ALL-TIME HIGHS – Let That Sink In

I think this is going to be a quick update as I am grinding on end of month and quarter portfolio work. Almost three months ago as the global markets plunged into the abyss and the masses were screaming about geopolitics and a repeat of 2008, I shared that our studies were 80% in favor of new highs late this year or Q1 2026. And I was almost the lone wolf in that regard. Pervasive chatter about Armageddon was abound. What I did not think was that all-time highs would come in Q2. And yet, here we are.

I checked in on all of the high priced Wall Street strategists who were wildly bullish coming in to 2025 and then cut their targets. When, you ask? Right around the April lows when stocks were down 20%. And what are they doing now? You guessed it. Chasing the market higher and changing their outlooks again. Someone will have to remind me how these folks offer any value to investors.

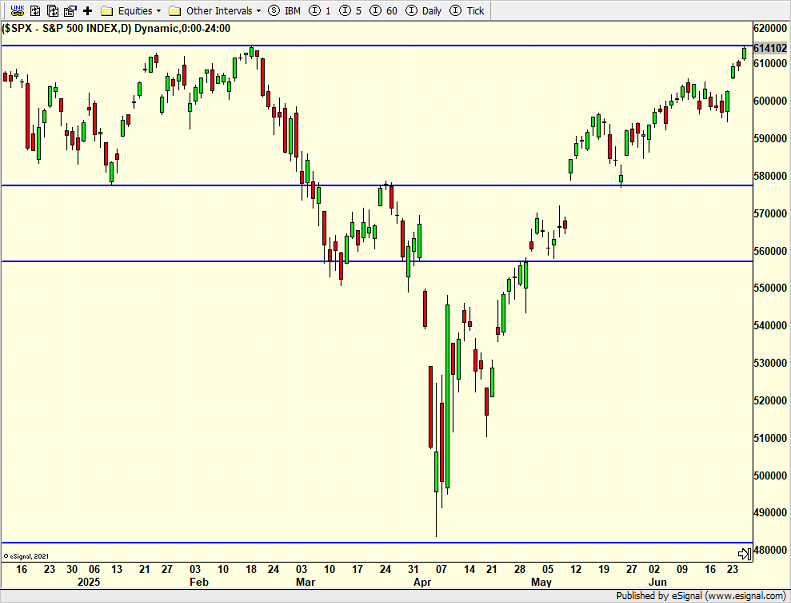

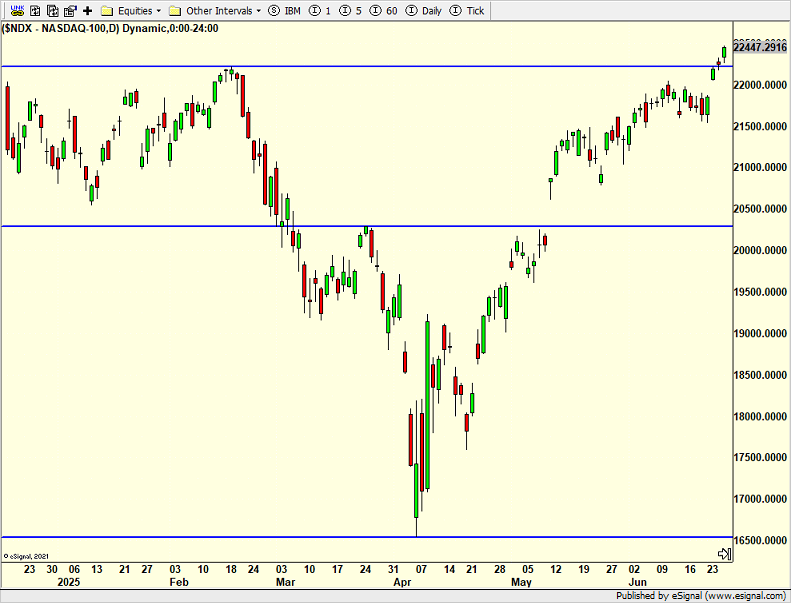

The S&P 500, above, should see fresh, all-time highs this morning. The NASDAQ, below, 100 is already there.

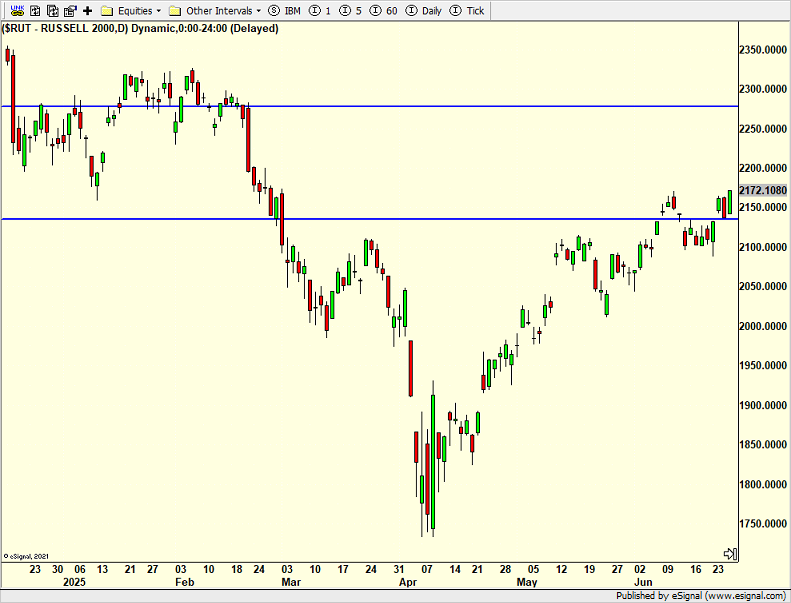

And those small caps. They still have a long way to go, but as I mentioned last week, I thought there was a trading opportunity.

Investors have really calmed down over the past few months. Things look very good right now. And that’s the first sign of worry for me. I do not think July will be a strongly bullish month.

A summer weekend is here. It was 106 in New Haven the other day. On Thursday it was 65. That is insanely volatile. Holy geez! It looks like once Sunday comes, we are going to get a long stretch of 80s without much rain. Our week with all three kids home will come to an end on Sunday. A big two-man golf tournament is in my weekend plans with my friend, ski buddy and favorite orthopedic surgeon. We are not strong enough to win, but I know we are going to have a great time and listen to some really good music.

On Wednesday we sold QLD and some MQQQ. On Thursday we bought IYT, SHW, QLD, more MQQQ, more UWM, more DWAS and more XOM. We sold some W, some RAIL, some CHWY and come COIN.