Inflation Hotter As Expected

We learned this morning that January inflation data was hotter than expected. I know my readers are not surprised because that is my theme for early 2025. Inflation should moderate during the second half of the year. And it was hot enough that I am sure pundits will talk about a Fed rate hike instead of cut. I think that’s unfounded and unwise.

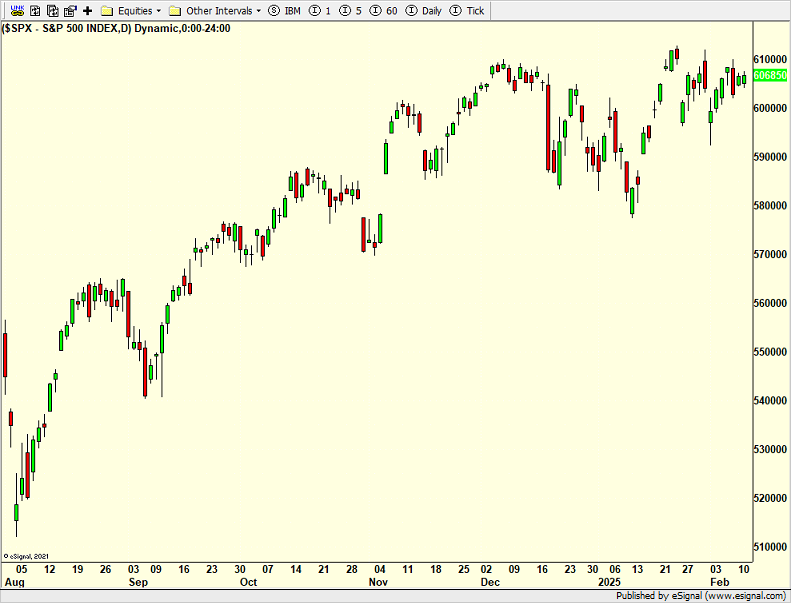

Let’s look, yet again, at the S&P 500 below. Not much going on this week. It remains one good day from new highs. I would really like to see the bulls have enough energy to get that fresh high which I think would be a decent opportunity to reduce exposure or cut risk.

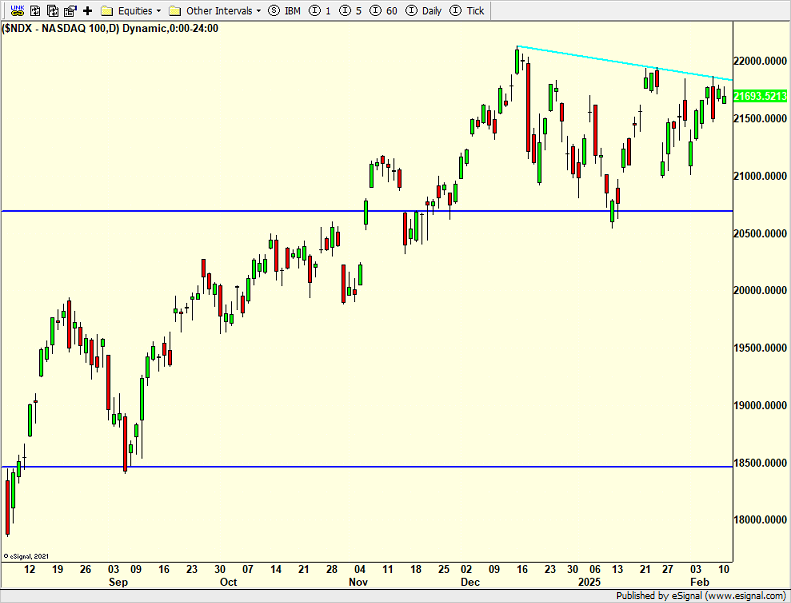

The NASDAQ 100 is below and it looks very similar to the S&P 500. I drew in a little line to help visualize what the bulls need to do. That line needs to be closed above which would also mean closing above last Friday’s ugly, red day. If so, that should create enough momentum for a run to new highs. Guess what? I think that would also be an opportunity to reallocate.

The open today looks a bit ugly, but it’s a long day. Let’s see what leads and lags. Bonds look the worst of all. They are probably the most important asset to watch in the short-term. I still have an upside target above 5% on the 10-Year which would pressure stocks. More on that later.

On Monday we sold some AIOT . On Tuesday we bought more QQQ, more KRE, more FVD and more FDRR. We sold PCY, EMB, TFLO and AIOT