1st Qtr Newsletter – 2025

Investing In a New World Order

2025 will be an interesting year for investors. The “Trump bump” following the Nov. 5th election sent a shock through the market and propelled Tesla stock into orbit. Bitcoin fans are looking forward to happy days and many traditional industries are changing course in anticipation of a more favorable environment for growth.

The rosy outlook of many investors, however, may be overlooking threats to the economy and financial markets. The impact of recent inflation is still with us and unlikely to go away. Higher production costs appear to be built into many business sectors. The success of recent union strikes could encourage more unions to strike for higher wages and benefits. Tariffs may raise the cost of goods imported into the U.S. The east coast longshoremen return to the bargaining table in February to resolve their demand for no more automation on the docks.

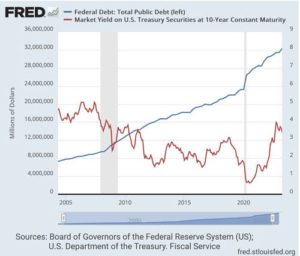

The U.S. money supply is still on a sugar high from Covid and government spending. When you combine record high government debt with 10-year highs for yields on U.S. Treasury securities, the U.S ends up borrowing money to pay interest – a classic credit card death spiral. The Federal government is also running into problems selling its debt, particularly to foreign nations.

In response to Russia’s invasion of Ukraine, the U.S. government froze a large part of Moscow’s $643 billion of foreign currency reserves, much of which was in U.S. Treasury securities. By essentially weaponizing the use of U.S. government securities for currency reserves against foreign nations, the U.S. made many countries reluctant to invest in U.S. debt offerings. China has been steadily liquidating its U.S. debt securities, as have many nations that fear coming under U.S. sanctions. One result is falling participation at Treasury debt auctions and higher costs to the U.S. government to borrow money.

Recessions fears also still exist, but the greatest threat could be geopolitical. The world is not a happy place these days. The immigration surge across the border in the last four years was remarkable in its global diversity. Sudanese are fleeing starvation and civil war. Russians and Chinese are fleeing their governments. More than 7 million Venezuelans have fled their country over the last decade in response to a political, economic and humanitarian crisis. South American governments are battling criminal gangs as families flee north. The Middle East is a powder keg. The list goes on and on.

How do you invest in the face of uncertainty? The first step is to accept that no one can accurately forecast the future. There are too many unknowns. What we can do is listen to the financial markets and invest accordingly. That requires an active management approach.

Over the last 20 years, behavioral finance has sought to explain why people act irrationally when making investment decisions. Psychological factors, emotions and biases are common culprits to rationalize illogical investment decisions. Professional active management practitioners, in response, have focused on developing disciplined strategies based on market research to guide investment decisions. The goal is to remove emotions and unconscious bias from decisions by relying on rules-based investing.

While active management cannot guarantee success, not every buy or sell will be profitable, and whipsaws can result from rapid changes in market direction, active management seeks to fulfill the market maxim – “Cut your losses short and let your winners run.” Equally important, the strategy provides a discipline for investing in uncertain markets and not letting fear of the future undermine opportunities for profiting from the market’s current trend. We don’t have to know the future. We just need to know today.

Past performance is not indicative of future returns. Active management cannot assure profitable investments. All investment strategies have the potential for loss as well as gains.

Add to Your Reading List

Some Final Personal-Finance Advice From Jonathan Clements is one of the most extraordinary personal finance columns written by Clements in his 30 years writing for the Wall Street Journal. In the Nov. 3, 2024 edition of the Journal, he explains that at 61 years old, he has been diagnosed with terminal cancer.

The rest is classic Jonathan Clements – a personal finance column on how he is arranging his financial affairs to make life without him easier for his wife and children. While we haven’t always agreed with Jonathan’s investing device – in our view he has way too much reliance on index funds and very little trust in active management – his columns always had good advice to offer.

Which is why, if you want to protect your family and heirs in the event of an unexpected turn of fate, Some Final Personal-Finance Advice From Jonathan Clements is a recommended must read. If you have access to the Wall Street Journal, download and print a copy for future reference. If you do not have access, give me a call and I will arrange a copy of the article for you.

