3rd Qtr Newsletter – 2019

Is 2019 a “Sell in May and Go Away” Summer?

The financial industry is rife with investment adages from “the trend is your friend” to “as goes January, so goes the year.” Among those snippets of market wisdom is “sell in May and go away.” Historically, the summer months have been a relatively flat period in the market. Among the proposed reasons for the phenomenon are the traditional exodus of financial professionals from an overheated New York City to homes on the coast, the flow of money into real estate purchases during the summer months, and the tendency to focus on vacations, golf course, beach, or pool.

While it would be nice to think that one can step away from worrying about the market during the summer, in five of the last six years, selling in May meant forgoing steady gains in the major market indices.

So far 2019 looks like a year when sell in May and go away is working, but before you take it to heart, there are a number of reasons the market could put in a respectable summer performance. GDP continues to be bullish, positive results of the current tariff tussle could propel the market higher and the Fed is taking a dovish position. It may also help that 2019 is a pre-election year, when the market tends to have its best performance of the four-year cycle.

Financial markets are anything but stable. Active management that strives to avoid major downturns and keep you invested when the trend is up can’t guarantee positive results, but we would argue makes sense across all market cycles and times of the year.

Password, Password, Who Has the Password?

Planning ahead for disability, dementia or the potential of one’s death is never fun. But if you want to prevent a potential disaster for your family or estate administrators, it is essential. And one of the most important pieces of information you need to have available are online passwords. Without a system in place to pass on your passwords, life can get very complicated.

An extreme example of the complications a missing password can have was the unexpected death of the founder and CEO of a Canadian cryptocurrency exchange, QuadrigaCX. His death and failure to leave passwords behind left $190 million in cryptocurrency belonging to the clients of QuadrigaCX totally inaccessible. There may never be a way for the investors to recover their funds.

COMPUTER, PAD AND SMARTPHONE PASSWORDS – Given the tendency to store important information digitally, including personal contacts, access to your computers and smartphone will be essential for someone trying to pick up the pieces when you are unable to do so.

EMAIL PASSWORDS – It used to be if you wanted to know what bills were due or what accounts an individual had, you checked their mail for statements. With the push to go paperless, many companies send statements via email. Without access to your email, bills, account statements, expiration notices and business emails are unobtainable.

FINANCIAL ACCOUNTS – Administering online banking and investment accounts has become easy and convenient as long as you have the right password. Without a password, it can be very difficult for a family member or executor to manage financial issues. Financial accounts include far more than just investment and bank accounts. There’s also PayPal, Venmo, Apple Pay, Android Pay, Samsung Pay, Google Wallet, credit cards, online retailers and more.

WEBSITES AND ONLINE BUSINESS ACCOUNTS – If you operate a business using online sites, such as a company website, electronic storefronts, Ebay or other online exchanges, without a password it will be difficult if not impossible for the sites to be modified or discontinued short of letting them expire or go into default.

SOCIAL ACCOUNTS – Without password access to close accounts, Facebook, Linked In, Twitter and other social media accounts can linger on long after an individual stops using the accounts or dies.

Complicating the issue even more is the encouragement that complex, unrelated passwords be used for different accounts and that those passwords be changed regularly.

Some options for passing on passwords include:

- Provide your passwords to a trusted family member. The catch here is the word “trusted.” Unfortunately, most financial fraud does not result from an unknown hacker, but a family member.

- Write down and place all passwords in a safe deposit box. Your executor or guardian/attorney-in-fact (in the case of incapacitation) can gain access to the safe deposit box through a power of attorney. The catch is the need to keep the list updated as passwords change.

- A digital wallet can be used to securely store passwords. With the wallet, you just need to provide a family member or executor with the password to access the digital wallet. This again could be through a secure safe deposit box. Not all digital wallets are created equal so research your options carefully before using.

Regardless of whether you use one of these options or find a better solution, make certain that in an emergency, the lack of a password doesn’t cause even more emergencies.

Social Security Claiming by the Numbers

When should you start to claim Social Security benefits? The answer depends on your personal situation. How long can you expect to live? What are your other resources for retirement income? What are your estate planning goals? There is also the question of your expectations for the future of Social Security.

But you also need to understand the how your claiming decision will affect the income you will potentially receive from Social Security over your lifetime. The numbers matter. ,/p>

Your primary options are:

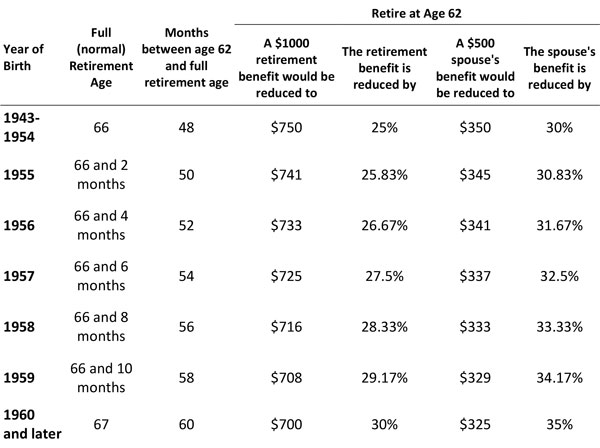

- Claim early – You can begin to receive Social Security benefits as early as age 62, but at a price. Your benefits will be permanently reduced by as much as 25%, while spousal benefits fall by up to 33%. The longer you live, the greater the penalty you will pay in lost benefits. For each year you postpone receiving benefits, the higher the benefit you will receive.

- Claim at full retirement age (this varies based on the year you were born) – This is the most common selection and nets you full benefits over your lifespan.

