2nd Qtr Newsletter – 2024

The Rest of the Story

Less attention paid to news and social media may pay off when it comes to investing. While reading a wide variety of news sources and trying to learn as much as you can about the economy and new trends is of value to every investor, making investment decisions based on the news media is questionable. By its nature, the news media is:

- Late to the game

The news media by and large reports on events that have already happened. By the time you hear about investment activity, professional investors and those on the scene have already had time to react. And thanks to today’s digital world, those reactions can be blazingly fast. - More easily manipulated than it admits.

The media’s pursuit of sensational headlines, exciting visuals and controversy is well understood by those seeking media attention. Feeding the beast when you know its appetite is just a matter of staging. - Simplified for quick, mass consumption.

Market impacting events are a lot more complex than can be conveyed in a 30-second quote, or even an hour-long feature program. A simple explanation for the day’s financial markets moves is just that, too simple to accurately explain the actions of billions of individual investors throughout the world.

For example, take two of the most widely touted economic indicators used to explain market moves – unemployment/employment and Gross Domestic Product (GDP).

Modest increases in employment and GDP were commonly cited as causes for first quarter market gains, as reasons for the Federal Reserve to lower interest rates, and to proclaim a soft economic landing a reality. Based on employment gains and GPD growth, analysts and market commentators were also quick to forecast a new bull market. But before you jump on the bandwagon, it helps to know “the rest of the story.”

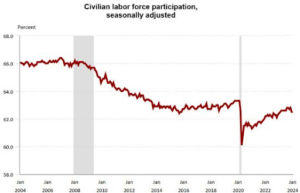

According to the U.S. Dept of Labor Statistics, full-time employment in January 2024 was below that reported in all the preceding 10 months. What did increase was part-time employment, at its highest reported level over the past 12 months in January 2024. The average work week is now about 34.1 hours. There’s also something very messed up about the current employment situation. Participation by the civilian labor force of working age adults still lags pre-pandemic levels.

Source: U.S. Bureau of Labor Statistics 1

Source: U.S. Bureau of Labor Statistics 1

Why are gains in part-time jobs replacing full-time? Where are the missing workers? Is the story as positive as the news coverage? For a wealth of information on the nuances of the employment in the United States, visit https://www.bls.gov/cps/lfcharacteristics.htm.

According to the U.S. Bureau of Economic Analysis, real gross domestic product increased at an annual rate of 3.3% in the fourth quarter of 2023. While this was down from the third quarter GDP increase of 4.9%, it was still considered a positive in the news. But there is a lot more to GDP than a quarterly number. It is made up of the fates and fortunes of many industry segments. Which segments are growing, and which are falling can be much more important than the single number.

Investopedia defines the calculation of a country’s GDP as “encompassing all private and public consumption, government outlays, investments, additions to private inventories, paid-in construction costs, and the foreign balance of trade. Exports are added to the value and imports are subtracted. The GDP of a country tends to increase when the total value of goods and services that domestic producers sell to foreign countries exceeds the total value of foreign goods and services that domestic consumers buy.”

A disconcerting part of the U.S. GDP is that the largest industry value added at 20% is Finance, insurance, real estate and leasing, a sector very vulnerable to bubbles. Professional and business services fall second at 13% of GDP. The third largest industry at 11% of GDP in Q4 2023 is Government – encompassing local, state and federal governments. The government sector was the greatest contributor to the 3.3% gain in GDP in the 4th quarter, not necessarily a positive for the economy. 2

As for inflation, government releases and the media reports focus on “core” inflation, which omits food and energy, the two costs everyone faces daily.3 Getting letters from one’s utility company warning of increased power bills is generally not a good sign of where energy prices have gone, to say nothing of the cost of eating out. All of which brings us back to the financial markets.

As for inflation, government releases and the media reports focus on “core” inflation, which omits food and energy, the two costs everyone faces daily.3 Getting letters from one’s utility company warning of increased power bills is generally not a good sign of where energy prices have gone, to say nothing of the cost of eating out. All of which brings us back to the financial markets.

The efficient market hypothesis (EMH) states that share prices reflect all available information and outperforming the market is impossible without purchasing riskier investments. But share prices also reflect the emotional state of investors. It is very true that financial markets are incredibly accurate reflections of the overall emotional state and knowledge base of investors at that moment.

