FOMC To Cut 1/4% – Bears Still Nibbling

Today is the last FOMC meeting of 2024. Obviously, because it’s December!

The market model for the day is plus or minus 0.50% and then a big move post 2pm. The market was setting up a rally after 2pm, but recent action mitigated that trend to a coin flip. There are a few outlier studies that suggest a large selloff on Fed day, but the more mainstream ones are not corroborating.

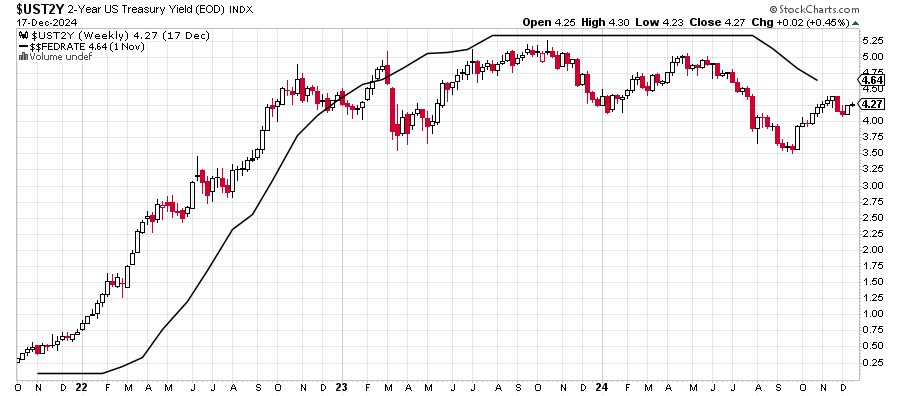

Jay Powell and the FOMC are going to cut the Fed Funds Rate by 0.25% today. That brings the rate to 4.25% to 4.50% which is exactly where the 2-Year Note yield is in the chart below. In other words, the Fed and the markets are in sync and neutral.

The stock market pullback remains intact. Seasonality turns more positive by Friday. We should see a rally. However, I continue to be bothered by a few things which pushes me to look for a bounce and deeper decline in Q1 2025.

On Monday we bought SQ and more XSMO and MC. We sold PM. On Tuesday we bought JNJ. We sold QLD and some DXHYX.