4th Qtr Newsletter – 2022

The Good News, Bad News of Inflation

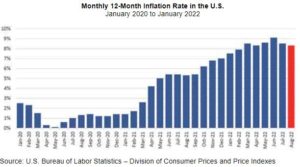

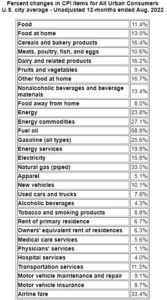

July and August brought good news on the inflation front with a drop from a 9.1% annual increase in the Consumer Price Index (CPI) recorded in June to 8.5% in July and 8.3% in August. But the end of inflation still has a rocky road ahead. Behind the recent decline are two major factors, lower energy costs and lower sales prices for used cars, both of which had seen increases in excess of 40% over the past 12 months.

Gasoline prices were 49% higher in June than the year prior, but declined in July and August, in part due to fewer miles driven and a strong U.S. dollar. Used car and truck prices had seen an unprecedented increase of more than 40% in 2021 and began falling in early 2022. Those declines helped offset inflation in many other categories of the CPI that continued to take a bite out of Americans’ income. T he food component of the index rose 11.4% over the prior year in August, the highest increase since May of 1979. With fall and higher heating costs looming, the respite from inflation could be brief.

Following the Federal Reserve Board’s August 2022 meeting at Jackson Hole, Fed Chairman Jerome Powell warned, “Reducing inflation is likely to require a sustained period of below-trend growth…. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.”

The problem with inflation is that it rarely ever ends without a fight. Rising prices spur demands for rising wages, higher interest rates, and higher prices to protect from inflation. Those higher costs tend to be sticky and often never drop back to earlier levels. The stickiest cost is labor. Union contracts and minimum wage laws lock wages in at inflation highs. Which is where inflation gets ugly with “pain to households and businesses.”

To break an inflationary cycle, you have two options – reduce demand or increase supply. Reducing demand comes down to making products and services more expensive. Since businesses typically depend on lines of credit and borrowing for inventory, facilities and equipment, increasing interest rates increases costs, forcing prices higher. Higher prices tend to limit demand.

Increasing supply is trickier. In an inflationary environment, consumer spending focuses on essentials. Prices of non-essential goods fall as businesses lower prices to reduce inventory and pay their operating costs. But if they can’t produce future goods at the lower price due to inflation, there’s little incentive to do so. For prices to fall after the fire sales, the cost of production needs to fall and that requires increased productivity from a more efficient labor force, new technologies and/or new sources of supply that lower the costs of production and providing services. Prices retreat as it becomes less expensive to supply the desired good or service. Computer technology is a prime example.

Source: U.S. Bureau of Labor Statistics

Inflation has existed since the invention of money and the discovery of governments that they can print money. The Roman empire was beset with inflation in the 3rd century but managed to hold on for nearly 200 years before disintegrating in the 5th century. Gold pouring into Europe from the New World triggered 400% inflation in the 16th century. The U.S. Constitution owes its existence to inflation. Prices in the colonies doubled in 1776, doubled again in 1777 and 1778. By 1781, prices had increased 80-fold as the Continental Congress printed money to finance the Revolution. The new “Union” was falling apart under financial pressures. Alexander Hamilton’s monetary and tax systems combined with the discipline of the Constitution kept inflation away until the Civil War.

Wars historically are almost always linked to inflation. Soaring inflation crippled the south during the Civil War as the Confederacy printed money, while the North was able to finance much of its war effort with debt. World War I caused prices in the U.S. to increase almost 100% in two years. Wage and price controls were used during World War II to keep inflation around 25%. But after the war, inflation took off with farm prices up 30% in a year. The U.S. was saved from an inflationary spiral by an incredible surge in productivity, much of which resulted from lessons learned supplying the war effort.

In the 1980s, inflation in the U.S. hit 13.5%, the highest ever peacetime rate. It only fell after the Federal Reserve sharply increased interest rates, triggering 10.8% unemployment and a deep recession.

Is there a way to reduce prices and reverse inflation without the pain of higher interest rates? You need to increase productivity — to find ways to make products, grow food supplies and provide services more efficiently and at a lower cost. That doesn’t happen in a month. Unless we are very fortunate, it’s not going to happen in a year.

