***SPECIAL Fed Day Update – High Probability Opportunity***

Wednesday concludes the FOMC’s meeting with the Fed standing pat but likely offering dovish language in preparation of a September interest rate cut.

The stock market model for the day is plus or minus 0.50% and then a rally post 2pm. Given the recent pullback as well as Tuesday’s action, the odds of a Fed day rally have greatly increased to 90% which means going long or adding to positions at Tuesday’s close. The challenge is that there are a number of high profile mega cap tech stocks sets to report earnings after the close on Tuesday and pre-market on Wednesday which makes the trade a bit higher risk and more volatile.

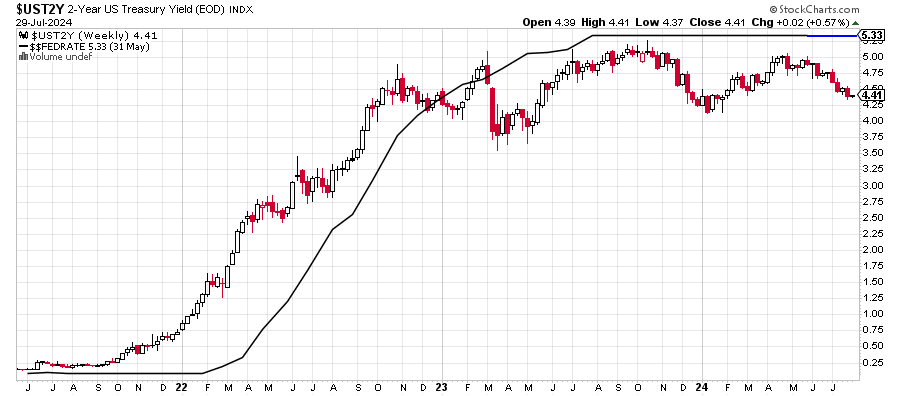

Below is a chart I show often and always around FOMC meetings thanks to my friend Tom McClellan sharing many, many years ago. It is the 2-Year Treasury Note in red, white and black with the Federal Funds Rate in solid black that ends in blue.

In my view as I have shared since the end of 2022, the Fed market went from hawkish to neutral as 2023 began. Today, the market is somewhere between neutral and dovish, expecting 2-3 rate cuts which is exactly what I forecast for 2024 with the risk being less. 7 months later and I still shake my head that the pundits so wrongly forecast 6-7 rates cuts in 2024.

Does the economy need a rate cut?

I think “need” is a strong word. Unemployment is now above 4% but not comfortably so, at least not yet. A few more months above 4% and a problem will develop. Credit card delinquencies are jumping. The economy for the average American is showing some weakness. Inflation may have abated, but high prices persist.

There is also this little event called the election in about 100 days. Every four years we hear the minority party cry about the Fed being political because they moved rates in an election year. 2000, 2008, 2020. The Fed absolutely had to take action. I am not so sure that’s the case today. They can play catch up pretty quickly.

And don’t worry. The bull market ain’t over. Heck, the bigger picture rally isn’t even over. Remember, ignore the election talk. It has no bearing on the markets or the economy. Weakness can be bought in Q3, but rallies can be sold.

On Monday we bought more levered NDX. On Tuesday we bought more SBUX.