3rd Qtr Newsletter – 2024

Balancing Willingness to Take Risk and Ability to Take Risk

When it comes to the return we really want from our investments, the answer is generally the highest possible. But risk must also be a part of the investment decision.

Most people accept the fact that higher return requires taking greater risk, but all too many assume that higher risk assures higher returns. That’s not the way it works. Risk is the possibility that you will lose money, sometimes all your money. If risky investments did not offer the potential for oversized gains, no one would invest in them. But accepting risk is never a guarantee of profit.

Most people accept the fact that higher return requires taking greater risk, but all too many assume that higher risk assures higher returns. That’s not the way it works. Risk is the possibility that you will lose money, sometimes all your money. If risky investments did not offer the potential for oversized gains, no one would invest in them. But accepting risk is never a guarantee of profit.

In building portfolios for clients, one of our questions is how much risk you are comfortable with, i.e. if your portfolio loses 10% will you be looking for another advisor? What about 20%, 30% or more?

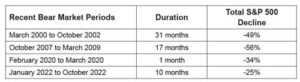

While the long-term trend of the market is up, recent bear markets have resulted in losses of 25% and up. If you are determined your portfolio returns should equal the performance of the S&P 500 Index, investing in an Exchange Traded Fund that tracks the S&P 500 will achieve your goal, but can you accept the accompanying risk?

As a financial advisor, our role is that of a fiduciary. That requires that we look beyond your stated willingness to assume risk to your ability to take risk. How much loss can your portfolio reasonably assume without causing financial distress? This takes into consideration hard facts, including:

- Age – Do you have time to replace lost savings or recover from a down market?

- Life status – Are you retired, unemployed, under-employed? Do you have health issues, dependents, major life changes coming up? What are your savings goals

- Current assets – Do you have sufficient assets that a loss will not negatively affect your present life and long-term financial requirements? How much can you risk in the pursuit of higher returns?

- Job stability – If a high-risk investment loses value, will you be able to rebuild your net worth through savings from your work.

- Emergency savings – Do you have sufficient available funds to wait out a market recovery period, a disaster, or a family emergency without having to liquidate investments?

Willingness to Take Risk and Ability to Take Risk change over time, which is why it is important to provide your advisor with updates as your life changes. Our goal is to assure your financial security over time while managing the risk of investing.

Cautious Optimists Make the Best Investors

To be a good investor, it helps to be an optimist. Otherwise, bad news and potential problems would overwhelm your ability to make investment decisions. The bears can always make a good argument about why the market is approaching meltdown because there’s always something that can go wrong. But there’s also a lot of good news.

In Berkshire Hathaway’s 2021 shareholder letter, comes “In its brief 232 years of existence, however, there has been no incubator for unleashing human potential like America. Despite some severe interruptions, our country’s economic progress has been breathtaking. Our unwavering conclusion: Never bet against America.”

The good news about investing is that the market goes up a lot more than it goes down. That puts the odds on the investor’s side. But investors still need risk controls, particularly when approaching retirement. Bear markets combined with the need to withdraw funds for living expenses can put a retirement portfolio into a death spiral. That’s where caution comes in. Yes, we believe in the power of the equity markets to create wealth. But we also know a little caution, and sometimes a lot of caution, doesn’t hurt!

Planning Ahead - If the 2017 Tax Cuts and Jobs Act (TCJA) Sunsets

Remember the Trump tax cuts that took effect in 2018?

Without Congressional action, the Tax Cuts and Jobs Act (TCJA) of 2017 is scheduled to sunset after December 31, 2025. Regardless of who the next president will be and the makeup of Congress after the 2024 election, the odds that the TCJA tax cuts will be extended are not looking good.

With national debt in excess of $34 trillion, a national deficit of $1.6 trillion per year (the amount spending exceeds annual revenue to the federal government) and increasing interest costs on that debt, the federal government is looking for money. And in the end that money is going to come from taxpayers.

That leaves many Americans with just 18 months to lock in tax savings from the TCJA before the start of 2026. Depending upon how much you may face in future taxes, the savings could be extensive.

Sunsetting Individual Benefits from the 2017 TCJA

- The TCJA reduced personal income tax rates across the board through lower individual tax rates, modified tax brackets, and almost doubling the standard deduction from $12,700 to $24,000 (married filing jointly). In 2026, those changes revert to the 2017 tax code, with limited inflation adjustments.

