Market Reaction To The Horrific Acts

With the unspeakable and heinous acts over the weekend, the presidential race has widened according to the polls taken. Additionally, the RNC convention begins tonight. This is important because it is likely that Donald Trump will take a commanding lead by the end of the week. It may be temporary, or not, but I fully expect the markets to pivot towards Trump 2.0 with stocks continuing the new theme of the “everything up market” that began last Thursday.

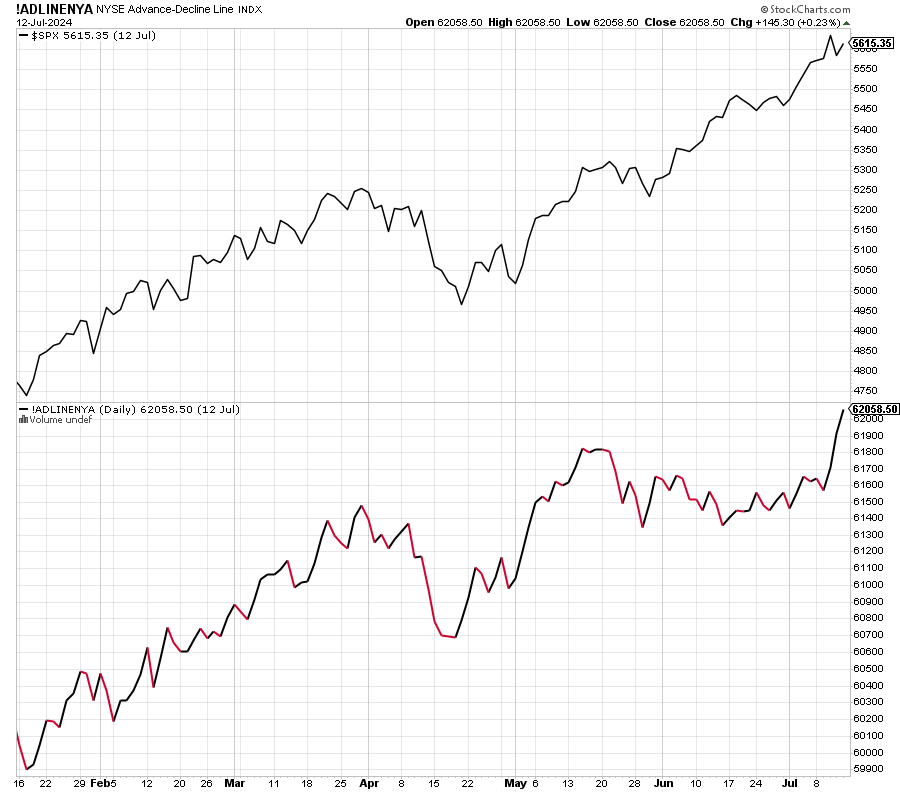

Below is that chart of the “everything market”. Look at the lower chart which is the NYSE Advance/Decline Line. I worried and worried and worried that the A/D line may have peaked for the cycle which would have started the clock ticking on a new bear market. That caution condition has now been rectified, unusually so.

Additionally, the likelihood of extending the 2017 tax cuts has just grown significantly. That’s important because non-partisan think tanks score more cuts as adding to the deficit which hurts the bond market and raises long-term interest rates, something that used to be associated with Democrats. Also, it is widely expected that a Trump 2.0 would lead to Fed Chair, Jay Powell, being summarily fired. That matters because the next Fed chair would likely be softer on interest rates which spurs on more inflation.

For today, stocks should rally with the defensive sectors lagging. I do not think tech is the big leader. Interest rates should go up. I don’t have an opinion on gold and oil.

In market terms, Trump 2.0 is not all rainbows and unicorns. This is not 2016.

On Friday we sold levered S&P 500 and some NVDA.