The Set Up For A Pullback – Even Nvidia Can’t Help

6 weeks ago, markets would have sold off significantly had President Trump attacked the Chinese regarding violating their trade agreement with the U.S. This morning, stocks are down marginally in the pre-market. Folks can argue that the economic news with cooler inflation and a “miraculously” shrinking trade deficit are more important.

And that’s been my point exactly all year. I have hammered that with each successive social media post and press conference regarding tariffs, the markets are becoming more and more comfortable or care less and less. Early April should have been the worst market reaction for 2025. I fully expect to see markets rally on bad tariff news later this year. Then we will know that tariffs have been fully priced in and markets have moved on to other issues, like deregulation and the bill to extend the 2017 tax cuts.

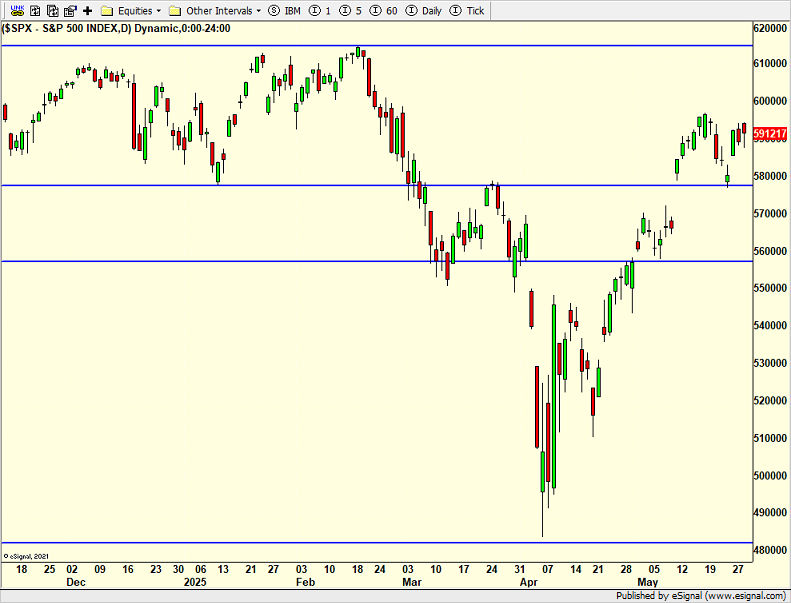

The stock market definitely looks a little tired to me. Nvidia’s blowout quarter resulted in a strong opening for the market that faded all day. Semis fared no better. When bulls were chirping on Twitter about Nvidia, I had a feeling the day would not end well.

It looks like the stock market is setting up for a 2-4% pullback, whether that’s soon or later in June remains to be seen. The perfect scenario would be for one more rally about 6000 by the S&P 500 and then the pullback. That could or would set the market up for a nice, low volatility summer rally.

On Wednesday we bought SSO. We sold EMB and some MQQQ. On Tuesday we bought EMB. We sold SSO. On Thursday we bought PCY, CELH, EMB and more SPLV. We sold SSO, TTI and some SPHB.