Weakest Week Of The Year Is Here – Fed Wrong

The Fed slashed interest rates for the first time since March 2020. While I thought 1/4% was best for an initial move, a very confident Jay Powell thought otherwise. I tried reminding him that the last two times the Fed began with a 1/2% cut didn’t end so well. One was January 2001 and stocks plummeted another 40% with recession hitting post-9/11. The other was September 2007. The bull market peaked a month later and then collapsed 58% into March 2009.

The key point is that I absolutely do not think the markets are in the same places as 2001 and 2007. Rather, they are on firm, bull market footing. Nonetheless, with stocks at all-time highs and unemployment just above 4%, 1/4% would have been more appropriate.

Long time readers are already familiar with my sometimes harsh criticism of the FOMC. For supposedly being the sharpest bankers on earth and among the smartest people in the universe, they seem to make some colossally poor decisions, each and every one although I only remember back to Arthur Burns in the 1970s.

Before I move on, I want to offer a comment on inflation. The Fed did do a good job bringing inflation down after they were woefully late in starting and had to play serious catch up. I don’t think inflation has been beaten. Yes, it’s down from 9% to sub 3%, but I do believe there will be another wave coming after the next recession. High conviction on that.

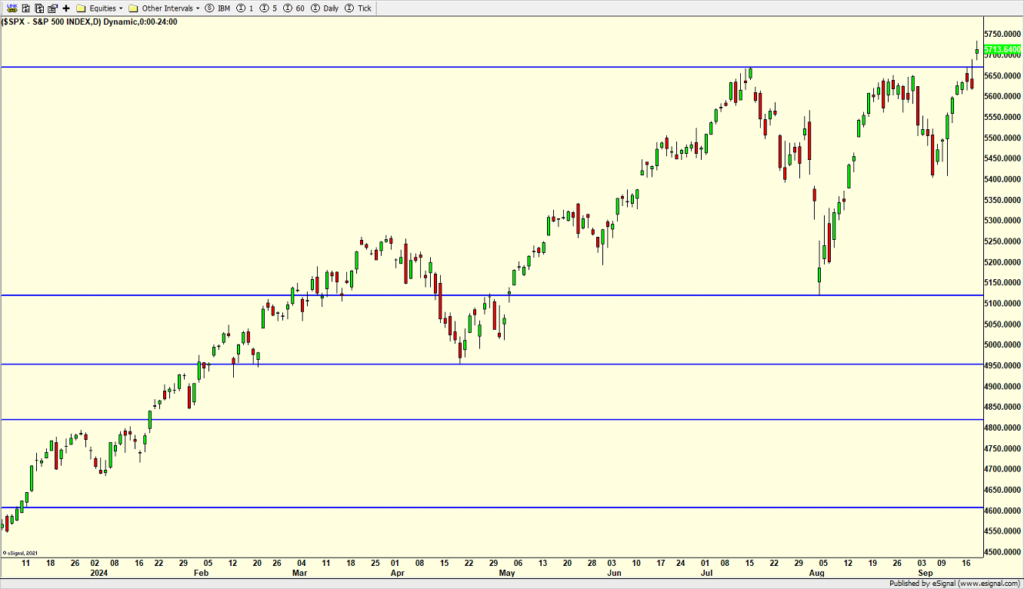

Let’s turn to the S&P 500 below. Notice the fresh, all-time high last week.

Now let’s look at the NASDAQ 100 below. You know that index; it’s full of all the AI names and hot and sexy stocks. Notice anything different? Not only is it not at all-time highs, but it’s not even above it’s August peak yet. That is the clearest sign of how leadership has changed this quarter. Anytime I discussed pruning Nvidia or Apple or outright selling Super Micro, people chirped me that I didn’t get it. Markets do have a funny way of punishing late comers as well as the greedy.

Today begins the weakest week of the year in seasonal terms. It is also the week after an enormous options expiration on Friday. The week is supposed to be negative. 27 of the last 34 years have seen this week on the defensive. However, let’s keep in mind that price is always the final arbiter and today, price remains firm at worst. I would use any weakness to plant some new seeds over the coming weeks for a run into 2025 unless market internals weaken.

I started this blog on Friday as my son and I flew to FL to visit the U as well as check off ballparks for the Marlins and Rays. Obviously, I failed in completing it and needed to play catch up today. One of my closest friends’ son joined us in Miami. We really enjoyed the Marlins ballpark.

It was just D and me in St. Pete for the Rays. The stadium is older and near the bottom of our list. Bad ceiling. Bullpens in the field. Very cramped bathrooms.

When D and I travel, we don’t exactly eat healthy nor go down the plant-based route. Ford’s Garage in St. Pete belongs on Diners, Drive Ins and Dives. One of my all-time fav places for comfort food. I only wish I could go again. Thankfully, I didn’t have a heart attack and I can say that my diet starts today.

On Wednesday we bought QQQW and TFLO. We sold SDS. On Thursday we bought PEP, TQQQ and more QQQW. On Friday we bought SPYB.