- Claim late – Wait up to age 70 to claim your Social Security benefits and the benefits you will receive increase by 8% for every year after your full retirement age that you postpone receiving Social Security up to age 70.

Full Retirement and Age 62 Benefit by Year of Birth

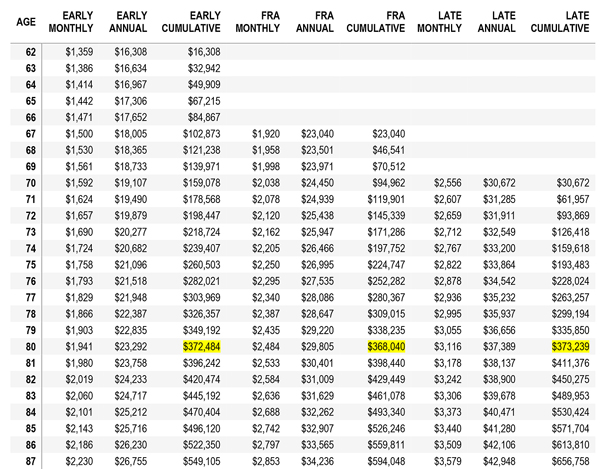

In the following example, an individual born in 1958 currently earning $70,000 a year is evaluating whether to take early retirement in 2020, wait for full retirement age, or delay retirement until age 70. The table was created using estimated data from the Social Security Administration’s online Quick Calculator https://www.ssa.gov/benefits/retirement/estimator.html. Benefits increase by 2% each year based on estimated inflation.

In terms of cumulative benefits, claiming late will net the highest benefit – provided the individual lives long enough. Looking at benefits on a breakeven basis, i.e. how long will it take to catch up with total benefits to date if benefits are claimed early, at full retirement age or late – it’s interesting to note that at age 80, all three claiming strategies are close to the same cumulative benefit.

Comparison of Social Security Benefits Based on Claiming Age

This is a hypothetical example that uses estimates of benefits and inflation and should not be construed as actual results or financial advice. Your results will differ based on your earnings history, retirement age and the potential for changes in Social Security benefit structures.

The decision of when to claim Social Security benefits comes down to a financial and lifestyle choice. If you are worried about running out of money in retirement, it may make the most sense to postpone claiming benefits until age 70, after which you will receive the maximum payments through the remainder of your life. If you have sufficient resources and prefer retirement over continuing to work, claiming benefits early may make the most sense. But beware that if you decide to go back to work there may be a hefty reduction in your benefits.

If you claim benefits before your full retirement age and then return to work, Social Security will deduct $1 from your benefit payments for every $2 you earn above the annual limit. For 2019, that limit is $17,640. The year when you reach full retirement age, $1 in benefits will be deducted for every $3 you earn above a higher limit. There is no reduction in benefits once you exceed your full retirement age.

The right claiming decision on Social Security is essential because it will impact your benefits for the rest of your life. The numbers matter. Take some time to sit down with a qualified adviser and understand your options and their financial impact before you make a decision.

"I Should Have Saved More"

The number one regret for most people, retired or still working, comes down to five simple words – I should have saved more. Life comes with risks – from changes in employment to accidents, natural disasters, medical issues, family problems and unexpected expenses. Having money in reserve is the best safety net there is to make your financial ends meet until life returns to normal. It can also reduce your sense of daily stress and give you the ability to take advantage of future opportunities.

So why do so few people have savings to tide them over rough patches in life?

- Inability to delay gratification.Perhaps the most important lesson of life is the ability to delay gratification of a want or desire. Media, advertising, and human nature all combine to tell us we deserve what we want now. Yet, studies clearly show children who are able to delay gratification of an immediate want for a future reward tend to end up more financially successful as adults.

- Accumulation of high-interest debt.Credit card debt goes hand in hand with the inability to delay gratification. The catch is that purchasing an item on credit and not paying off your card balance every month can end up doubling the actual cost of the item. The high interest rates for credit debt not only take away one’s ability to save but dramatically increase the cost of anything purchased on credit.

- An upbringing that never stressed the value of saving.Maybe you had rich parents who picked up the tab and never taught you self-reliance. Or profligate parents who always lived on the edge spending whatever money was available. You may have learned helplessness where relying on someone else to rescue you from a bad situation took the place of planning ahead. If you can recognize where your resistance to saving comes from, it’s a step toward changing your life.

- The feeling that the amount you have to save is too little to make a difference, so why bother.Small amounts do matter, particularly when contributed regularly and allowed time to compound. One of the best strategies for saving is to pay yourself first. Have automatic withdrawals made from each paycheck to a savings account. With that money no longer available, it’s easier to keep spending at a lower level. As your earnings increase, increase the amount you set aside each month.

- Relying on the unlikely to bail you out of financial problems.It is delusional to think that winning the lottery will solve all your financial problems or that a relative will drop dead and leave you the money you need. A phenomenal amount of money is wasted on the purchase of lottery tickets which could be used to build financial security. The odds of winning the lottery are next to impossible. Yes, there are winners, but that doesn’t make it likely that you will be one of them.

No matter how much or how little you earn, a financial safety net is essential. Life isn’t fair. Bad things happen to good people. But they don’t have to destroy your life if you have the financial resources to pick up the pieces and move on. If you are not currently saving, put together a plan that will let you set aside money every month. If you are saving on a regular basis, are you saving enough to meet your goals? And finally, are your savings working for you, i.e. earning money?

Financial success starts with setting aside money, saving for a goal and having a financial reserve to survive a rough stretch. Don’t wait for tomorrow. Set up an automatic withdrawal from your paycheck or income source now.