3rd Qtr Newsletter – 2023

60/40 Portfolio Nears the Three-Quarter Century Mark

The 60/40 portfolio, consisting of 60% equities and 40% bonds/fixed income, may be the most common financial recommendation individual investors encounter. It traces its origins to 1952 when economist Harry Markowitz published his Efficient Market investment model that became known as Modern Portfolio Theory.

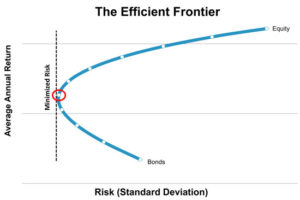

The brilliance of Markowitz’s theory was the use of diversification to reduce portfolio risk without unduly depressing return. The tools to do so at that time were rather simplistic, individual stocks and bonds. Market history indicated that if equities fell in value, bonds would rise in value. By graphing risk (standard deviation) and mean return basis using market data preceding 1951, Markowitz’s fishhook-shaped curve showed that the average highest return for the least amount of risk resulted from a blend of 60% equity and 40% fixed income.

Markowitz developed the Efficient Market Theory before computers and before today’s multitude of investment vehicles were developed that allow investment managers to slice and dice the market into endless allocations. It’s interesting to note that over a 70-year time horizon, that fishhook shape still appears to be valid. But naturally, there’s a catch. Real portfolios don’t have a 70+ year life span to wait out multiple market cycles.

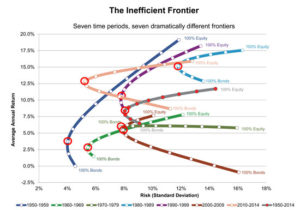

The problem with the Efficient Frontier is that over shorter time periods the “frontier” is a moving target. The 60/40 portfolio was a spectacular failure in 2022 when both equities and bond returns nosedived, resulting in a loss of -16.07% (60% S&P 500 / 40% Barclays Aggregate Bond Index). The graphic below is from a study published in 2015 in ProActive Advisor Magazine.

It depicts the efficient frontier of equity and bond portfolios illustrated in 10% increments. Equity returns are based on the S&P 500® Index, including the reinvestment of dividends. Bond returns include the reinvestment of dividends and are based on the Barclays Capital Aggregate Bond Index. Index returns do not reflect management fees, transaction costs or expenses. The red circle indicates the optimal allocation based on risk/return.

In 1970-1979, the fishhook disappeared as 100% bond and 100% equity portfolios achieve roughly the same return but with equities at more than double the volatility. In 2000-2009, the fishhook inverted, and bonds dramatically outperformed equities, moving optimal risk/return to 30% equities/70% bonds. Only in the 1980-1989 period was 60/40 an optimal allocation. The moving frontier illustrates the problem with using simplistic 60/40 portfolio designs and expecting a predictable return. Using 70+ years of data fails to match actual results of shorter periods.

In a 2004 interview with Jason Zweig in Money Magazine, legendary investor Peter Bernstein described a rigid allocation like 60% stocks, 40% bonds as a way of passing the buck and avoiding decisions.

Today’s investment manager has computing power, software tools, data and investment options that far surpass the simplistic financial world Harry Markowitz dealt with in 1952. As Peter Bernstein said in that 2004 interview. “Investors do better where risk management is a conscious part of the process….I view diversification not only as a survival strategy but as an aggressive strategy, because the next windfall might come from a surprising place. I want to make sure I’m exposed to it.” *

Our goal is simple: Manage portfolio risk and optimize return. A rigid allocation limits the ability to strive for that goal across different market environments.

* Peter Bernstein interview: He may know more about investing than anyone alive by Jason Zweig, MONEY Magazine, October 15, 2004.

Trickle Down Effect of Higher Interest Rates

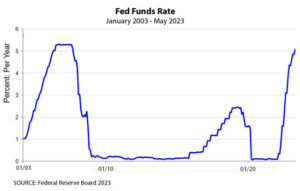

Starting in February of 2022, the Federal Reserve began increasing the Federal Funds Rate to bring inflation under control. Through May 2023, rates rose faster than in previous any cycle. In the process, the Fed brought back to the spotlight a risk many investors had disregarded after over a decade of low interest rates – interest rate risk. 2022 was the worst year on record for bonds, according to Edward McQuarrie, an investment historian and professor emeritus at Santa Clara University.

U.S. government securities are considered among the safest investments in the world. Held to maturity, U.S. bonds can be expected to maintain the same cash value as their initial issue terms. If one needs to liquidate a bond position prior to maturity, however, prevailing interest rates and the remaining time to maturity, i.e. duration, determine the cash value of the bond. With bond investing, when interest rates rise, bond prices fall, and vice versa.

