Friday Was All About Window Dressing & Month-End Mark Up

Welcome back from the kinda, sorta end of summer. I hope you had lots of fun with family and friends. We saw friends Friday night, went to a really fun 50th party on Saturday and had a huge BBQ on Sunday. I tested out my 69 day rested shoulder on Monday without any issues. What a relief. I was so happy.

Friday was month-end and ahead of a long weekend. My sense is that liquidity was poor and there was some serious month-end marks up going on which should be unwound this morning.

Look at the chart below of the S&P 500. Each bar is 5 minutes. Lots of folks didn’t work on Friday or left early. Look at the last two hours, one hour and 10 minutes. Not much push back from the bears into the weekend.

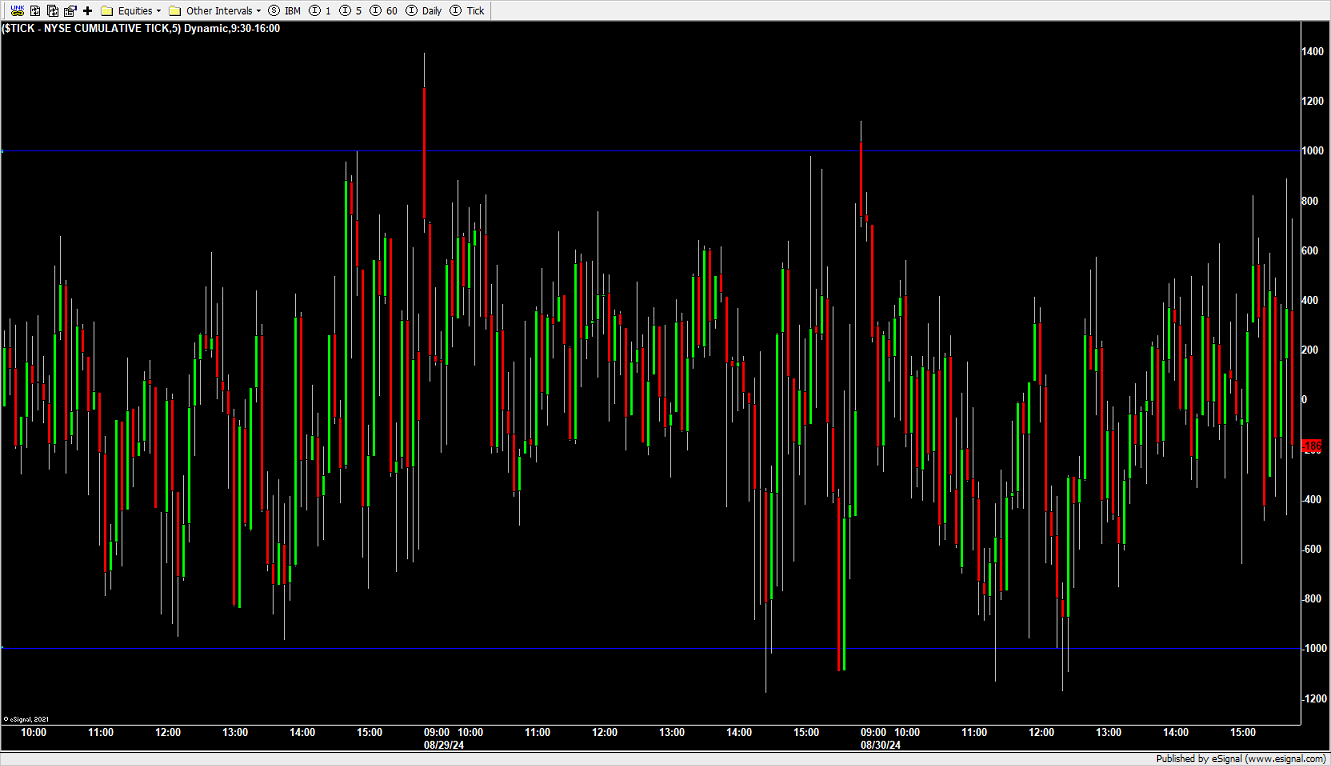

If there was real buying, I would expect the wonky chart below to repeatedly hit +1000 in the final minutes and hours. It didn’t even get there once. That tells me the buying was concentrated in the biggest stocks in the indices which can be manipulated to push the indices higher.

This window dressing is nothing new. It has happened for years and decades. It’s the worst kept secret on Wall Street. Usually, we see that price move unwound fairly soon. Pre-market looks lower. If the bulls can’t mount a rally early on then I would see with even higher confidence that Friday was all about portfolio games.

Stocks are due for a pullback before an assault on new highs. September is the worst month of the year. In an election year, the seasonals show a headwind for the next 6 weeks.

On Friday we bought JBHT, IJJ, RHYRX, RYAVX and more DRN. We sold FBND and some EMB.