8 Straight For The Bulls As Some Bears Throw In The Towel

Make it 8 straight, I think. What a rally off of the April 7th crash bottom. Lots and lots of folks fought and disavowed the rally as just a dead rat bounce in a longer-term bear market. I sense that Thursday saw some change as bears were giving up and opening the door to the rally being for real. Where have they been?

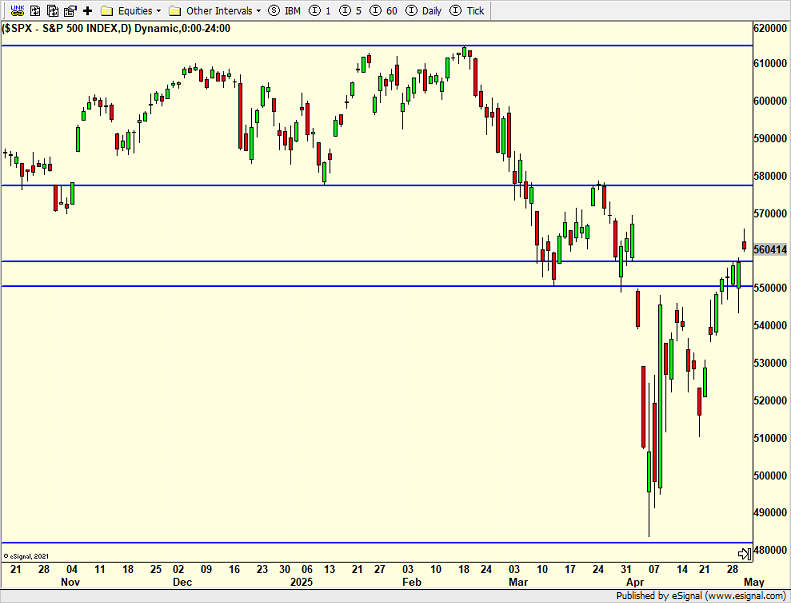

My operating thesis was that the S&P 500 would rally to the 5500-5600 area before the bears put up a stand again. Thursday saw an overshoot over 5600 and pre-market action has the bulls continuing the rally. 5800 would be next. Again, stocks have already regained 100% of what they lose from the three-day tariff tantrum plunge. They are in the range where Wal-Mart’s growth scare led to the first 9% lower from all-time highs.

I have also been operating under the idea that the “V” shaped bottom below will not lead to a move to all-time highs. As I mentioned, “V” shaped bottoms typically occur when the Fed does a major pivot like 2020, 2018 and 2001. Jay Powell and friends are not pivoting at all yet. I will keep an open mind, but I still do not believe stocks are fully off to the races again, even though they have rallied so strongly and so far.

I will be in Orange County CA next week for the annual NAAIM conference which I find an invaluable resource. I was so looking forward to temps around 80 with low humidity. However, someone forgot to tell Ma Nature. She has temps in the low to mid 60s planned for me although I don’t get outside at all until dinner.

On Wednesday we bought QID, SMG, more PCY, EMB, MQQQ, IWM, UWM, INTC, BMY, SBUX and UNH. We sold AGG, some MQQQ, DWAS and TLT. On Thursday we bought AHTFX, CHD, AGG, more MQQQ, SPLV and SVARX. We sold QID, DWAS, XPO, PCY, some USFR, MQQQ, EMB and TLT.