Which brings us to the importance of not following the latest newscast, tweet or market prognosticator’s outlook but the market trend. We will never know all the factors and decisions behind the daily action of individual stocks and indices, but we can watch the trend for signals that a change in direction is underway and respond accordingly. Not every buy or sell move will be correct, but reducing one’s participation in declining price trends changes the investment game. Investing always carries risk. But if we can reduce the risk of losing value to downturns, we have the leverage to potentially outperform in rising markets.

The information we need to follow – market trend – doesn’t come from news or social media, nor from corporate and government announcements, but from the market itself.

References:

1 https://www.bls.gov/charts/employment-situation/civilian-labor-force-participation-rate.htm

The Importance of Living Within Your Means

Investors had an exhilarating ride during the fourth quarter of 2023 and the opening of 2024, and many are feeling considerably richer and more financially secure. But before you get too carried away with your new wealth and decide it’s time live large, take a moment to recall Warren Buffet’s advice, “Remember that the stock market is a manic depressive.”

While markets can remain on an emotional high for far longer than might seem rational, good times are inevitably followed by bad times.

If you are investing for retirement, to make a major purchase, to open a business or to be able to take time off from work to reorient yourself, you need to take a long-term approach to investing. You can’t take a chance on confusing a bull market with future investment performance because the market does not treat overconfidence kindly.

Stick to your plan. Live within your means. Keep saving. And remember that the market giveth and the market taketh away. Make certain your advisor has a plan to manage the risk of market downturns to preserve gains for when the market turns against you and when gains are hard to come by.

Developing Multiple Sources for Retirement Income

If you anticipate being rich – far beyond your income requirements – in retirement, read no farther. If you are concerned about maximizing the income available to you in retirement, then one of your considerations needs to be the impact of taxes. By having alternative sources of income that are taxed differently, retirees can tap into different sources of funds over the span of their retirement to minimize taxes, reduce the impact of down markets, and have more after-tax funds to spend.

Personal income taxes are typically the highest taxes investors will pay. The largest source of funds for most retirees are tax-deferred retirement accounts. While these funds provided tax deductions during your working years, they are fully taxable as personal income when withdrawn. Federal taxes will claim 22% to 37% of every deferred retirement plan withdrawal as well as interest and nonqualified dividends from taxable investment accounts. Pension payments are also fully taxable at personal income tax rates unless the recipient made after-tax contributions.

Depending on where one lives, state income taxes will take their share as well.

Social Security is not immune to personal income taxes. Depending on the recipient’s income, up to 85% of Social Security benefits can be subject to taxes. That includes survivor and disability benefits.

Standard deductions and Alternative Minimum Taxes will impact actual taxes. Net investment income tax (NIIT) factors in for some taxpayers. at a rate of 3.8%. In 2024, the 28% AMT rate applies to excess AMTI of $232,600 for all taxpayers ($116,300 for married couples filing separate returns). AMT exemptions phase out at 25 cents per dollar earned once AMTI reaches $609,350 for single filers and $1,218,700 for married taxpayers filing jointly.

Standard deductions and Alternative Minimum Taxes will impact actual taxes. Net investment income tax (NIIT) factors in for some taxpayers. at a rate of 3.8%. In 2024, the 28% AMT rate applies to excess AMTI of $232,600 for all taxpayers ($116,300 for married couples filing separate returns). AMT exemptions phase out at 25 cents per dollar earned once AMTI reaches $609,350 for single filers and $1,218,700 for married taxpayers filing jointly.

Source: Internal Revenue Service, “Revenue Procedure 2023-34.”

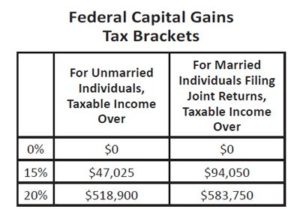

Capital gains from the sale of investments held more than a year in a taxable account, as well as qualified dividends, get more favorable tax treatment, leaving the investor with a higher after-tax, take-home amount than ordinary income.

Source: Internal Revenue Service, “Revenue Procedure 2023-34.”

Source: Internal Revenue Service, “Revenue Procedure 2023-34.”