One way to think of bond values is the competition for return. If an investor can purchase a new bond with the same maturity date paying 5%, an existing bond’s price needs to be discounted to produce a competitive 5% return if sold.

Duration risk is the name economists give to the sensitivity of a bond’s price to a 1% change in interest rates. Duration also affects bond funds. For example, a bond fund with 10-year duration will decrease in value by 10% if interest rates rise 1%. On the other hand, the bond fund will increase in value by 10% if interest rates fall 1%.

In addition to maturity – the length of time before the bond’s principal is repaid, variables such as how much interest a bond pays during its lifespan as well as the bond’s call features and yield, which may be affected by changes in credit quality, play a role in the duration calculation.

While rising interest rates provide better returns on new debt investments, there’s typically little in the way of good news for borrowers when interest rates increase. Variable rate loans see a noticeable interest rate increase when they adjust, and the cost/interest rate of new loans increases.

A great many businesses depend upon variable rate lines of credit to purchase or manufacture products and repay the line of credit as products are sold. For the businesses to continue to be viable, increased interest rates are passed along to buyers. Interest rates for commercial real estate loans typically adjust every five years, adding more interest rate pressure on owners of business property from office buildings to retail, industrial and residential buildings.

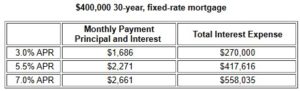

To put costs in terms of the average person’s budget, it may help to consider the impact of higher interest rates on mortgage interest paid over the life of the loan.

Over the 30-year life of the loan at 7%, interest payments will exceed the original loan balance. Higher payments, make qualifying for loans more difficult and buyers may need to lower the amount they can borrow to qualify.

The biggest negative impact of rising interest rates will hit the biggest borrowers, which are almost inevitably governments. With more than $31.42 trillion in outstanding U.S. debt in December 2022, many investors are considerably poorer in terms of the cash value of their U.S. government securities. To persuade those investors to purchase more government debt will require higher interest rates.

States and local governments have an additional $4 trillion plus in outstanding loans. Higher interest rates will take their toll when outstanding obligations are rolled into new debt offerings, or additional funds are raised through new borrowing. An improving economy with increasing tax collections could offset higher interest rates, however, the Federal Reserve’s goal in imposing higher interest rates is to depress the economy to lower the rate of inflation.

So far, the U.S. economy is holding up admirably in the face of higher interest rates, with a continuing strong job market, leaving future interest rates uncertain. Will inflation fall off, allowing lower interest rates, or will continuing inflation keep the rate pressure on?

A Salute to William O’Neil

“I never met anyone, or heard of anyone, or read of anyone who was successful who was a pessimist. You have to be positive, or you’ll never get anywhere.”

William O’Neil – 1933-2023

William O’Neil, founder of Investor’s Business Daily, died Sunday, May 28th at the age of 90. O’Neil was remarkable not only for his rise from poverty growing up in the Dust Bowl of Oklahoma to investing success, but for his focus on helping individuals invest successfully in stocks. In 1964, O’Neil became the youngest person to purchase a seat on the New York Stock Exchange at the age of 30. He was an early adopter of computers to analyze and select stocks, launched the Investor’s Business Daily in 1984 and in 1988 published the book “How to Make Money in Stocks,” introducing investors to his CAN SLIM investing technique.

At the center of O’Neil’s investment philosophy was the stop loss. Any time a stock declines 8% from its prior high, it is time to sell, he maintained. “As long as investors limit their losses, they have the opportunity to invest in another company with a positive price trend. If the first stock reverses its trend and shows good price momentum, you can always buy back in. But you can’t always count on a recovery. This is the great fallacy of buy-and-hold investing. Many stocks have gone all the way to zero, even in a bull market.”

Tax Reduction or Tax Evasion?

Looking for a way to eliminate ordinary income and/or capital gain taxes on the sale of property?

The IRS is warning taxpayers that despite what promoters may say, misusing Charitable Remainder Annuity Trusts are not the way to do so. The IRS is cracking down on abusive arrangements involving Charitable Remainder Annuity Trusts (CRATs) promoted as a means eliminating taxes on donations and receiving tax free income from the Trust.

Charitable remainder annuity trusts, or CRATs, are irrevocable trusts that let individuals donate assets to charity and draw from the trust a specific dollar amount each year as annual income for life or for a specific time period.

- Transfer of property to a CRAT does not result in an increase in basis to fair market value as if the property had been sold to the trust.

- Grantors receive a partial income tax deduction based on calculation of the anticipated remainder distribution to the charitable beneficiary.

- When the trust sells property used to fund the trust, it must recognize any gain over the original basis as trust income. That income is taxable to the grantor when withdrawn as annual income.

