Bears Still Hate And Disavow – Pullback Here

Greetings from Orange County, CA where the weather is anything but sunny. In fact, it is cool, drizzly and foggy. I actually have layers on. And why did I leave sunny CT?

Friday was another very strong day for the bulls with 2150 stocks up and only 500 down on the day. It was also the 9th straight up day for the S&P 500 which has carried higher during this first rally off the bottom than I would have thought. I read a number of comments from bears who are doubling and tripling down that this rally is just a bear market bounce before heading down another 20%. These are the same folks who have disavowed and fought this rally the entire way up. I think they are dead wrong.

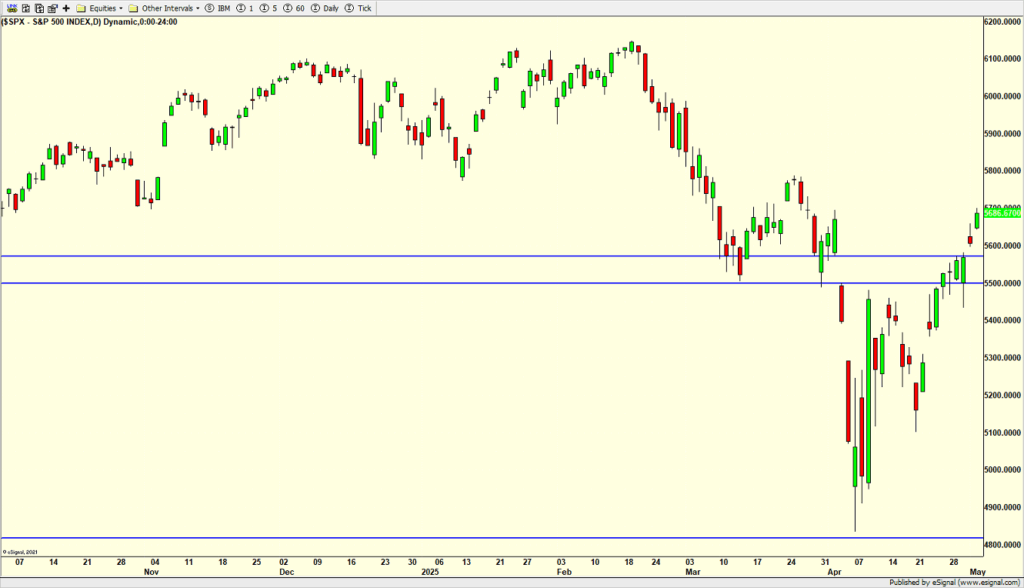

Remember the threes scenarios I offered last month? The most likely one had stocks bouncing to 5500-5600 before turning back down below 5000 by late May or so. Number two had stocks forming a “V” shaped bottom, which it has, and then rallying to 6000 before rolling over again. Number three had a small bounce and then sharp decline which is off the table.

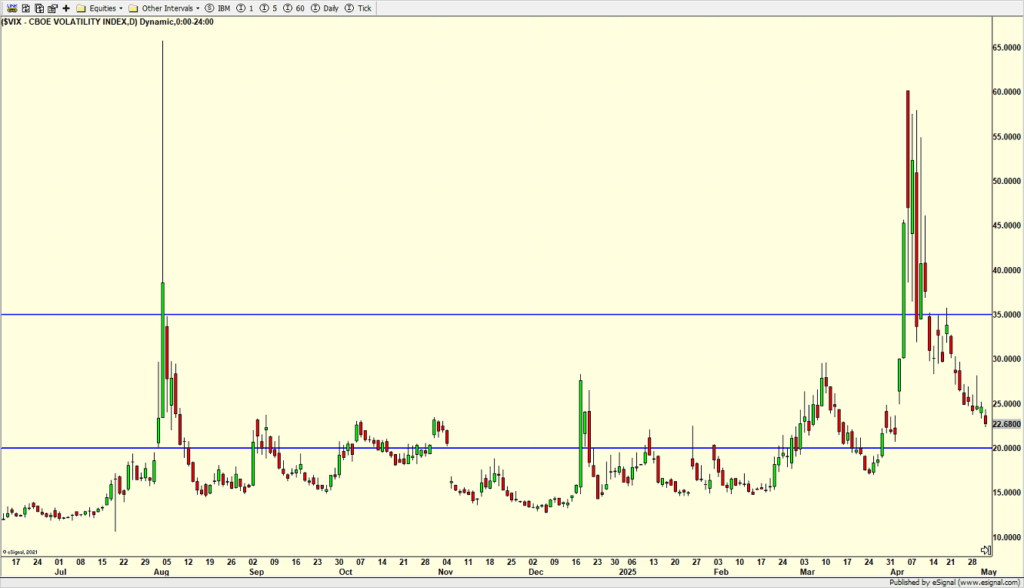

Again, I am a little surprised by the power and magnitude of the rally so far, but that hasn’t changed the way our models have played it. I have written many times how important watching volatility is. The index is below. The key to everything is getting the VIX to fall significantly which it has. VIX below 30 makes things easier. VIX below 20 makes things on the easy side.

Stocks are set to pullback this morning. After 9 straight up days, no one should be shocked. For now, I think weakness is buying opportunity, but I will also watch how strong the decline is.

On Friday we bought QID. We sold EMB.