Oil Plunging, Stocks Surging – Exactly What The Pundits Did Not Want

As I wrote about on Monday, there was all kinds of hysteria over the weekend about stocks crashing and oil spiking. Some newly minted experts even said the US would be in recession “within days”. A funny thing happened on the way to a 2008 redux, the markets did the exact opposite.

Look at crude oil below on the far right. From $78 to $64 to just two days. An awful lot of dumb money poured into oil right before it plunged. And now it’s back into the Goldilocks zone of $60-$90.

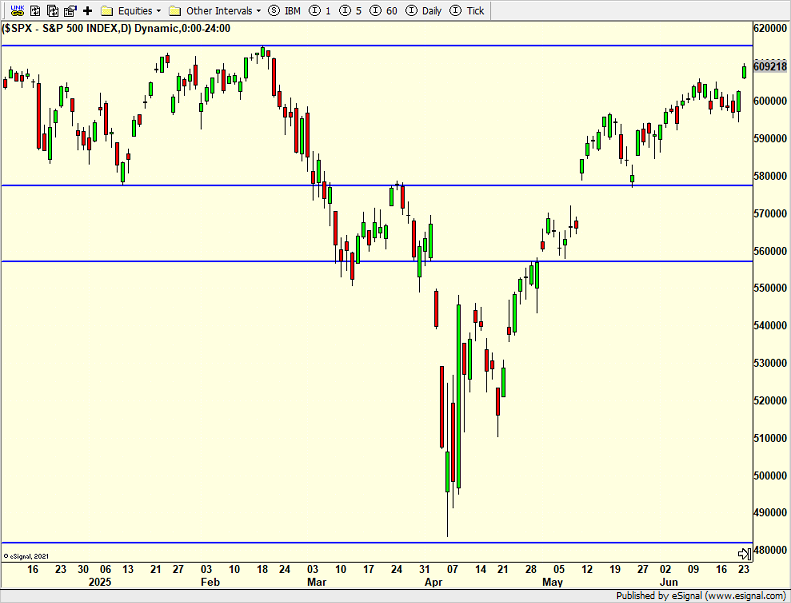

And the stock market you ask? The S&P 500 is but one good day away from all-time highs. The NASDAQ 100 (QQQ) is already there. So much for fire and brimstone and a crash.

I lost track of how many times I have written it, but investing based on reaction to geopolitics is a loser’s game. The time to do the good work is before the event, certainly not during.

I have been looking for one more pop to new highs before a deeper pullback set up. It looks like that what the market is giving us. I don’t think the weakness will be anything substantial, just a pause to refresh and shaking out of the weakest holders. As I have said since April, I continue to buy weakness.

On Monday we bought SSO and PCY. We sold SSO. On Tuesday we bought EMB. We sold some QLD.