2nd Qtr Newsletter – 2022

Coping with Market Downturns

Just when it looked like the Covid pandemic was falling behind us and life was getting back to normal, Russia invaded Ukraine and every hope for a calm investment year went out the window.

With unknown repercussions of the Ukrainian invasion and the long-term impacts of an unprecedented array of financial sanctions against Russia looming over the market, joining the threats of continuing inflation and supply shortages, and the potential for further Covid disruptions, it isn’t surprising many investors and media commentators are beginning to sound more than a bit panicked. What’s next? Recession? Bear market? A European war? And what does it mean for your investment portfolio?

The truth of the matter is we don’t know what will happen next week or next month. What we do know is that markets go through periods of high volatility and uncertainty. Even in times without geopolitical tensions, financial markets are cyclical, moving from undervalued to overvalued, cycling briefly through a reversion to the mean or average price earnings (PE) ratio before swinging to the next extreme. While it would be nice to think that we can set rules and expectations that stock prices will comply with, in the short-term, market trends are by-and-large driven by emotions.

Media commentators like to provide a simple summary for why markets went up or down and what influenced investors on a particular day. The likelihood that their analysis is correct is next to zero.

Markets are the sum of billions of investors worldwide reacting to their own perceptions, compounded by computer programs striving to make a profit from often miniscule moves. That’s not to say one can’t be successful as an investor, but success requires NOT reacting to the latest media panic.

To be successful over the long-term, investing requires:

- An understanding that there will be up markets and down markets, that stock prices are volatile and often fail to follow logical rules.

- An investment strategy that guides how we react to the prevailing trend or market uncertainty.

- Discipline to stick with the investment strategy.

There’s only one way to begin to understand market volatility and cyclical trends. You need to study past markets. While history never repeats, it does tend to rhyme. Look at market charts, find out what was happening during periods of extreme movements. In every market there have been winners and losers. What characteristics did each display? If this isn’t your forte, find an advisor who studies the markets and can explain how that knowledge has impacted his or her approach to investing.

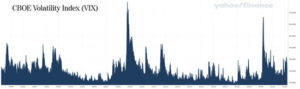

Extreme price fluctuations are the norm, not the exception when viewing markets long term. The graph above shows the Chicago Board Options Exchange’s (CBOE) Volatility Index (VIX), a popular measure of the stock market’s expectation of volatility based on options activity in the S&P 500 index (SPX).

There are many ways to invest successfully. But one of the surest ways to lose money in the financial markets is to continually change course, chasing the latest hot investment fad. This is why an investment strategy is so important. As an investor, it is impossible to comprehend the complexity and opportunities of the entire global market. You have to identify where you have the ability, knowledge and fortitude to potentially be successful. This is the start of an investment strategy.

An investment strategy can be as simple as buy an S&P 500 index fund and hold for the long term. But this works best if you have a lot of money that you are unlikely to need if the market takes a dive, and you can wait 5-10 years to recover. Even then, there’s no guarantee that your investment will be successful over your investing time frame. If you have limited time and you need your funds to be earning returns rather than recovering from a 20-40% loss, you need a different investment approach than you might take with a 30-year investing horizon.

In our investment advisory firm, we take the approach that every market environment has opportunities for profit if you are flexible and utilize an investment approach that helps you identify when the risk of holding individual positions is too high and how to find opportunities in a given market situation.

A sound investment approach doesn’t have much value if you find yourself second guessing your strategy and making random moves without a plan. If you don’t have the confidence and discipline to stick with your investment approach, you are back to chasing the latest investment fad.

Every investment approach will have losing trades. There can never be a guarantee of success. This is a business without certainty. Coping with uncertainty requires flexibility, not panic.

Replacing panic with an investment strategy requires accepting that investing always has risk. The amount of risk you can afford to take depends a great deal on how much wealth you have, when you will need your funds and your mental ability to cope with loss. Without an investment strategy, too many individual investors buy high out of fear of missing out and then sell low because they cannot bring themselves to change directions until the pain is too great. A late sell is too often followed by the reluctance to reinvest as the market recovers until they have missed much of the opportunity to recover their loss.

It is this cycle of panic followed by a reverse panic that devastates portfolio returns. It is also the reason many investors choose to retain an investment advisor that has a strategy and approach to the markets that makes sense and tries to avoid making emotional decisions. We know the market goes up and we know the market goes down. In order to navigate the markets, we must have faith, patience, and the emotional fortitude to stay the course.

