Now It’s a Slowdown

Inflation, inflation, inflation. Jobs, jobs, jobs. That’s all we’ve heard all year. Yet, this week the narrative seems to have changed to a slowdown. Is it the elusive “soft landing” so many positioned for in 2024? Is it recession? For now, it seems like just chatter and drivel without hard data backing it up.

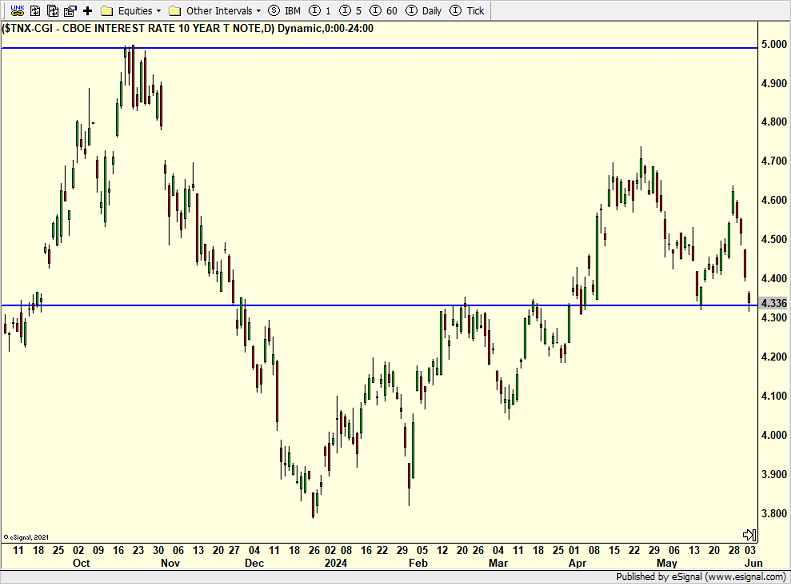

Let’s take a look at the 10-Year below to see what the market is fussing about on the far right of the chart. Yields have come down from 4.65% to 4.33% in one week. Some believe that little move is significant.

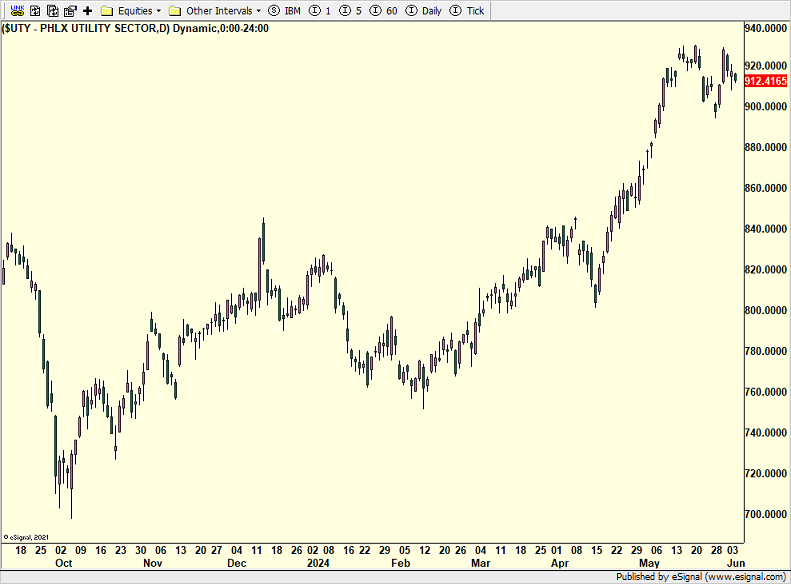

The utility sector below had its Dotcom-like AI rally in April and May which I wrote about several times. It hasn’t been playing along with the fall in yields.

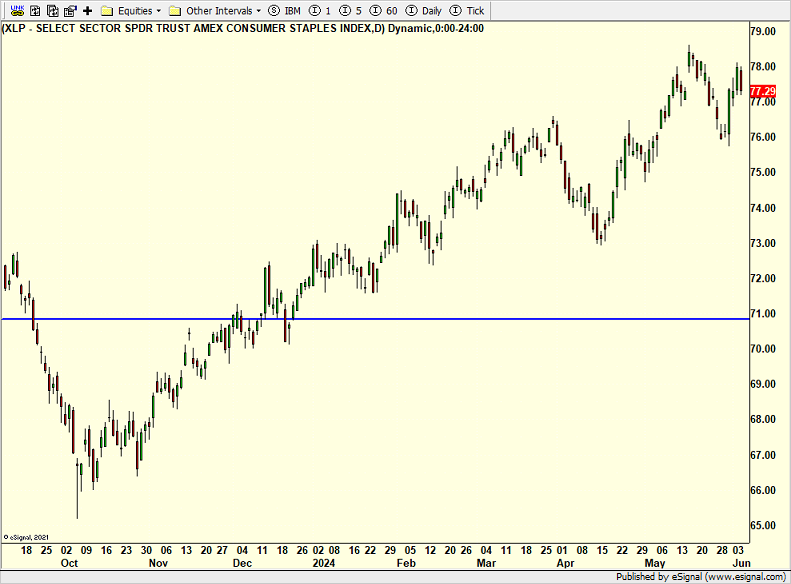

Likewise, consumer staples in the chart below just bounced for a few days, rather than took off like they should during a potential slowdown.

I am skeptical that this slowdown narrative has legs. The stock market looks like it’s back to AI and high tech leading at the expense of most else. The Fed is not cutting rates anytime soon. It’s certainly a bit schizophrenic lately.

On Monday we bought EMB, PCY, PMPIX, RYPMX and levered S&P 500. We sold some levered NDX. On Tuesday we bought RYFIX. We sold PMPIX, RYPMX, levered S&P 500 and some RYKIX.