Bulls Wounded – New Lows Coming Soon

I am sure I am wrong, but I don’t recall two such opposite days like Wednesday and Thursday since 2020 and 2008 before that. Wednesday was insanely strong from a price perspective, especially in the beaten down tech area. Thursday was super weak across the board for the most part. In hindsight I think the bulls used cover from earnings to window dress portfolios for month-end and that’s it.

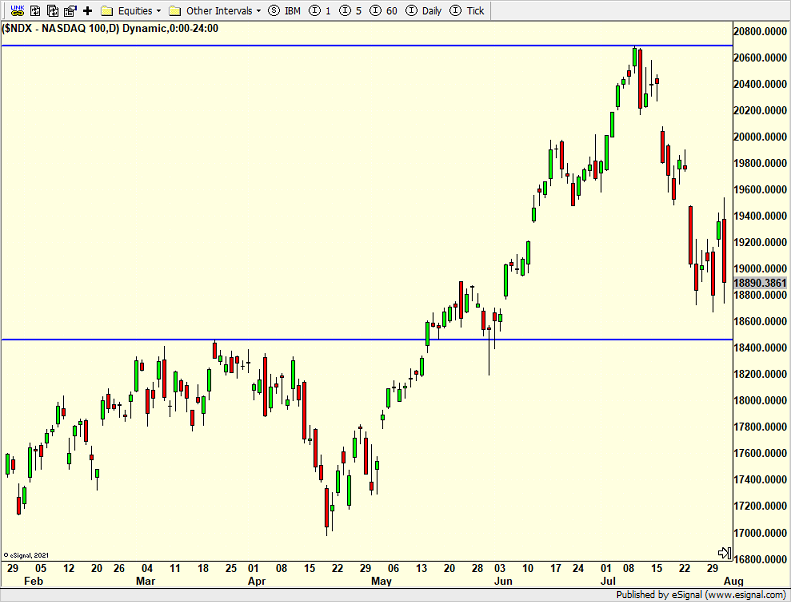

The NASDAQ 100 is below. In real time, Wednesday looked like one of the those blast offs from a low that leaves people behind. As you can see below, we did not do any net new buying. I wasn’t buying it.

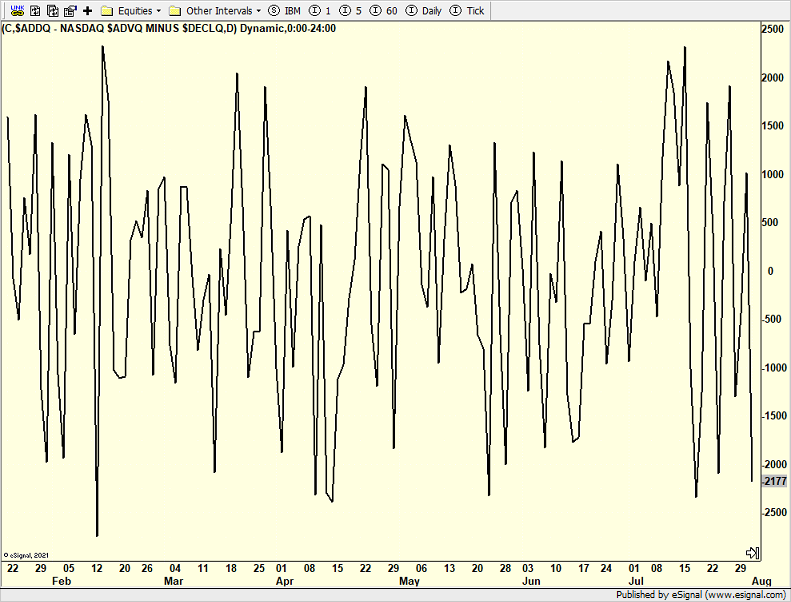

It bothered me that there were only +1000 on net advances for a day that saw a 3% rally and then -2100 on Thursday. That’s not a sign of underlying strength.

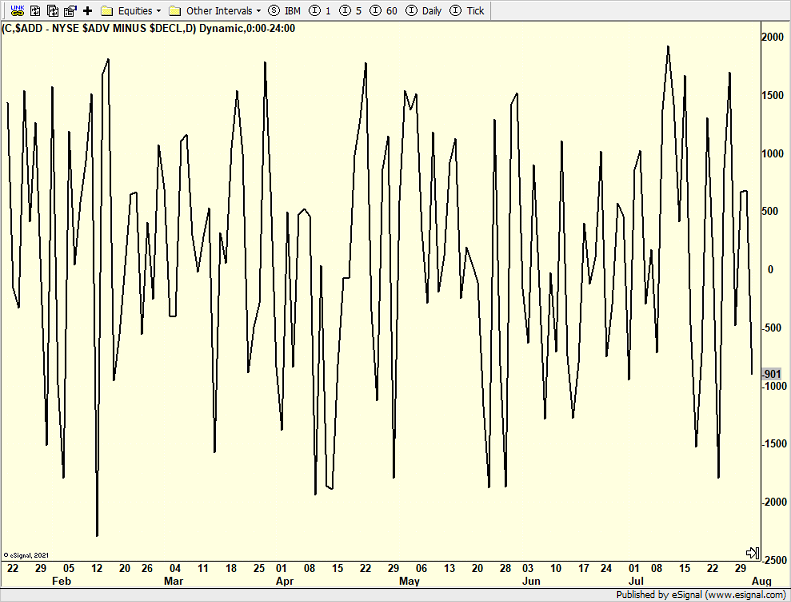

The S&P 500 is below. Hard to argue the bulls are in control. It looks like new lows for July are coming up soon.

On Wednesday there were only +600 net stocks rising for a 2% rally. That should have been at least +1500. On Thursday it was -900 which isn’t awful.

Recently, I have written that the bottom of the pullback isn’t in. I still believe that. The unemployment number is this morning and it looks like a “damned if you do, damned if you don’t” number. Stronger than expected will weaken the Fed’s case to cut in September. Weaker than expected will mean the economy is trending towards 0% growth which has been my target.

The market is punishing the late comers to AI and tech which was long overdue. I thought this was coming last quarter. Nvidia and the like are dropping sharply and quickly. My concern is that most folks seem to be interested in buying more instead of banking profits like we did last month.

If Friday is down hard for stocks, it does set up the possibility of follow through on Monday, but that would require a 2%+ sell off. The bull market ain’t over. Weakness can be bought, but strength needs to be sold and folks should not overstay their welcome.

I know why folks leave Houston, Florida and the Gulf Coast during the summer. CT has that oppressive humidity now. Glad I am not playing golf. Well, not really, but it helps me to cope. Double headers for D this weekend. Hoping to see friends at one my favorite places on earth, The Place. Sit outside on tree stumps. BYOB. All food cooked over a giant open flame.

On Wednesday we bought EPI and TUR. We sold EPU and EWT. On Thursday we bought GDX and NUGT. We sold LYV and some DXHYX.