Some Final Personal-Finance Advice From Jonathan Clements – WSJ (https://www.wsj.com/personal-finance/jonathan-clements-personal-finance-cancer-e30d1396?page=1)

Managing a Financial Windfall

Unexpected financial windfalls may include an inheritance, lawsuit settlement, insurance payout, severance pay, hefty capital gains on an investment or even a winning lottery ticket. If you are fortunate to receive an unexpected payout, the hardest part is next. Keeping your windfall.

Windfall wealth tends to be viewed as “found money.” Unlike money you’ve earned, its unexpected nature makes it seem like a treat, easy to spend and easy to share. And very attractive to fraudsters, relatives and friends, who are happy to help you spend it. More than a few lottery winners say their lives were ruined by that sudden wealth, and a saddening number commit suicide when the money and life it bought run out.

Managing a financial windfall

1. Consider paying off all your outstanding debts and then setting the money aside for 5-6 months in a low-risk account, i.e. a money market fund with a major securities company or a bank CD. Give yourself time to figure out exactly what you want from that money and make plans.

2. If you need to splurge a little to get it out of your system, have a tight limit on how much you can spend. A new car, house, or private island can come later when you have a plan.

3. Prepare an explanation for those who ask you about your newfound money or want to help you spend it. Perhaps… “This has been overwhelming. I am still learning about the tax consequences and other requirements regarding the money, so I am not in a position to make any gifts, loans or investments. You need to give me time to find my bearings.”

4. Avoid talking about your windfall. Make no financial promises to anyone. Postpone gifting until you understand your new financial position.

5. Build your financial team.

- You are going to need a tax accountant. Very few windfalls come without tax implications.

- Find a good financial planner. If you want to use your windfall to create long-term financial security for yourself and or your family, you need to understand how much money you can spend over a projected lifetime.

- Select a good investment advisor affiliated with an established firm with a clean compliance record. Start with a conservative portfolio. As long as you don’t lose your capital, you can always invest more aggressively as you gain experience and understand what your advisor is recommending. Avoid too-good-to-be-true return schemes.

- Don’t buy or start your own business if you have no experience running a similar business.

6. Unfortunately, you may need a good personal lawyer as well. If you do not have one, take out an umbrella insurance policy. Money tends to attract ex-spouses, ex-friends, grown children, needy relatives, creditors, former business partners, etc. If your windfall comes from a lottery ticket that others think they have a claim to as well (co-workers, golf buddies, and anyone you might have purchased tickets with), you could have a problem. Lawsuits are wealth destroyers.

7. Don’t quit your day job. It’s easy to underestimate how much income you will need over your lifetime. To replace a $100,000 a year salary and benefits such as health insurance, life and disability insurance, retirement contributions, etc., from investment income, you will need $5 million or more in invested capital.

8. Be very careful who you trust for financial advice. Recommendations from friends and relatives are not the best. Unsolicited financial advice is rarely in your best interest.

Money can do great good and great evil. Don’t let a windfall become an albatross around your neck!

In the poem The Rime of the Ancient Mariner, an albatross follows a ship setting out to sea, which is considered a sign of good luck. However, the mariner of the title shoots the albatross, an act that will curse the ship and cause it to suffer terrible mishaps. The ship’s crew let the mariner know that they blame him for their plight and they tie the bird around his neck as a sign of his guilt. From this arose the image of an albatross around the neck as metaphor for a burden that is difficult to escape. From Wikipedia.

Pig Butchering Joins the Scammer's Playbook

Sometimes it seems that we are overdoing the fraud warnings. But the greatest threat to the financial security of our clients is not a market downturn, inflation or an unexpected disaster. The greatest risk facing many people, particularly as they age, is fraud.

Fraud is the possibility that you will end up destitute without any means of recovering your loss. The nicer you are, the more faith you have in human nature and the more you enjoy reaching out to new friends, the more vulnerable you are.

In 2023, the Federal Trade Commission reported consumers lost more than $10 billion to fraud. And that includes only reports the FTC received.

It used to be you could pick out scammers by four red flags:

- They Pretend.

- They say, “There is a Problem,” or “You have won a Prize.”

- They Pressure

- and they want a Payment.

But today’s scams are much more sophisticated. Today’s scammers don’t just want payment; they want information to access your accounts.

Multi-step scams, AI voice scams and long-term courtship of victims – unattractively known as “pig-butchering” – are just a few approaches. Spoofing of legitimate businesses is common in phone calls, text messages, emails, social media and personal interactions.