Many retirees assume that they will need less income in retirement and will fall into lower tax brackets. But the sale of real estate, business ownership or high value personal property can push taxpayers into higher tax brackets. Required Minimum Distributions (RMDs) based on life expectancy, can also result in higher income than expected.

Reducing the amount of retirement savings lost to income taxes requires developing alternative sources of retirement funds long before you retire. Roth 401(k) and Roth IRA accounts, for example, are funded with after-tax dollars. Withdrawals after five years following the first contribution are exempt from federal personal income taxes as well as most state income tax structures. With no required minimum withdrawals, flexible use of these accounts for income can be used to lower taxable income.

With annuities, the portion of a withdrawal representing the initial principal is tax-free, while earnings are taxed at personal income rates (unless the annuity was purchased with pre-tax funds, in which case the full withdrawal is taxable).

Savings bond interest is taxable at ordinary income rates upon maturity.

Interest from municipal bonds issued by state, city, and county governments, is exempt from federal income tax and may be exempt from state tax. Profits from the sale of municipal bonds, however, have tax consequences.

Life insurance benefits are generally not subject to tax when received as a beneficiary. Surrendering a policy for cash may result in tax consequences.

Gains from the sale of the taxpayer’s primary home that meet specific ownership and use criteria can be excluded from income tax up to $250,000 ($500,000 for married couples). Excess value above the exemption amount is taxed as capital gains.

The goal of developing alternative sources of retirement income is to be able to modify income sources in response to changing circumstances and market returns to minimize taxes and optimize after-tax income.

All too often, investors focus on fees and returns, overlooking the fact that taxes may have a much greater impact on what is available to spend in retirement. If you have not thought about diversifying sources of retirement income, take some time to work with your financial advisor on what you might need in retirement.

The information presented here is an overview only. A number of factors including personal circumstances may affect tax consequences. Consult with your tax advisor before making any decisions.

Longevity Changes the Game

“If I knew I was going to live this long, I would have taken better care of myself.”

Attributed in various forms to Mickey Mantle, film producer Adolph Zukor at his 100th birthday, humorist Erma Bombeck, columnist Billy Noonan and others.

Human longevity forecasts envision a growing population of 120-year-olds by 2050, 26 short years away. The maximum human lifespan could top 130 by 2100 according to researchers at the University of Washington.

On the one hand, the prospect of a longer life is exciting. Think of what you could do with all those years. On the other hand, it is terrifying. Extending the average life span by 30+ years will mean a host of social and financial changes. As investment advisors, our first thought is “What will be required in the way of savings to support increased longevity?” “Can our clients accumulate enough savings to retire without also factoring many more years of work?”

On the one hand, the prospect of a longer life is exciting. Think of what you could do with all those years. On the other hand, it is terrifying. Extending the average life span by 30+ years will mean a host of social and financial changes. As investment advisors, our first thought is “What will be required in the way of savings to support increased longevity?” “Can our clients accumulate enough savings to retire without also factoring many more years of work?”

Social Security claiming will clearly have to change to avoid bankrupting the country. Careers may need to span 85 years, instead of today’s common retirement age of 65. Relationships may falter as loves and friendships become much harder to sustain over a century of personal changes.

Also worrisome is what will our health be like? Will we be able to stay involved and productive when we top 100 years? One certain factor is that living longer and getting the most out of those years means we will need to take better care of our health. According to the Centers for Disease Control and Prevention (CDC) six in 10 adults in the U.S. have a chronic disease. Four in 10 have two or more chronic diseases.

While genetic factors may play a role, lifestyle is a known factor in developing chronic health problems. Obesity – the accumulation of excess body fat to the extent that it can potentially have negative effects on health – impacts 49% of American adults. Tobacco use, poor nutrition, lack of physical activity and excessive alcohol use are known contributors to chronic diseases, including:

- Heart disease

- Cancer

- Chronic lung disease

- Stroke

- Alzheimer’s disease

- Diabetes

- Chronic kidney disease

Even with great advances in medicine, chronic or acute disease can require long-term care. The expense of accessing that health care will be a concern for many.

A longer lifespan means the old ways of working, saving, retiring and living out our lives will change. While those already in retirement may not see the impact of increased longevity, a 30-year-old today could be looking at 90 more years of life ahead. That requires rethinking how one lives their life today and how to plan for much longer longevity as individuals and a society. Taking better care of your health is a good starting point.