- Widespread use of the standard deduction eliminated itemizing deductions for most Americans. Itemizing will be back in fashion if the standard deduction reverts to 2017.

- The positive for Americans with big mortgages and high state and local taxes will be the ability to use major itemized deductions. Taxpayers who itemize deductions will be able to deduct interest paid on the first $1 million ($500,000 for married taxpayers filing separately) of debt secured by a first or second residence. Also, the interest paid on the first $100,000 of home equity debt, regardless of the purpose for the loan, will be deductible, as will the state and local tax (SALT) deduction.

- Dying wealthy will be a lot more expensive. TCJA doubled the lifetime gift and estate tax exemption (from $5.6 million to $11.2 million in 2018 for married couples filing jointly), indexed to inflation.

- The maximum child tax credit falls back to $1,000 and the maximum refundable amount will be cut.

- The 20% pass-through deduction and limitation on noncorporate loss deductions disappears.

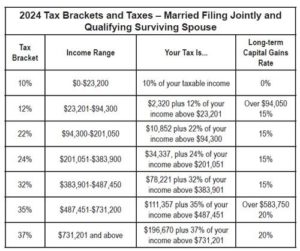

- Capital gains taxes will no longer be tied to ordinary income tax brackets.

- More taxpayers will once again be subject to the Alternative Minimum Tax (AMT).

This list is just an overview of major provisions impacting individuals in the 186 pages of the original Tax Cuts and Jobs Act and the resulting regulations to implement the changes.

Reducing Potentially Higher Future Taxes

The good news? You have a little over a year to take advantage of the existing tax code.

The best place to start is with your tax advisor to make certain you understand how the TCJA sunset will affect you and your tax burden. Everyone’s situation is different, and a custom approach often produces the best results. Just make certain that you understand that there is no guarantee that Congress will allow the TCJA to expire. It’s possible precautions may be unnecessary.

Some tactics you might discuss with your advisor include the following:

Harvest capital gains and reset your tax basis.

If you are likely to fall into a higher capital gains tax rate in 2026, it may make sense to sell investments with significant long-term capital gains prior to expiration of the TCJA. Because you are harvesting gains, not losses, you can repurchase the securities at a stepped-up basis, locking in tax savings.

Adjust your exposure to the Alternative Minimum Tax

Exercising Incentive Stock Options (ISOs) could reduce your exposure to the AMT. The AMT is computed by removing many of the typical income tax deductions, and in some cases including additional income such as from the exercise of incentive stock options.

For those with major estates, consider gifting

There is no need to die early to take advantage of 2024 estate tax exemptions of $13.61 million for individuals or the combined exemption amount of $27.22 million for married couples. In general, individuals and married couples can use their estate, gift, and generation-skipping transfer tax exemption during their lives, by gifting to irrevocable trusts and other advanced estate planning strategies before the Jan. 1, 2026 deadline. Gifting depressed assets that have temporarily dropped in value, whether directly to a beneficiary or in trust, can allow you to move assets out of your estate using less of your lifetime estate and gift tax exemption.

Convert a traditional IRA to a Roth IRA

Converting a traditional IRA to a Roth requires paying your income tax liability upfront, in exchange for no Required Minimum Distributions and tax-free future growth and distributions. There are some catches to how distributions must be made, so make certain you understand the rules.

Charitable giving using cash

Under the Tax Cuts and Jobs Act, the deduction for cash contributions directly to charity increased from 50% of Annual Gross Income to 60%, including for gifts to a donor-advised fund. After sunset, this limit will revert to 50%, so donors should consider maximizing their cash gifts.

Business will feel the pain

Many businesses were positively impacted by the 2017 Tax Cuts and Jobs Act. These benefits could disappear with the sunset of the Act. These impacts are beyond the scope of this brief article, but something business owners need to discuss with their accountants.

These strategies are intended for informational purposes only and are by no means a financial recommendation. Beneficial Capital does not offer tax or legal advice. Any approaches made to reduce future tax liability need to be made with the advice of your tax and financial advisors. Given the complexity of our tax law, there are undoubtedly a number of other tactics you can use to capture savings under the TCJA before the end of 2025.

