The Down & Outs Are Up & In – Huge Week Ahead

Friday saw the bulls come back to work after the pullback had reached deep enough for them to see value. I am not sure it has run its course, but I always try to be nimble enough to take action and not get stuck in a mindset.

Since March I have written about a number of big picture portfolio moves as we have reduced exposure where it had been over 100% as well as reduced or sold off AI and other technology positions to cut overall portfolio risk. In some or many cases we took small and then larger position in the beaten down sectors and companies. I spent time writing about our foray into Hershey’s which we still own as cocoa prices were melting up like an old fashioned Dotcom stock.

As long time readers know I am usually early when I move into the beaten down areas. Some would rightfully argue that I am wrong which is true. Last week a number of those companies which we have patiently held began to go. Bristol Myers and Pfizer in the drug space. MMM in the industrial space. Others we do not own as well. We will see if this continues to be a seismic shift like we have seen in small caps. It certainly looks that way.

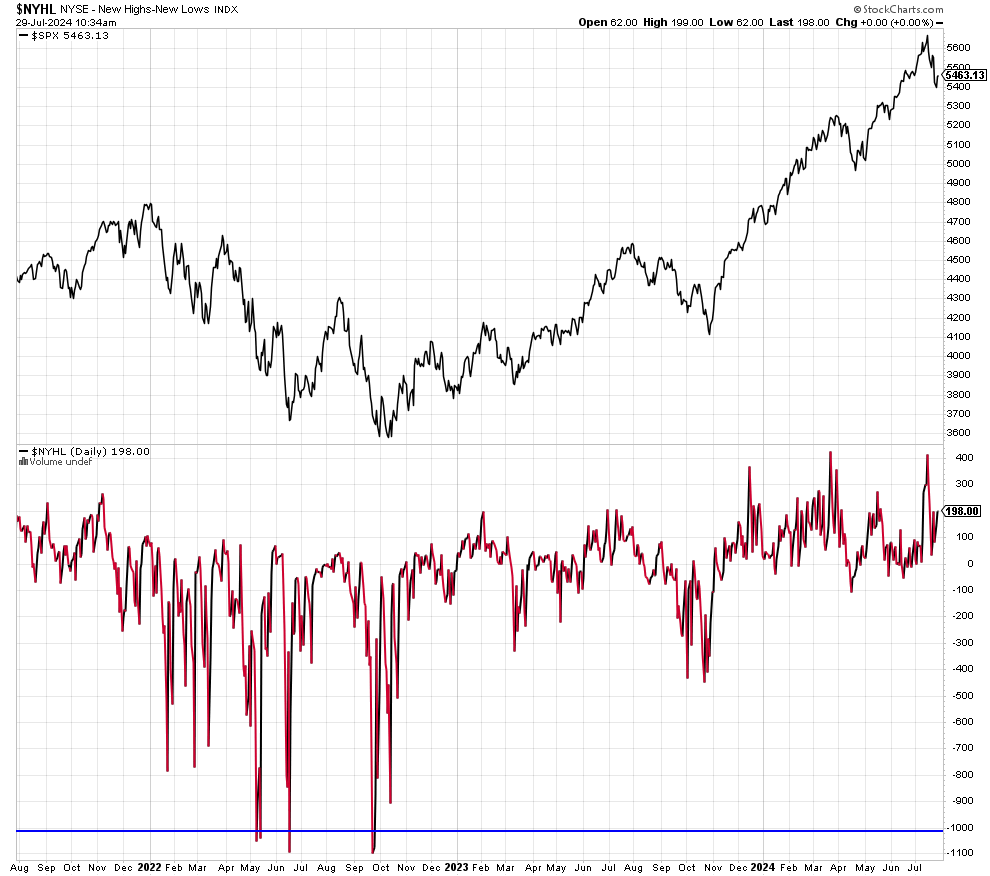

Below is a chart of the new new highs/lows on the NYSE. It’s just the number of stocks making new 52-week highs minus the ones making new lows.

What I want you to observe are the spikes, meaning that more and more stocks saw new highs at three junctures over the past 8 months which is healthy. Also notice that pullbacks were short-lived and none hit 10%. In other words, buy the dip.

It’s a huge week for earnings, mega cap in particular as well as the FOMC meeting and employment report. Buckle up!

On Friday we bought EMB and PCY. We sold SSO.