- With a deferred annuity, IRS rules state that you must withdraw all of the taxable interest first before withdrawing any tax-free principal.

- The trust is required correctly report trust income and distributions to beneficiaries, file required tax documents and follow applicable laws and rules.

Taxpayers, the IRS warns, “are legally responsible for what is on their tax return, not the practitioner or promoter who entices them to sign on to an abusive transaction. The IRS may assert accuracy-related penalties ranging from 20% to 40% of an underpayment of tax, or a civil fraud penalty of 75% of any underpayment of tax” related to such transactions associated with CRATs.

While Charitable Remainder Annuity Trusts may help donors make certain they do not run out of money in retirement and that any remainder goes to a charity one supports, you need to make certain and work with qualified investment and tax professionals in setting up the Trust. The IRS has flagged CRATs for additional scrutiny and the penalties for an abusive CRAT are substantial.

Retirement Planning Without the Fear Factor

When it comes to retirement planning, much of the advice you will encounter has two big flaws:

- The belief that focusing on the fear that you have not saved enough and will run out of money before you run out of life will motivate you to save more.

- One-size fits all rules.

Fear is a powerful motivator over the short term. When it comes to long-term goals, requiring setting aside gratification today for a distant goal of retiring, fear loses its power over time. Fear-based motivation is related to negative thinking. If the financial cost or goal is too overwhelming, paralysis can set in. When fear lasts too long, it tires you out and makes you want to give up.

It also doesn’t help that most retirement advice comes with one size fits all rules, such as the following:

- You will need at least 80% of your preretirement income to live on when you retire, assuming you have no mortgage.

- Your retirement should begin at age 65 because you can lock in medical insurance through Medicare at age 65.

- You should wait until age 72 to retire when you will receive the highest Social Security payout.

- Withdrawing 4% of your retirement savings your first year and increasing the amount each year by the rate of inflation will provide you with an income you should not outlive, although recently planners have begun hedging their advice by recommending a 3% rate of withdrawal.

- At 4%, you will need to have 25 years of savings to retire.

Between fear marketing and rules approaches, there’s not a lot of positive motivation. Which may be why it is so hard for many people to save for retirement. Even having lots of money doesn’t assure a happy retirement.

It’s time to turn retirement planning around and start first with what your idea of retirement encompasses. Not having to go to work every morning is not a retirement plan.

Retirement can easily stretch 25 years or more. What do you want to do with those years? And, if you are married or in a long-term relationship, what does your partner want to do with those 25+ years? The last thing you want to do is to retire and discover you don’t share the same goals, resulting in a costly split up and leaving you with considerably less assets than you anticipated.

The real determining factor for how much money you need to be able to retire financially secure is what you want your retirement to encompass. If you envision renting your home, buying a motorhome and spending the next five years wandering the 50 states, that’s a different financial commitment than five years of exotic cruise ship voyages. If you want to sell your home and move closer to family members, that’s part of your plan.

It may help to think of retirement in five-year increments, remembering that as time passes, we will be older and less able to pursue some of our early retirement goals. How would you like to envision your life at 85 versus 65?

Another consideration is what sources of money you might have in retirement beyond Social Security and your savings. Can you build an income stream from your hobbies? You may want to continue to work part-time or take a job you find more fulfilling that may pay less. Financial advisors are notorious for working long after others are retired simply because we enjoy our work. If that is your situation, do what makes you (and your partner) happy.

Every retirement plan is inherently different, reflecting the individual desires, assets, and abilities of the retirees. This includes a realistic look at what your health will permit you to do and planning for certain eventualities of aging.

Before you lock yourself into a plan, it might make sense to give it a trial run. Can you handle life in a motorhome? If you are thinking of retiring to raise vegetables on rural farm, perhaps a summer on a farm might be in order first. Do you like traveling as much as you think you will? Give it a test run.

If volunteering is in your plan, before you build your retirement on filling your days giving back to society, try it out first with organizations you want to support. All too often individuals find that volunteering is a lot like a regular job with bosses you may not enjoy, regular work hours, client/customer issues and training programs that can deal with issues you thought you left behind along with a paycheck. If an organization isn’t the fit you thought it would be, look for others where your skill set is valued or consider starting your own non-profit.

Realize that plans change. If retirement doesn’t turn out the way you imagined, figure out what is making you unhappy and how you can change your life. If you have a surplus of money, don’t be afraid to spend it the enjoy new experiences.

Retirement will always have its uncertainties, but if you start thinking early about what you want from retirement, testing your ideas, and focusing on what you really want to do with all those years, you will find it a lot easier to be motivated to save the money you need. Focusing on positives rather than negatives changes the game.