Owning Gold is Gaining Popularity

When you can buy gold along with your groceries at Costco, there’s clearly increased desirability to owning gold. But before you get too carried away with your gold stash, there are a few things you need to understand.

Warren Buffett’s bias against gold is that it does not build value through growth or pay interest, unlike dividend stocks, bonds and savings accounts. There is no compounding over time. Its value derives directly from demand.

Unless you opt to own gold through an Exchange Traded Fund (ETF), you will find gold is a lot easier to buy than it is to sell.

Gold jewelry can usually be sold online or offline to a local jewelry store or pawn shop. Gold coins, also referred to as bullion coins, are a different matter. They are considered an investment or store of value, rather than a consumer item. You can look up the current value of bullion coins produced by national mints via an online gold bullion market such as Monex, Money Metals Exchange or JM Bullion. The listed price is not, however, what you will receive when selling your coins. Dealer costs, handling charges and delivery fees can quickly reduce profits from rising gold prices.

Online gold buyers tend to offer the highest price, but you can’t walk in with your coins and walk out with money. There is considerable trust involved in an online transaction. You need to make certain the buyer is reputable. Better Business Bureau ratings and reviews are a start. Local coin shops and pawn shops provide the benefit of immediate cash and personalized service, although they typically offer lower prices. Pawn shops tend to provide the least value for your coins and may not deal honestly with novice sellers.

If you make money selling your gold, the government will want its share. The IRS classifies precious metals, including gold, as collectibles. This applies to gold bullion coins and bars as well as exchange-traded funds that invest in physical gold and other precious metals. Physical holdings in gold or silver are subject to a capital gains tax equal to your marginal tax rate, up to a maximum of 28%. Short-term gains for gold you hold for less than a year are taxed at the ordinary income tax rates that apply to income such as wages or interest.

Sales of physical gold or silver need to be reported on Schedule D of Form 1040 on your tax return. A loss from selling gold can be used as a tax deduction. Depending on the type of metal you are selling, Form 1099-B must be submitted to the IRS at the time of the sale. An IRS form may also be required when bullion is purchased based on the amount of bullion you purchase, how it is paid for and the mint year.

Storing gold can also be problematic. Homeowner’s insurance typically has a $200 limit of coverage for gold and silver bars or coins. While you could pay an additional premium and install security devices, keeping gold at home has risks. Bullion Vault holds its customers gold in vaults in London, Zurich, New York, Toronto or Singapore, but there is a cost.

Before you purchase gold as an investment, inflation hedge, disaster protection or other reasons, make certain you understand why you are purchasing the gold, where you will store it and how you will sell it if you need funds. Gold bullion is not a readily liquid source of funds, and it comes with a degree of personal risk if you plan to keep it in your home. You also need some way of letting your heirs know where your gold is in the event of a personal problem or death.

T+1 Settlement Took Effect on May 28

As of Tuesday, May 28, the day after Memorial Day, a SEC new rule is in effect requiring most securities transactions to ‘settle’ in one day. Settlement is when stock is transferred from the seller’s portfolio to the buyer, and payment is deducted from the buyer’s account and transferred to the seller.

Prior to May 28, U.S. financial institutions had two days – T+2 – to settle transactions involving:

- Stocks

- Corporate bonds

- ETFs

- Municipal securities

- Some mutual funds

- Limited partnerships that trade on exchanges.

Now those transactions are required to be completed on a next-day basis. Proceeds from selling a security will show up in investors’ accounts faster, allowing money to be reinvested quicker. Investors will need to have their funds ready, however, before they buy securities. There’s little if any lag time to have funds transferred between accounts. T+1 does not impact options and government securities like Treasurys, which are already on a next-day settlement schedule.

T+1 is expected to benefit the financial industry by reducing ‘failure to deliver (FTD)’ risk when trades fail to settle because either the money or the stock isn’t there. The ability to reinvest funds from a transaction quicker may also add greater volume and volatility to financial markets.

Faster technology is a key reason for T+1, however, meme stock trading added impetus to the change. Frenzied meme trading In early 2021 put massive stress on retail trading platforms, increasing the amount of margin they had to post as collateral for the trades. Since the start of T+1, the balance in the National Securities Clearing Corporation’s Clearing Fund, where collateral is posted to cover FTD losses, has fallen by 25%.