“A” Low Has Been Seen

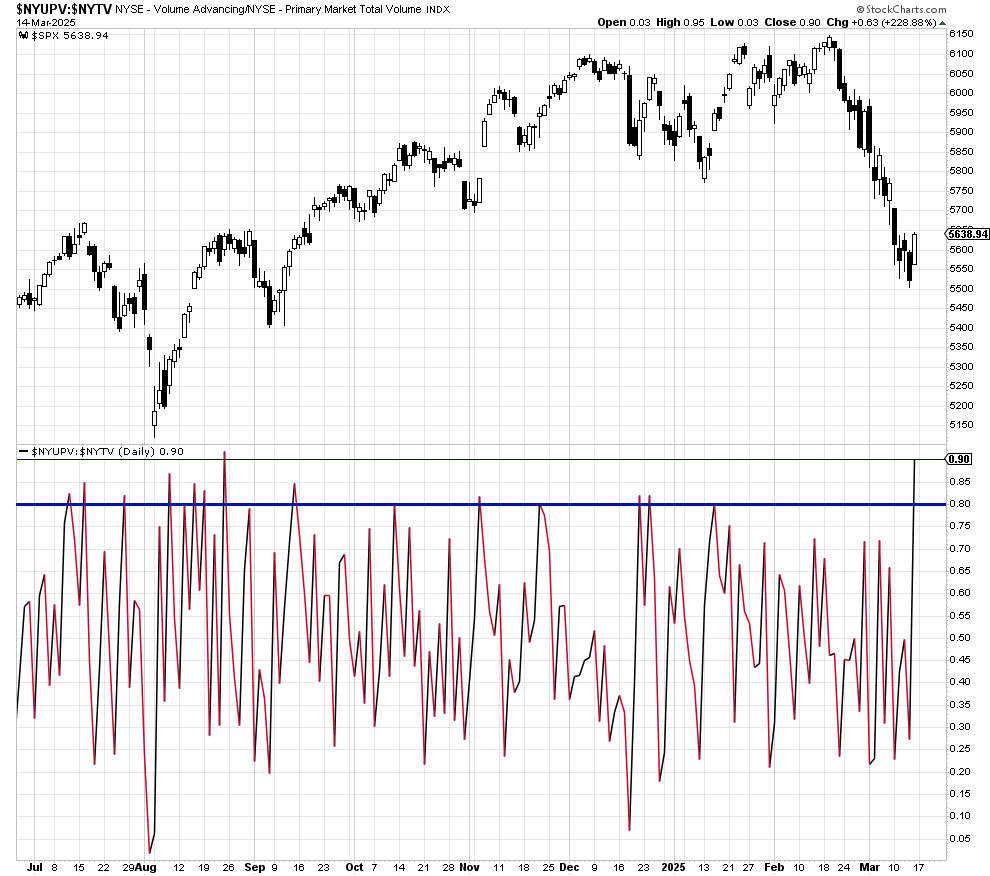

Stocks finally saw a meaningful bounce on Friday. I imagine there were an awful lot of people short the market on Thursday when the S&P 500 breached the recent lows. 90% of the volume came in stocks that went up. Longtime readers may recall that 90% is an historically significant number as it is a confirmation sign of the bulls regaining control. However, before we get too excited that the final bottom is in, this is a process. A 90% day is important but there are other factors that need to line up before I have high conviction.

Below is the S&P 500 in the upper chart with 90% in the lower chart.

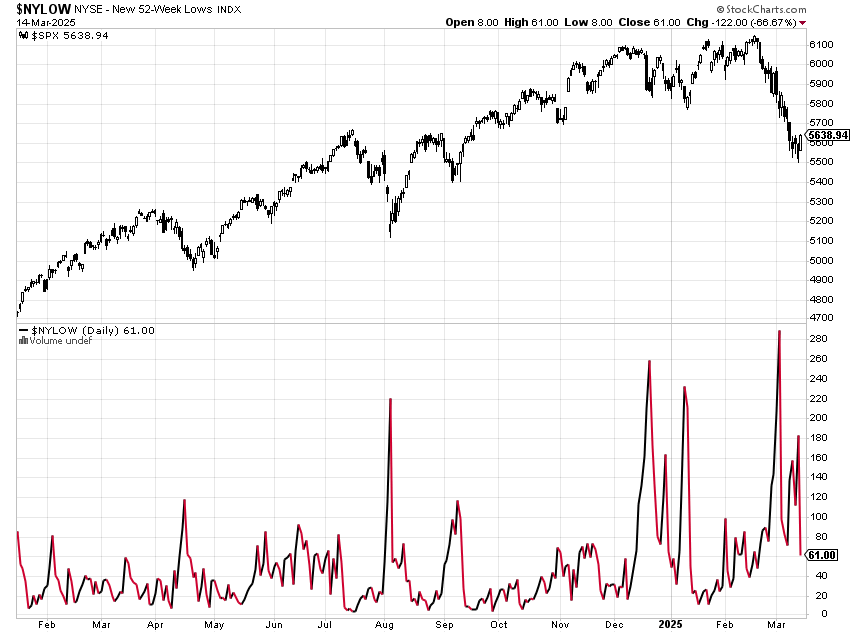

And here is the updated chart of the number of stocks making new 52-week lows on the NYSE. You can easily see downside momentum waning over the past one to two weeks, a positive sign.

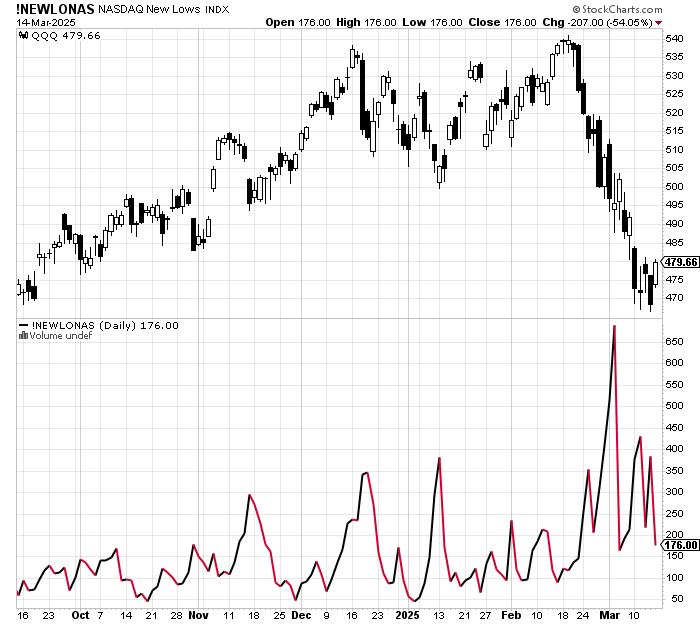

And here is the same chart for the NASDAQ.

It certainly looks like “A” low was formed last week. However, the decline still does not look complete. There are a number of possible scenarios going forward with a rally and another decline to new lows being the highest probability. That would let a lot of other indicators line up for a multi-month rally, possibly to new highs. For now, being nimble is the best option.

And to repeat and reiterate, this decline is a growth scare which began with Wal-Mart’s announcement last month. The lazy pundits and companies are hiding behind tariffs as an excuse. They are wrong as usual.

On Friday we bought SDS and more MQQQ.