Multi-step scams work to build your fear that you have a problem. The first contact might be an email alerting you to a problem with your account and providing you with a number to call. Next may be a call from your “bank” saying they have detected unusual activity in your account, followed by a third call from a “vendor” asking if you have made an unusual transaction. The follow-up calls are designed to build your belief that the first contact was legitimate and to get you to call the number.

A common AI voice scam is a call from the familiar voice of a relative or friend asking for your help with a problem. The next call may come from their “lawyer” explaining how you can help.

Pig butchering relies on relationship building over time, often offering a romance or new friend. Essentially, the victim is “fattened up” to create a sense of relationship and trust that makes them willing to turn over assets to the scammer. According to FBI reports, the most common “butchers” are overseas call center employees, provided with personal information and scripts designed to prey on loneliness, greed, and the need for friendship.

Warning Signs

- Received a stray text or email message and didn’t recognize the sender?

- Is a stranger texting to see if you will be at pickleball or just to say “hi”?

- Received an email reminder for a bill you don’t recognize?

- Is there an issue with a delivery address that you need to correct?

- An alert on a new charge to your account?

- A reminder to renew your registration?

- An email asking you to update credit card information?

- Did you receive notice that your account will expire without your action?

- Does the subject line say “Bad news”?

- Is Microsoft calling to tell you that your computer has been infected?

You are about to be scammed.

Your Best Response Is DELETE

Delete messages you don’t recognize. Don’t trust emails that say you have a delivery problem, an unpaid invoice, or a problem with an account. Don’t open attachments, don’t follow up, and don’t respond to any requests for contact or information. Hang up on callers you don’t know. And don’t answer email appeals for money from political candidates, charities, fake friends, or even neighbors.

If you want to confirm that a contact is fraudulent, call the individual, financial institution, merchant or other sender DIRECTLY using contact information provided on their website or from directories you trust. NEVER use a link or phone number provided by the sender or caller.

Get Help

Talk to a friend, your banker, financial advisor or even the police if you think you may be a victim or are being groomed for fraud. Don’t be embarrassed that you may have been foolish – get help. Another red flag for fraud is being told not to reveal relationships or recommended actions. The scammer doesn’t want you to get help!

Fraud is a global business, way beyond the Nigerian prince emailing you to ask for help getting money out of his country. If there is a way to trick you out of your money, there is someone giving it a try. And they are GOOD at what they do, which is getting you to believe them, share access to your financial accounts or send money.

Establish a Trusted Contact Person

If you want another layer of security to protect you against fraud, consider naming a Trusted Contact Person for your accounts. A trusted contact is a person who financial institutions have your permission to contact if they cannot reach you or become concerned that you could be the victim of financial exploitation or are experiencing a health crisis. For more information on how a Trusted Contact Person might work, please contact our offices and let’s talk. Don’t let a scammer steal your financial security.

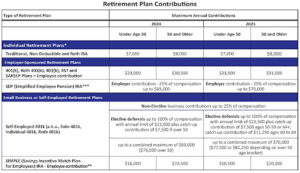

IRS Adjustments to Retirement Account Contributions

Modest increases apply to 2025 retirement plan contributions, with the exception of Self-Employed 401k (a.k.a., Solo-401k, Individual 401k, Roth 401k) plans where the Secure 2.0 Act provides a special catch up for an age bracket considered adversely impacted by Covid restrictions. The act also provides different contribution maximum and catch-up limits for employees aged 50 and over who participate in certain applicable SIMPLE plans. Ask your financial advisor about those changes.

* The 2025 income phase-out range for taxpayers making contributions to a Roth IRA is increased to between $150,000 and $165,000 for singles and heads of household, up from between $146,000 and $161,000 in 2024. For married couples filing jointly, the 2025 income phase-out range is increased to between $236,000 and $246,000, up from between $230,000 and $240,000 in 2024. The ability to make tax-deductible contributions to a traditional IRA while participating in a workplace retirement account is also subject to income limits that vary based on filing status and participating or non-participating spouse. Make certain you review and understand income limitations prior to making contributions.

** Under a change made in SECURE 2.0, different contribution maximum and catch-up limits apply for employees aged 50 and over who participate in certain applicable SIMPLE plans.