What My 4 Key Sectors Say

With the stock market or near all-time highs, let’s drill down and focus on my four key sectors to further gauge market health. Recall, we recently looked at new highs and then the NYSE A/D to asses market participation.

The semiconductors are first. While they are not yet at new highs, it’s hard to argue that they are lagging or holding the market back. I do expect new highs this year.

Banks are next. Remember all those Chicken Littles crying about a repeat of 2008 in early April? Yeah, not with banks overcapitalized. And not with banks at new highs. Sorry bears. Not today.

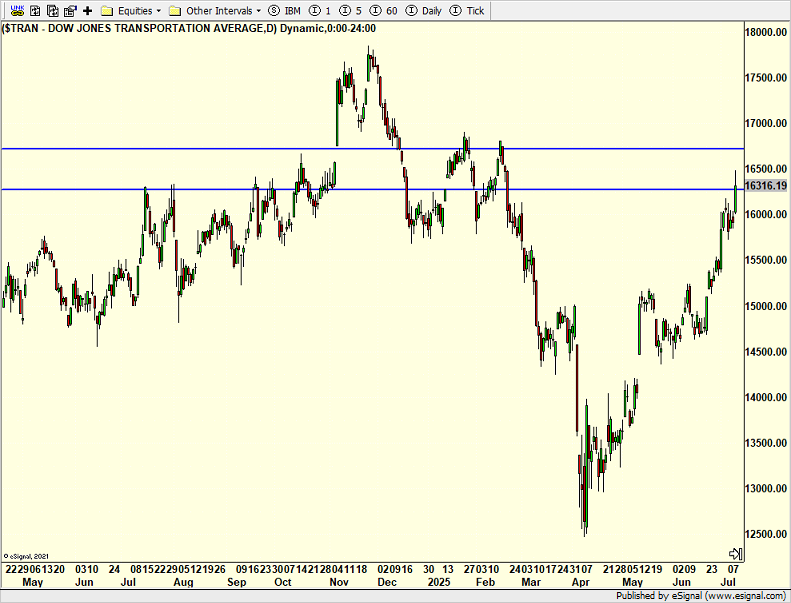

The transportation sector is below. It has clearly been lagging, especially without energy soaring. I rate it as neutral in the grand scheme of things.

Finally, we have the consumer discretionary sector which looks very similar to the transports.

All in all, my four key sectors are not showing weakness and not warning of impending doom. Stocks remain overbought and sentiment is a bit too happy right now; nothing that a 2-5% pullback can’t cure.

After a way too filled long, July 4th weekend, I am hoping for a little downtime this weekend. Golf looks to be in my future with some social plans in the evening. I am also focused on getting in better shape before I play 9 rounds in 6 days in the land where golf was born.

On Thursday we bought EMB. We sold PCY.