘Too good to be true’ is rarely ever ‘true.’

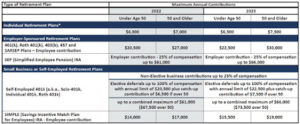

Retirement Plan Contribution Limits for 2022 and 2023

The inflation rate in 2022 has substantially increased employee contribution limits for retirement plans in 2023. New limits for 2023 contributions as well as 2022 contribution limits, which need to be made before April 15, are shown below.

*The ability to make tax-deductible contributions to a traditional IRA while participating in a workplace retirement account is subject to income limits that vary based on filing status and participating or non-participating spouse. After-tax contributions to a Roth IRA are also subject to income limitations. For example, to be eligible to contribute to a Roth IRA in 2023, your modified adjusted gross income (MAGI) must be under $153,000 (single) or $228,000 if married and filing jointly. That is up from the 2022 levels of $144,000 (single) and $214,000 (married filing jointly). Make certain you review and understand income limitations prior to making contributions.

Rethinking Retirement Accounts

Tax-deferred retirement accounts offer the benefits of tax-deductible contributions, lowering your taxable income, as well as tax-deferred growth of assets. But there are disadvantages to ending up with excessive balances in taxable retirement accounts.

The higher your annual Required Minimum Distribution, the higher your ‘means-tested’ Medicare premiums and the lower your after-tax Social Security payments. Your distributions might be subject to the upper brackets of Federal income tax rates. Any balances left in your retirement accounts when you die will be included in the calculation of your estate value for tax purposes, but there will be no markup in the basis of those assets. Your beneficiaries will pay personal income taxes on every penny, with the exception of Roth IRAs.

There was a time when leaving excess retirement accounts to the next generation was a way of assuring your heirs would have funds to help them in retirement. The 2019 SECURE Act eliminated the ability for retirement account beneficiaries to stretch withdrawals from inherited IRAs over their projected life expectancy. Now inherited tax-deferred and Roth accounts must be depleted within 10 years, with limited exceptions. That can mean higher income tax rates for beneficiaries as well as a considerable distribution of funds at a time when they may not have much experience managing money.

While it is always better to have income and pay taxes than it is to not have income, a retirement asset strategy can potentially lower taxes in retirement, leave you with more money to spend, and assets that can be passed on to heirs with a step-up in basis, giving your heirs the ability to plan when gains on an inheritance become taxable.

Roth IRAs, where taxes as paid up-front and there are no taxes on gains, can be used to eliminate federal taxation of future disbursements. In addition to increasing after-tax income during the account holder’s retirement, the Roth structure allows an inherited Roth IRA to transfer to beneficiaries without personal income tax liability.

Assets with interest earnings such as bonds or income-producing stocks that would be taxed at your personal income bracket may be best placed in tax-deferred retirement accounts where they can grow tax-free until withdrawn. That provides additional leverage for growth compared with paying taxes as interest and income occurs.

Assets purchased for long-term appreciation can be more efficient in taxable accounts where capital gains taxes take a smaller bite out of the final proceeds than personal income taxes during your life.

If you are already retired, it may make sense to start drawing down tax-deferred retirement accounts before you tap into taxable accounts. That’s where a withdrawal strategy or plan comes in very handy. Any time you can save taxes on your income, you have more money to spend and less need to liquidate additional assets.

It’s never to early to rethink your investment strategy to blend asset location and tax impacts into an approach that makes the most sense for your financial situation and your future goals. Let’s start the New Year off with a plan!

Giving Away Money Needs to Start with a Plan

One of the more pleasant surprises in life is to discover you have more money than you will be able to spend, and you can afford to make financial gifts to family, friends, causes, and charities. But before you do so, you need to talk with your financial and tax advisors about the pros and cons of gifts and whether you risk running out of money you might need later.

There are two tax realities that make gifting over the next three years more attractive.

- The recent inflation adjustments increased the estate and gift tax exemption to $12,920,000 over an individual’s life before federal gift taxes take effect. The amount that can be given to any individual without gift tax implications has increased to an all-time high of $17,000. If couples choose to work together in making gifts, those amounts double.

- Unless Congress acts to extend provisions of the 2017 Tax Cuts and Jobs Act (TCJA), the estate tax exemption reverts to the 2017 inflation-adjusted exemption of about $7 million at the end of 2025. Taking advantage of today’s higher exemption could reduce future estate taxes if the estate tax provisions are allowed to expire. In that situation, even if one has already exceeded their gift tax exemption, gifting now and paying gift tax at 40%, could potentially save future taxes by decreasing the size of the estate.

On the downside, there is a potential disadvantage to giving gifts such as stock, property, collectibles, etc., before you die, rather than as an inheritance from your estate. When the recipient liquidates the gift, the individual will owe taxes on the appreciated value from when you first purchased the gift. An inherited asset generally receives a step-up in income tax basis to the value at the time of death, eliminating any capital gains prior to your death. Of course, that is if future tax law changes don’t eliminate the step-up in basis, as was proposed in 2021. There’s always the risk that strategies put in place today may be undone by tax rules in the future.

The $17,000 per individual per year is a different matter altogether. You can gift as many individuals as you would like over the course of a year, but there can only be one annual gift to each individual. This might be a way to offset college tuition, help make a down payment on a home, buy a used car, or hundreds of other ways to offer a helping hand. As long as the gift is under $17,000, there are no gift tax ramifications or taxable events. Naturally, there is a catch. You can’t expect the money to be repaid. That would make it a loan and if you decide to forgive a loan, it could be considered taxable income to the borrower.

Gifting can also be a way to avoid future family arguments over your estate by legally transferring assets to another before you die.

If you think you might someday want to apply for Medicaid long-term-care benefits, however, you need to be careful because giving away money or property can interfere with your eligibility. To qualify for Medicaid, individuals cannot have income or assets above a certain level. Under federal Medicaid law, transferring certain assets within five years before applying for Medicaid, can make you ineligible. This includes gifts to charities and gifts to individuals up to $17,000 that federal law allows without a gift tax. Medicare considers them to be transfers.

It is important to work with a knowledgeable financial advisor and make plans that consider different future scenarios and how gifting might affect your net worth, future estate, and tax liability as well as your eligibility for federal programs.