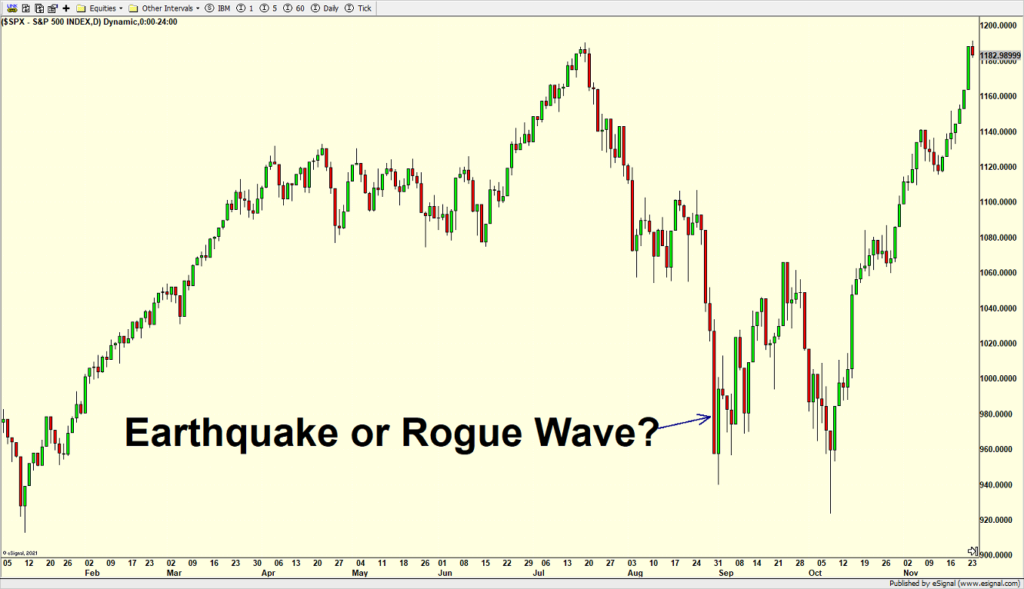

Earthquake Or Rogue Wave – A Look At 1997 & 1998 For Clues

Continuing on the theme I mentioned on Friday about an earthquake or rogue wave, I went back to the two international events that caused these in the 1990s. The first chart below is from 1997 when the Asian currency crisis hit in October. On that day in October the Dow Industrials saw their single largest point decline in history. Of course, on a percentage basis, it didn’t rank all that high.

After an all-time high in early October and a mild pullback, the Dow saw a two-day rally and then had a mini-crash. That was really it. There was a minor November pullback, but nothing too serious. Although one could argue that we had an earthquake and two small aftershocks, that looks more like a rogue wave in hindsight.

Below is from 1998. If you recall, Russia defaulted on her debt in August which was the primary cause of that massive decline that ended with a huge bang at the end of August. Hard to argue that was an earthquake in hindsight. In the days and weeks after we saw a number of pullbacks or aftershocks as the market bounced for almost a month.

However, the aftershocks weren’t done. Long-Term Capital Management was next. If you recall, it was an enormous hedge fund with dizzying amounts of leverage managed by the supposed masters of the finance universe. They had trades on which would only fail once in a thousand years. And fail they did. LTCM almost brought down the entire financial system. Then Fed Chair, Alan Greenspan, slashed interest rates and essentially forced other Wall Street firms to bail out the collapsing hedge fund giant. The final aftershock before the Dotcom Bubble was generationally inflated.

Today is below. It certainly looks more than 1997 than 1998. But the biggest difference is that today’s market looks even stronger. The S&P 500 is only one strong week away from new highs, something I definitely did not and do not see happening. Stocks have been on quite the run as seasonal patterns are negative into the fall now.

Nothing better than spending time with family…

On Friday we bought XOP, RYVIX, levered inverse S&P 500, levered inverse NDX, more RYCIX and more RYFIX. We sold some levered NDX.