Inflation is as old as the creation of money; somehow people always survive in the end. What inflation does require is looking carefully at your finances (particularly if you are nearing retirement), finding ways to optimize your investments, and minimizing your outflows. You also need to consider how to adapt your lifestyle if there is not a soft landing. If you are concerned about inflation’s impact on your life, call and let’s set a time to talk.

Why Are Forecasts So Often Wrong?

The nature of humanity is to seek control over our lives. We try to impose patterns on life to help us predict the future, even when those patterns may have little reality. We look to science for ways to control the world around us. In the financial industry, great effort has been spent on developing models to analyze markets and determine optimal investments. In the investment advisory industry, we strive for the idea of financial stability, of knowing your money will last as long as you do.

But it often seems that the more humanity seeks to control and understand the world, the weather, the markets, the behavior of a crowd, or even the tipping point of a social or physical change, the more unpredictable events become. Are we using the wrong data sets, the wrong assumptions? Why does life spiral out of our control?/p>

That question is as old as mankind. Peter L. Bernstein in his book Against the Gods: The Remarkable Story of Risk, published 1998, proposed that humanity created gods to impose order on the world. Events could be blamed on whether the gods were happy or upset and one could seek to change one’s circumstances by appealing to the gods. When the gods approach failed to change reality, mathematics was invented and the calculation of risk. How many times could dice be thrown and produce certain number combinations?

By the 1900s, the early U.S. Weather Bureau believed it could pinpoint when and where hurricanes would happen (the resulting forecasts did not end well), a feat which still escapes weather scientists today. Wildfires, earthquakes, and volcanic eruptions may give telltale signs that an event is eminent, but never fail to surprise.

Part of the problem is that we are dealing with immensely complex systems. Can the flapping of a butterfly’s wings cause a global change? We simply don’t know, although not from a lack of trying.

A fascinating, simplistic experiment to understand complexity is the sandpile. Most of us at one time or another in our childhood built sandpiles or sand castles until it suddenly collapsed. In 1987, three physicists at Brookhaven National Laboratory in New York decided to study “non-equilibrium” systems by building a digital sandpile, adding one grain of sand at a time randomly to the pile to see at what point an avalanche would begin. (https://physicsworld.com/a/per-bak-1948-2002/) Their work showed that many phenomena in Nature are so complicated that their large-scale behavior cannot be predicted from their microscopic origin. What is the typical size of an avalanche? There is no typical number. “At any time, literally anything it seemed, might be just about to occur.”

Further experiments classifying relatively flat sand areas as low risk and steeper sections as high risk showed that the more high-risk areas in the sandpile the greater the potential for an avalanche. But the consequences of the next grain were still unpredictable. It could be cataclysmic or a brief slippage. Since that time, study of the “critical state” at which change occurs has expanded into many areas, revealing our inability to precisely predict upheavals in many natural and man-caused phenomena.

Why does this matter? It reminds us that we live with uncertainty and need to accept that there are things we can control and things we cannot. For those we cannot, we need to look for ways that we can survive with the least damage and move on.

Watch Out for the Tropes!

Have you been told recently that your comment is just a trope? If not, the word could be turning up any day now, likely as a putdown. A trope twists language to create a meaning beyond the literal. While trope is closely related to “metaphor”, if someone tells you that is just a trope, they may mean it is just a common or overused theme or device.

The financial industry loves tropes, cliches and metaphors. They provide a colorful summary of conditions without having to be accurate. If you are the author of a new term, one of the worst corruptions of the term is to see it turned into a trope. Nassim Taleb coined the term black swan in his best seller The Black Swan: The Impact of the Highly Improbable, only to see it increasingly used as an excuse for failure when, as he protests, the circumstances were not only probable but predicted.

Tropes can also be used to mislead. A perfect storm is a critical or disastrous situation created by a powerful concurrence of factors, which are often observable as they develop. The surprise is what happens when people ignore the warning signs. Failing to head for shore in the face of a known danger, is not a perfect storm, but the result of overconfidence.

Simple Techniques to Avoid Late Fees and Penalties

Back in July, the Wall Street Journal reported a curious trend…people are forgetting to pay bills.

If you find yourself forgetting payments, there could be a number of perfectly normal reasons. As we get older, time seems to go faster and a deadline can be on us before we know it. There’s also the problem of too many things on your mind, too many activities that are much more fun than paying bills, or even depression.