Put the News on Time Out

By and large the media conforms to the belief that bad news sells. People are more likely to watch or read about controversary or disaster news. Toss in an election year, guaranteed to be full of fearmongering, and immersing yourself in the news can become bad for your health.

Studies of viewers over the last two pandemic years have shown that watching news of physical and social disasters leads to a form of post-traumatic stress disorder (PTSD), complete with symptoms of depression, anxiety, stress reactions and substance abuse. Rather than thinking for ourselves, we begin to follow the herd, reacting to coverage of the news rather than the actual news itself.

This is why it is so important to take time off from the news, ramp down the social media and turn up time with family and friends. Rather than reacting to media coverage, research information. Look for competing viewpoints. Read history. Find a good book. Go for a walk. Invite someone you would like to know better to lunch.

Don’t let a crazy world drive you crazy. Let’s make 2022 a year we look back on and think … “All things considered, it was a pretty good year.”

Asset Location Is an Important Tool to Reduce Taxes

A 20% drop in the value of our investments can put us in a total funk but paying 35% in taxes is accepted as a necessary evil. Reality check: Taxes can cause far more damage to your financial well-being than a market decline. Which is why asset location matters. Asset location is a tool that investors can use to strive to minimize gains lost to taxes.

Asset location refers to the account structure in which your assets are held and the type of assets you own. Common investment “locations” include:

- Taxable brokerage or bank accounts

- Tax deferred retirement accounts

- Roth IRA and Roth 401k accounts

- Mutual Funds

- Exchange Traded Funds

- Bonds

- Hard assets such as gold or collectibles

- Cash Value Life Insurance or Annuities

Tax Basics

Taxes serve to fund the government and its programs. To maximize that funding, the federal government and most states have graduated tax brackets. The more you make, the higher the tax rate. This creates three basic tax goals for the investor: (1) minimize taxable investment gains during high income years, (2) take advantage of lower tax rates whenever possible, and (3) control sources of income in retirement to minimize tax impacts.

Capital gains taxes apply to gains realized from assets held for investment. Assets held for more than one year are considered long-term and have specific Federal capital gains tax rates of 0%, 15% or 20% in the 2021 and 2022 tax years. Most U.S. states tax long-term gains at rates between 2.9% and 13.3%. with the applicable tax rate based on the taxpayer’s total income for the year.

Gains on investment assets held for less than a year, dividends and interest from investments and are taxed at the individual’s personal income tax rate. Forty-one states have their own income tax rates. Nine states without income taxes include Alaska, Florida, Nevada, New Hampshire (does tax investment earnings), South Dakota, Tennessee, Texas, Washington, and Wyoming.

In addition, there is the federal 26% and 28% Alternative Minimum Tax (AMT) that applies to income in excess of $206,100 for all taxpayers – after the 2022 AMT exemptions. To help fund the Affordable Care Act, a federal 3.8% surtax applies on incomes above $200,000.

Calculating capital gains and income tax rates begins with adding all your income sources to get total annual income. This number determines your long-term capital gains rate as well as your personal income tax rate.

This is a very oversimplified tax summary. There are a host of tax complications that come into play from depreciation recapture to deductible expenses, exemptions, and more. There’s a reason accountants make a very good living from preparing tax forms. The point is that minimizing or managing taxes through asset location and timing the realization of gains and losses can make a real difference.

Common Asset Location Options

Taxable brokerage and bank accounts are reported annually on your tax filings and tend to have the highest tax consequences for short-term gains, dividends and interest. Because you, or your adviser, determine when assets are sold, you can control to some extent when gains are recognized.

Tax-deferred retirement accounts allow you to move taxes on gains into the future when you may have a lower tax rate. When contributions are tax deductible, you also defer taxes on monies invested until funds are withdrawn in retirement. The disadvantage is that tax-deferred contributions and all gains will be taxed at your personal income tax rate when withdrawn.

Roth accounts are funded with after tax contributions but have the advantage of eliminating federal taxes on gains if the account is compliant with the five-year rule.

Mutual funds can have unexpected tax surprises. When assets are sold within the fund, gains or losses are allocated among all shareholders. You cannot control when gains or losses will occur.

Exchange Traded Funds have a more advantageous tax structure. While you will still be liable for taxes on dividends and interest, capital gains or losses are triggered only when you personally sell your shares in the fund.

