Small & Mids Offer “Value” Here

Wednesday saw an unusually strong reversal from early losses to gains. I saw lots of folks commenting about the last time we saw -1%+ losses turn into +1%+ gains was right at the bear market low in October 2022. To me, that’s irrelevant. Stocks had declined 20-30% in 2022 and in 2024 they were just a few percent from all-time highs. Context. People arguing that another bull market blast off of 20%+ is here is absurd.

With that said, the bull market remains alive as I have stated since October 2022 and all months since. I have not wavered on that. There have been times where 4-7% pullbacks were due and overdue. Some were easier to spot than others.

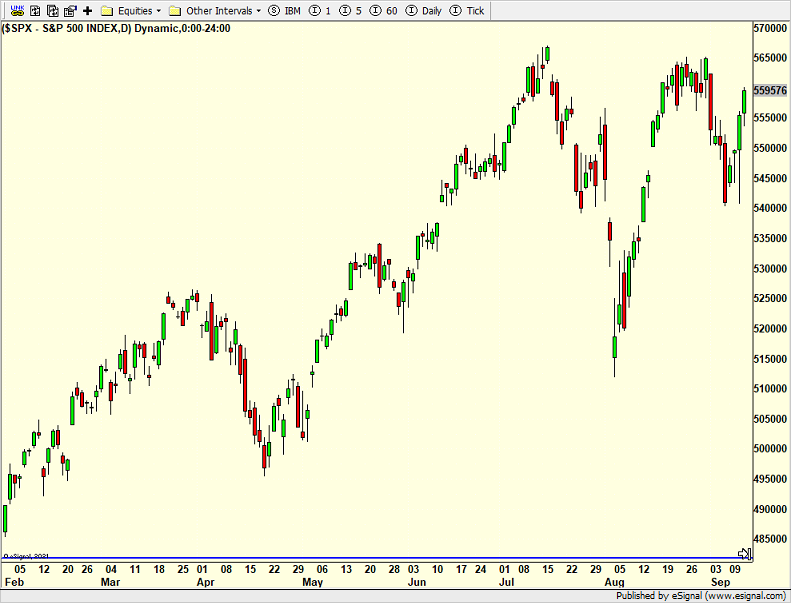

I have been of the opinion that last Thursday’s spike low was not going to hold and the market would see at least one lower low. My thesis will be strongly tested if the S&P 500 can close above the August highs. Looking at the major indices, the S&P 400 and Russell 2000 look the most interesting from a bullish perspective. The 400 is below which is made up of mid cap stocks. These two indices have been lagging but look like they could play catch up as mega cap tech takes a breather.

A beautiful summer weekend awaits in CT. The cool nights are great, but sunny and lower humidity days are the best. Mother Nature was not kind during my quick FL trip earlier this week with temps and humidity in the 90s when it wasn’t raining. However, it is always great to see clients, break bread and catch up. Looking forward to seeing friends tonight at their new beach condo and walking in the sand to grab dinner. Fall baseball this weekend. A trip to one of my all-time favorite “restaurants” awaits on Saturday. The Place. I have been going since the mid-1970s. Check it out. One of the best!

On Wednesday we bought XRT, RYRIX, IWP, NUGT, GDX, EWM, EPI, more levered NDX and more SSO. We sold EWT and EZA. On Thursday we bought more levered NDX.