The good news is that there are a number of relatively simple changes you can put in place to make certain you don’t incur late fees or penalties because time got away from you.

1. If you have the money to pay your bills when they are due, set up automatic payments. Combine automatic payments with alerts from your bank, so you know when bills are paid and the amount.

2. Use credit cards to make utilities payments to assure that you never face a disconnection issue or late payment charge. The catch is to not pay extra to use a credit card for payment and pay your credit cards on time. Credit cards are a very bad and expensive way to borrow money!

3. With regards to paying your credit cards, if you are not comfortable with automatic payments, set up an automatic minimum payment every month so you never pay a late fee as well as interest if you miss a payment.

4. If there are better times of the month to pay your bills, talk to the companies behind the bills to see if you can change the due date to group payments. Then, ideally, you only sit down once a month to pay bills.

5. Set calendar alerts or reminders 10 days, 5 days and/or 1 day before due dates on your digital calendar so alerts show up on your computer, laptop, pad, and/or phone. If you prefer low-tech, put payment dates on your printed calendar for a full year. Include:

- Credit cards

- Mortgage or rent payments

- Car payments

- Utilities

- Dues

- And other regularly scheduled payments.

6. You can hire a bookkeeper to manage your payments and meet with you regularly for signatures on checks. This can be particularly useful if you have a hard time dealing with finances and numbers.

7. If poor money management skills are behind your failure to pay bills on time, you may want to consult a credit counselor. Failing to pay your bills on time is not just an inconvenience, it can get very expensive over time and endanger your credit rating, ability to borrow money and ownership of items purchased through loans.

Preparing for the Inevitable

Ideally, we will all grow old, given the alternative is dying too young. But preparing for the day we will be old is hard. In fact, most people prefer to avoid thinking about aging until they are face-to-face with reality, which can be too late if they need long-term care and are unprepared financially for the cost.

dying too young. But preparing for the day we will be old is hard. In fact, most people prefer to avoid thinking about aging until they are face-to-face with reality, which can be too late if they need long-term care and are unprepared financially for the cost.

According to the Center for Retirement Research at Boston College, among individuals age 65 and onward:

- A fortunate 20% will need NO long-term care support

- 25% are likely to experience a severe need for long-term care

- 22% will have low long-term care needs

- 33% will have moderate long-term care needs

Where you fall on the spectrum depends on a number of factors.

Heredity is a critical factor. The catch here is that with better medical care, people are living longer and over their expanded lifespan have more time to fall victim to health issues their parents never experienced. Still, it helps to look at family members to evaluate what problems you might face. A family history of Alzheimer’s disease has to be a consideration in looking at the possibility of long-term care.

And then there is the bugaboo of your health status. As Covid brought to the forefront, the more comorbidities you have, the more vulnerable you are to debilitating illnesses. Comorbidities are distinct health conditions that are commonly present at the same time. Diabetes and coronary artery disease are comorbidities. They can co-occur because high blood sugar can damage blood vessels. People who have cancer, chronic lung or kidney disease, high blood pressure, obesity, HIV, or diabetes are at higher risk for serious illness or death. While death eliminates the need for long-term care, you may dodge that destination in exchange for requiring long-term care.

Long-term care doesn’t necessarily mean assisted living or a nursing home. Home health care by paid caregivers, family members and friends is the preferred option for many people, particularly those with low to medium needs. Others find the social stimulation of assisted living and senior homes a better solution. And sometimes, there’s just no option other than the 24-hour care of a nursing home.

The best solution to being able to afford the care you want is to be wealthy. The second is to have long-term care insurance. But these policies have proven difficult to sell to a public that doesn’t want to think about growing old. Add in very high premium increases that have disillusioned policy holders and the potential of losing tens of thousands of dollars in premiums if long-term care is not needed, and selling long-term insurance becomes increasingly difficult.

This is why retirement planning needs to consider more than just how to meet your living expenses and desired adventures in retirement. You also need to plan for the more difficult part of aging – the possibility that you will need help with day-to-day life in your later years. It’s not fun, but it is part of real life.

We encourage clients to sit down and talk with us about their risks and where they would like to be if they need long-term care. Building the financial reserves you could need is much easier the sooner you start. Give our office a call today and set an appointment to talk about your concerns and resources.