Major Economic News This Week Against Backdrop Of Strong Stock Market

Interesting week so far for economic data. First, the Bureau of Labor Statistics (BLS) revised job growth down by 911,000 jobs. That is an epic revision and certainly weakens many narratives and spins about the robustness of the economy. That data was from April 2024 through March 2025. Not shockingly, the politicians have gone dark regarding jobs, and that’s from both sides.

This morning, the government released inflation at the producer level. Surprisingly, at least to me, it actually fell after rising a very hot 0.90% last month. Recall that I thought 0.90% seemed “curious”. Average them together and you get 0.40% which was in the range I had expected. In any, it’s good news after bad news the prior month. The CPI matters more and that’s coming on Thursday morning. Our model still shows warmer but not hot inflation for the next few months.

Guess what the 911,000 revision and PPI do to the Fed.

You are correct. Interest rates are going to get cut by 1/4% next Wednesday. I really hope the Fed doesn’t try and play catch up all at once by cutting 1/2%. Markets like things to be incremental and not signal panic. And I continue to question why we even need the Fed to control short-term rates.

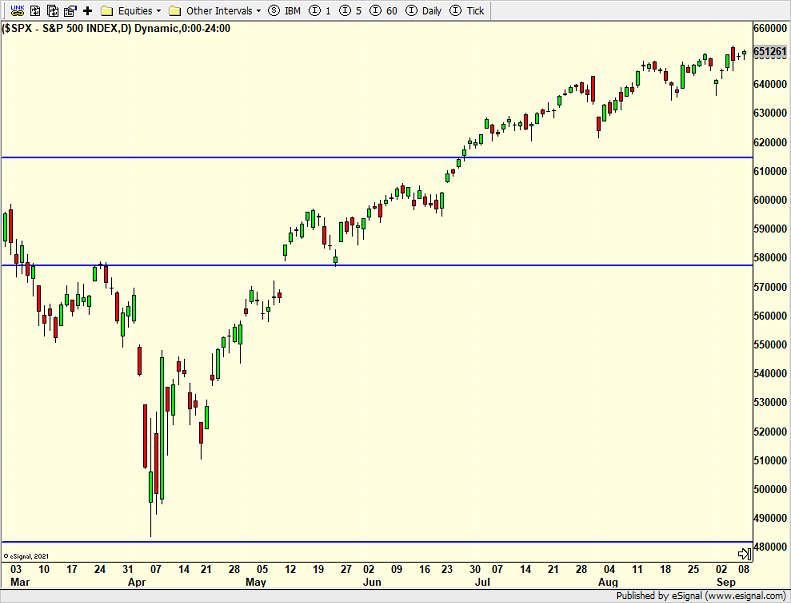

Markets continue to trade well, better than I expected. The S&P 500 has been creeping higher. I am interested to see how it behaves if and when it finds itself in new high territory again which looks to be this morning.

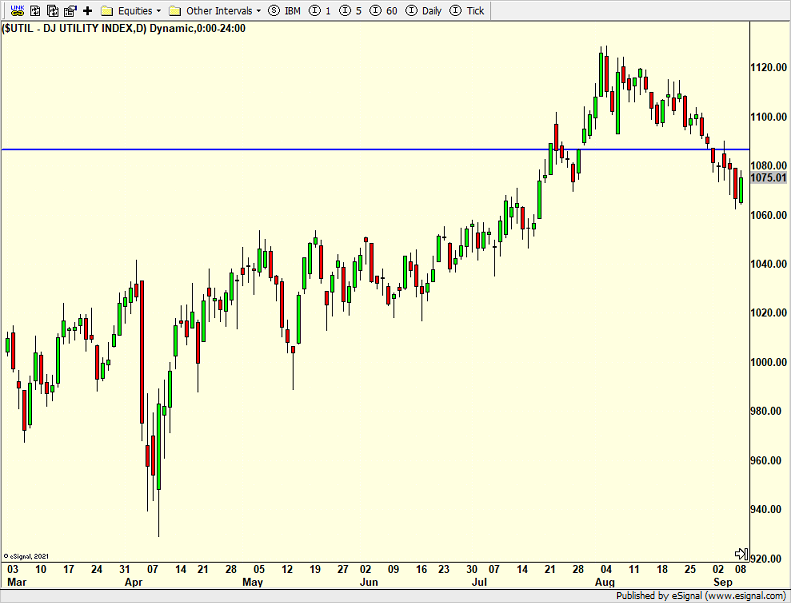

Utilities have been on watch list this week and I have just been waiting for a trigger to buy. They are certainly in the zone for a rally. We did sell the solar sector (TAN) the other day so we do have some cash to deploy.

On Monday we bought TOST and QLD. We sold SSO, TAN and some FDLO. On Tuesday we bought VVV. We sold CROX.