Minimum Downside Met – Banks Teed Up Into Earnings

The S&P 500 met my minimum downside target for a low because it breached the December lows and closed below them as well. However, that doesn’t mean the bottom is in for sure. We just have to watch and see how the market behaves. This is not one of those bell-ringing, close your eyes and buy situation. I think that happens either later this quarter or later this year.

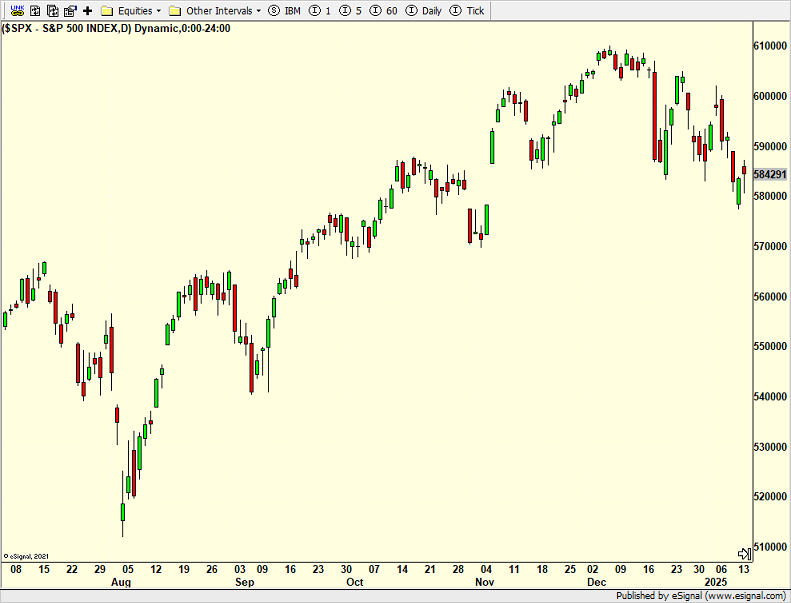

In the chart below of the S&P 500 you can see a pattern of lower highs during the pullback and lower lows. Let’s see if we change the behavior with higher lows and maybe higher highs.

Q4 earnings season goes into full motion today with a slew of high profile banks reporting before the stock market opens. I think it lines up well for the banks because they sold off into the news. That lowers expectations. If somehow the group has a blowout quarter and heads back towards the 140 level on the index below, I would be a seller. If I am reading this wrong and they sell off below the December lows, I would likely add to our position. I am not interested in chasing in either direction.

On Monday we bought IJJ, XRT, HYG, more HD and more UAA. We sold GDX, IWP and MQQQ. On Tuesday we more MQQQ and more AIOT. We sold SSO.