Tired

My flight back from CA to JFK was delayed because of weather and a not functioning lavatory. And then we had to fly around the storms which made it longer. Upon landing, wait for it, the gate was not ready. And my parking lot took 30 minutes to pick me up. So folks, here is a short update on a few hours of sleep.

Like me, stocks are a bit tired. Tariff news has been good this week, but stocks haven’t made much progress. I want to think that the S&P 500 sees 5800 before a deeper pullback sets up, but there is no rule saying it must. The rally has been strong and in straight line fashion which always concerns me.

Of course, some or many investors did emotionally panic and sell during the early April plunge and these folks are watching the melt up from the sidelines. On a non-partisan basis, it’s insane to try to manage money based on the winds of politics. Investors attempting to do this are doomed to fail and fail miserably. I see it all the time when new folks come in to tell me about how Obama, Trump, Biden and Trump are going wreck the economy and crash the markets. I shake my head and advise them to manage their own portfolios. That’s not how investing works. Now, if you want to credit and blame the Fed, well, that’s a different story. I am right there with you.

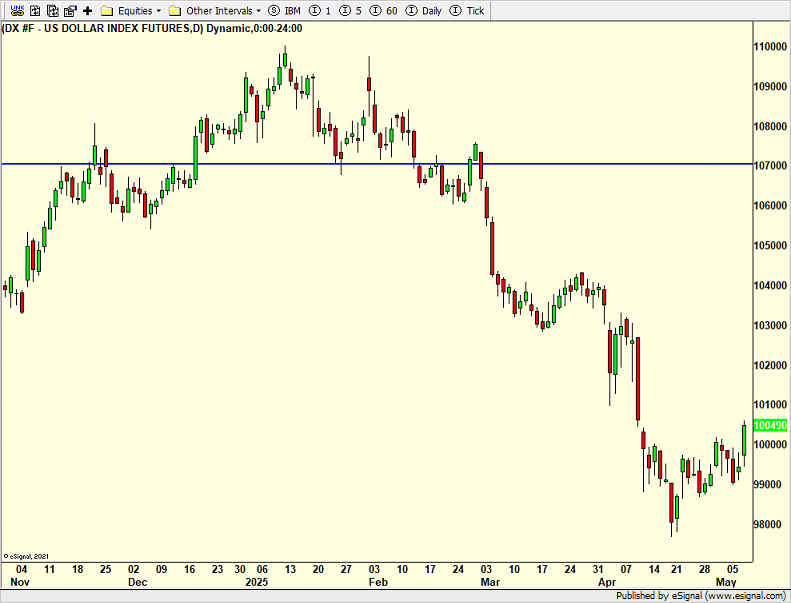

A pullback should not be too far off. And it should be one to buy. Leadership is starting to emerge. Momentum is winning. And the dollar is bouncing which should help U.S. denominated assets.

Lots of activity this weekend besides fixing my jet lag. The little guy has junior prom. Katie graduates from UCONN. Mother’s Day on Sunday. And I fly to Florida early Monday morning to see clients.

On Wednesday we bought EIS, PCY, more MQQQ and more QLD. We sold FXI. On Thursday we bought more MQQQ, more XBI and more AHTFX. We sold GDX, PCY and USFR.