Bears Making Some Noise – Or At Least Trying

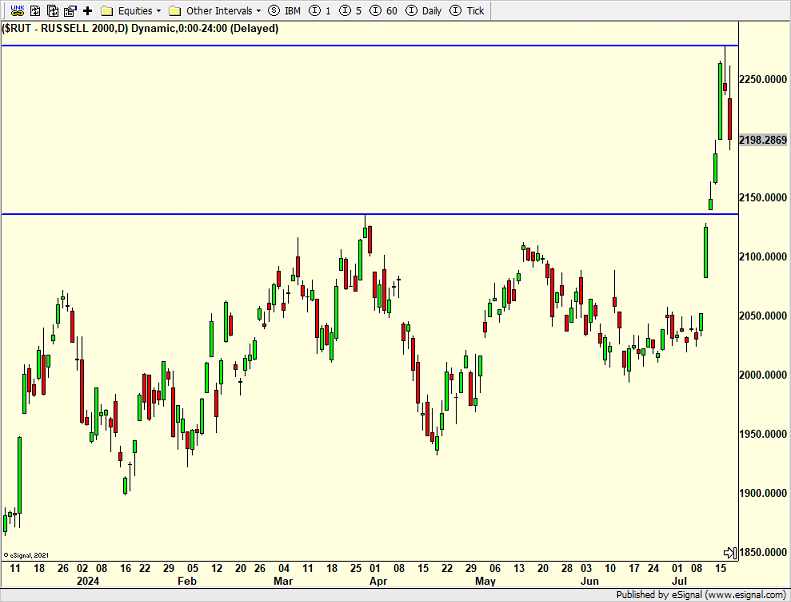

Roughly a week ago, I downgraded my 1-3 month outlook on the stock market, citing a number of participation and sentiment concerns. The same day, we saw a once in a million to billion year event regarding the Russell 2000 and S&P 500. Since then, the small and mid cap stocks have strongly led at the expense of the mega caps, especially technology and AI. Over the past few days, that has morphed into the modest pullback I have written about.

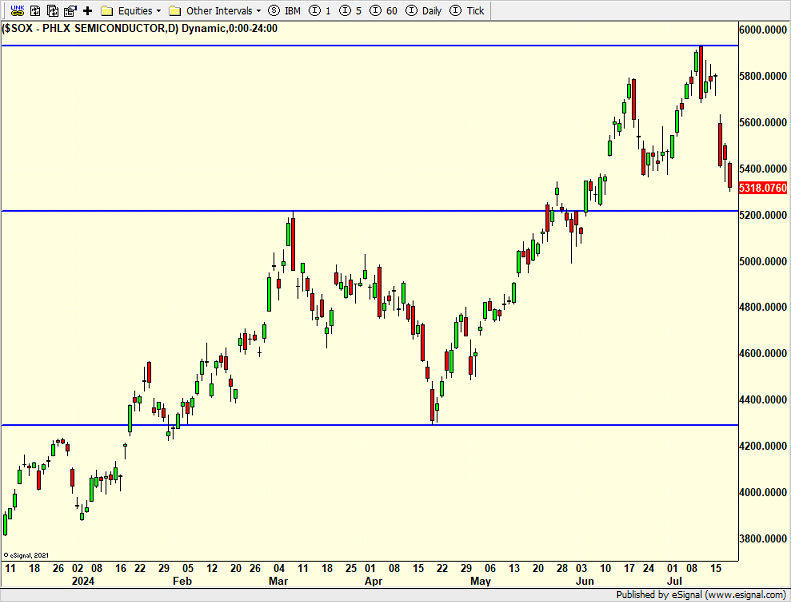

In portfolios, I mentioned that we had taken some chips off the table in Nvidia and Tesla as well as eliminating our entire sector level semiconductor position for the first time since roughly 2018. The semis chart is below. I do not believe its bull market is over. In fact, this 10-15% correction would restore some bearishness and perhaps provide an opportunity to rent it instead of owning it.

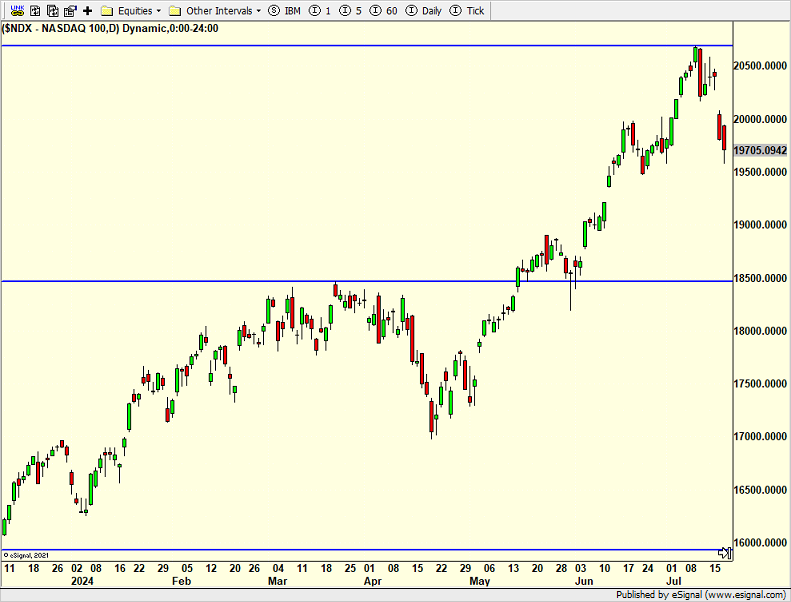

The rest of the stock market is a different story, having just started to digest and consolidate. The NASDAQ 100 and Russell 2000 are probably the two most important indices to watch because the market has been an “either or”. One leads. One lags. I do think both are buyable sooner than later for a bounce.

Looks like a beautiful weekend in CT. Humidity finally broke. The little guy’s elbow healed and he’s good to pitch. Most importantly, KT turns 21, a shock to most as she’s been playing in the 21+ space for years.

On Wednesday we sold some levered NDX . On Thursday we bought SBUX. We sold some levered NDX.