Bonds, held to maturity, generate interest income, which is taxed at the investor’s personal income tax rate. But there are also circumstances where sold before maturity they can result in short- or long-term capital gains or losses.

Hard assets such as coins, art, paintings, antiques, collectibles, etc. are considered alternative investments by the IRS and if sold at a gain after a year of ownership are subject to a long-term capital gains tax rate of 28%.

Cash value life insurance and annuities offer a number of advantages including tax-deferred growth of gains and potentially tax-free cash out. BUT these are complex contracts with the insurance companies and require careful review and understanding. Work with qualified investment professionals to make certain you understand the benefits and limitations of the individual products. All insurance contracts are NOT created equal.

Strategic Asset Location

Strategic asset location is designed to reduce taxes on gains and optimize after-tax income. Investments that generate short-term gains are often placed in tax-deferred investment structures, where they can compound over time without losing ground to personal income taxes.

Stocks that you anticipate holding longer than a year may be more tax efficient in a taxable brokerage account where the maximum tax on long-term capital gains when stocks are sold may be lower than your personal income tax rate. When you choose to take capital gains can impact your personal income tax rates. A substantial long-term capital gain will push taxes on other earnings into the higher tax brackets.

This is a very superficial overview of what can be a very complex decision. The goal of this discussion is to help you realize that there are ways to enhance the return on investments by minimizing taxes. There are additional account structures to consider as well as tax consequences. Consult with a qualified financial or tax adviser to help you optimize your asset location. And remember, when it comes to taxes, today’s advice may be inaccurate tomorrow. Make certain you are working from current facts and aware of proposed legislation that may affect tax policy.

Overcoming Retirement Account Investing Hesitations

The more economic uncertainty, the more hesitant we find clients are to lock up funds in a retirement account. But retirement accounts are an important part of building retirement security, particularly with Social Security forecasted to be in the red by 2025.

For investors concerned that they may need access to their retirement funds prior to age 59½, it helps to know that several exemptions exist that allow early withdrawals without a 10% penalty.

Better known exceptions to the 10% penalty (subject to certain requirements) include:

- Early withdrawals for rollovers into another retirement account within 60 days,

- Medical bills in excess of 10% of the individual’s adjusted gross income (AGI),

- Total and permanent disability of the account owner,

- Distribution to beneficiaries after the account owner’s death,

- Qualified education expenses,

- First-time homebuyers – withdrawals up to $10,000 from an IRA,

- Health insurance premiums paid by the unemployed,

- Qualified hurricane distributions,

- Qualified reservist distributions for the military.

Another way to avoid the 10% early withdrawal penalty is substantially equal periodic payments.

Under IRS code section 72(t)(2)(A)(iv), distributions that are part of a series of substantially equal periodic payments (not less frequently than annually) are exempt from the 10% penalty. These payments are made for the life (or life expectancy) of the account holder or the joint lives (or joint life expectancies) of the account holder and designated beneficiary. Once a SOSEPP is started, distributions must be taken for at least five years, or until the account holder reaches age 59 ½, whichever is longer. Stopping the payments early will result in penalties and interest in most cases.

Payments are considered to be substantially equal periodic payments if they comply with one of the following three methods: (1) the required minimum distribution method; (2) the fixed amortization method or (3) the fixed annuitization method.

With method 1, the annual payment is recalculated each year, based on the account balance and account holder’s life expectancy. Methods 2 and 3 use amortization or annuitization schedules to determine fixed distributions over the life expectancy of the account holder. Effective January 1, 2022, the interest rate used to apply the fixed amortization method or the fixed annuitization method was substantially increased with the addition of a 5% floor. Calculation of amortized or annuitized payments is now based on a rate not more than the greater of (i) 5% or (ii) 120% of the federal mid-term rate. Given 120% of the February federal mid-term rate was 1.67%, this new floor results in substantially higher annual payments.

Work with a qualified financial adviser or tax adviser BEFORE taking any early withdrawals from your retirement accounts. Early withdrawals can be a minefield of tax hazards. Distributions from tax-deferred retirement accounts are taxed as ordinary income and, if taken prior to reaching age 59½ without a compliant exemption, may be subject to an additional 10% IRS tax penalty and trigger interest charges.

While the exemptions may sound fairly straightforward, there are a host of conditions, definitions and calculations to consider. IRS notice 2022-6 explaining the calculation of substantially equal periodic payments is 17 pages long. It is easy to get tripped up by detailed requirements.