Make It Four Straight

Markets enter the new week on a four day winning streak. Additionally, last week saw a number of thrusts which indicate the beginning of a new intermediate-term rally for stocks. However, with the trend still tilting down, that also means that stocks are tired in the short-term and in need of some rest.

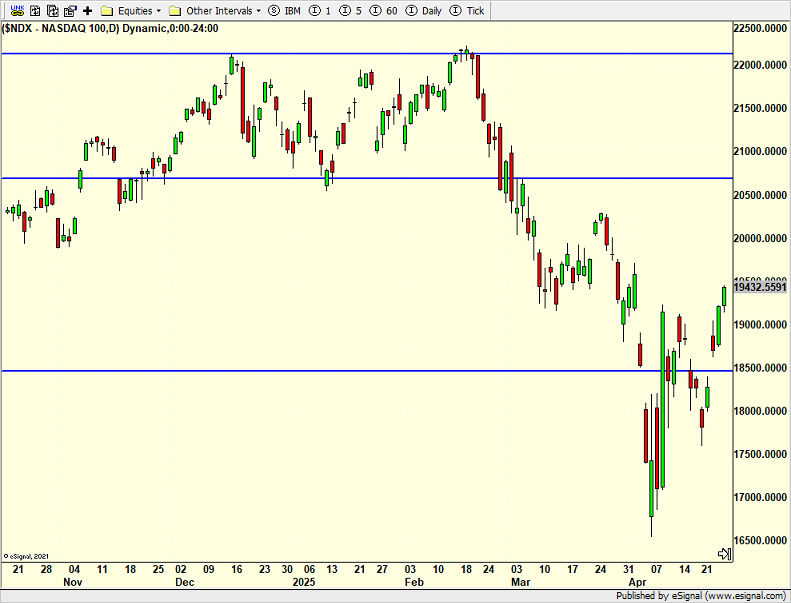

The NASDAQ 100 is first for a change below. With Google having reported last week and the good news being sold, a number of other high profile mega tech stocks are up this week with earnings. The index is laden and dominated with these names. While four straight up days is nothing to sneeze at, I would be very surprised to see the streak last to five or six. In fact, I think regardless of your intermediate-term views, reducing some exposure here is a good idea for the nimble.

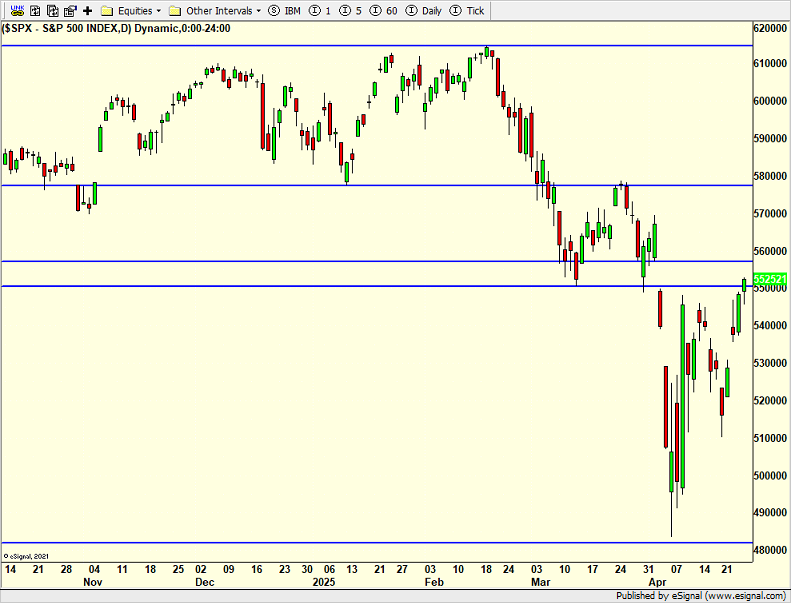

The S&P 500 is next and it looks similar to the NASDAQ 100, just less magnitude on the correction and rally. It looks like it is nicely repairing the damage from the plunge, but needs more time as I wrote about last week. Both indices have regained 100% of the decline seen from the tariff tantrum and are now dealing with the growth scare caused by Wal-Mart in mid-February.

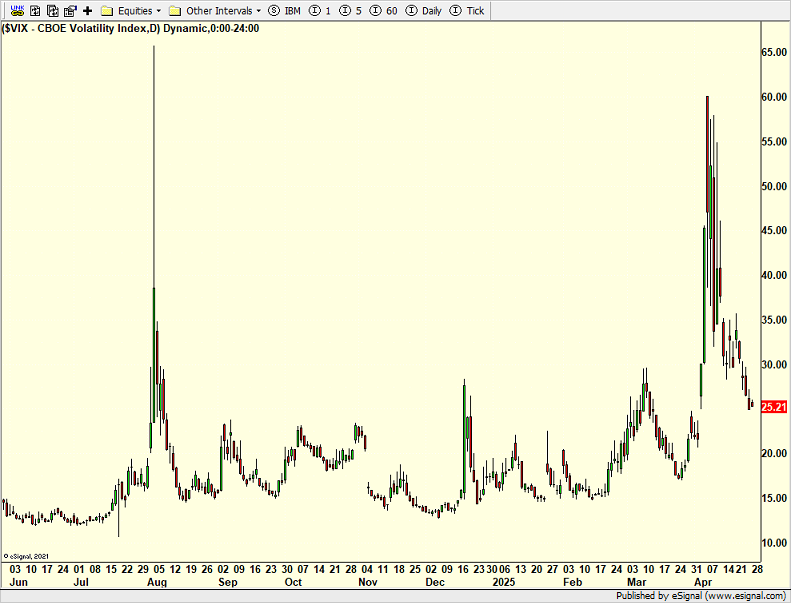

Finally, volatility has collapsed from 60 to 25 as I have been writing about. Vol typically spikes and then dies. It would be extremely rare to see the VIX spike and stay elevated. Again, this is all part of the healing process.

I remain in the camp that stocks need more time to heal. The ultimate bottom may be in; it may not. That’s not relevant today. My thesis has been that price has met its downside objective, whether the final low has been established or there is one more decline to marginal new lows over the coming weeks. Weakness is a buying opportunity. Strength is an opportunity to prune and plant. Today is a good opp to prune for some weakness this week.

On Friday we bought HYG, MQQQ, UWM, IWM and SDS. We sold QID and TWM.