***SPECIAL Fed Update – Dissolving The FOMC, Dow 50,000+***

On some, many or most FOMC (Fed) days, I often sing Europe’s, “It’s the final countdown”. At 2pm on Wednesday, Jay Powell and the rest of the FOMC conclude their two-day meeting with what will be the first interest rate cut since December 2024, one is long overdue.

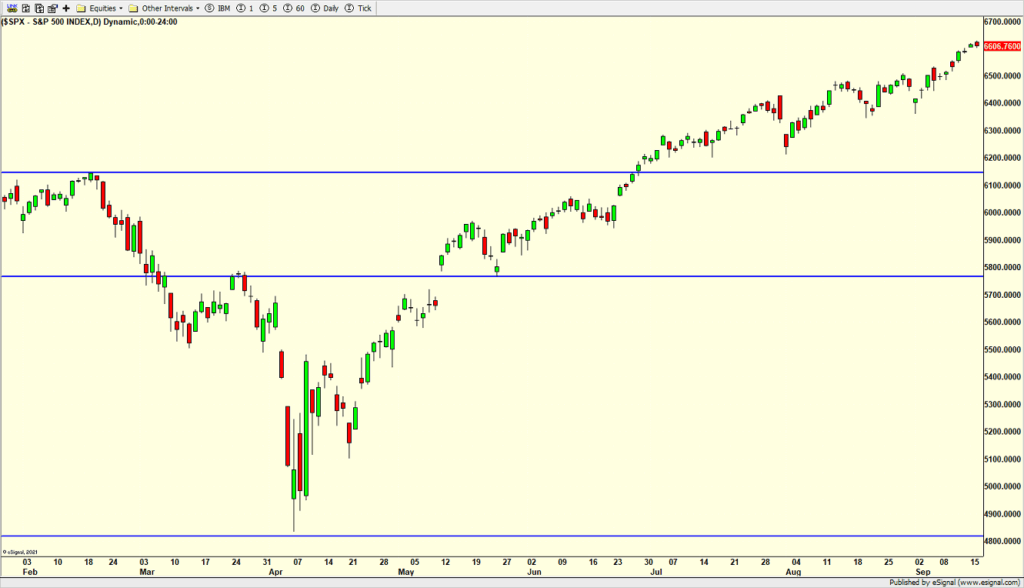

Before we get there, the stock market model for the day is plus or minus 0.50% until 2pm and then a rally. While the S&P 500 sold off mildly on Tuesday, it has rallied smartly into the meeting which takes away some of the fuel for a post-meeting rally. I also have a potential set up for market weakness after Wednesday, but we need some pieces to fall into place first.

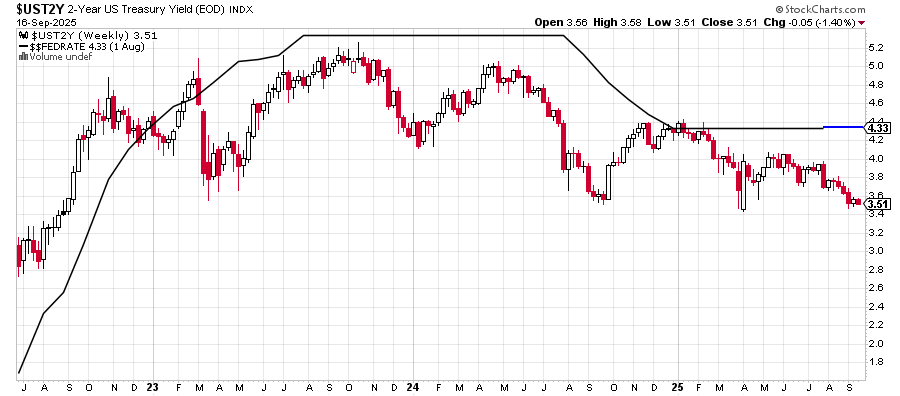

The chart below should not be new to anyone except our most recent reader additions. It is the Federal Funds Rate (FFR) in the solid black/blue line with the 2-Year Treasury in red and white. Since early 2023, the 2-Year has been below the FFR which is the rate the Fed controls. That tells you the Fed has been wrong and late, pretty much as usual. The 2-Year is currently saying that rates need to come down 0.75% – 1%.

Readers know that I have been pounding the table for a rate cut since March. My plan was for a 0.25% cut in March, skip May and another 0.25% in June. This was no different from late 2020 when I pounded the table to start hiking rates every other meeting. The people who sit around the FOMC are a whole lot smarter than I am. That’s a fact. However, they seem to freeze or become deer in the headlights when it’s time to take new action. And it’s not as if this has been a one off. From Greenspan whom I view as the worst chair of the modern era right through to Powell, they all have been asleep at the switch.

Before I pivot to the next topic, I want to say that I 100% favor an independent FOMC and Fed. Although many presidents like Truman, Nixon and Trump have privately and publicly strong armed, criticized and even castigated the Fed, I have never supported it under any circumstances. So, I guess that rules me out to succeed Jay Powell next year as Fed Chair. The same goes for Senators and Congressmen who use Fed Chair testimonies as an opportunity to blast the sitting chair. It’s disrespectful and undermines the system. Keep it all behind closed doors, if at all.

Do we really need the Fed to control short-term interest rates? Why not just dissolve or unwind that power and leave it to something more quantitative or just use the 2-Year? While I fully recognize the Fed does a lot more than just meet every six weeks to debate interest rates, the FOMC which votes on these changes doesn’t really need that power. I am fine putting the 2-Year in charge which is essentially “the market” that the FOMC ultimately follows anyway. Of course, Congress will never do that, but it’s always food for thoughts.

The NASDAQ 100 did not make it 10 straight up days, but it really doesn’t matter. Momentum is super strong although the index is super extended. A quick, sharp pullback would fix a lot of things, but is the market really going to reward all those who have been on the outside wishing they were in? I lost count how many people were absolutely certain of recession from the tariffs. And all those people who knew 2025 was going to be like 2008, or worse.

In late 2024 our quantitative work suggested 2025 would see a weakening but not weak labor market. That in turn could lead to a softer but not soft economy. As I have mentioned too many times to count, the Fed should have cut in March and June. I can make the case now that the economy is starting to find its footing and will re-accelerate in Q4 or Q1 for another stronger run based on tariff certainty and, more importantly, massive deregulation coming the tax and spend bill passed in early July.

If that happens, I fully expect a giant wave of IPOs, mergers and hostile takeovers in the market. Read Dow 50,000+, our longstanding target. Wondering who else forecast Dow 50,000 in 2022 when inflation was soaring and stocks were cratering. It’s just math from solid quantitative models, not speculation or feelings or thoughts. It’s certainly not from the Wall Street crowd who forecast recession and another multi-year bear market.

In the short-term, we know that momentum is strong but the market is overbought, a regime that happens often during strong rallies. I have often referred to this regime as a market that creeps or grinds higher day after day, week after week. It happens simply because the masses get caught on the outside wishing and hoping they were invested which usually occurs after a correction where people panic and sell. Rinse and repeat. Human nature just doesn’t change.

Stocks have been essentially straight up since late April. It has been another one of those close your eyes and enjoy the rides rallies. The masses kept looking for a 10% decline to buy and the pundits still talk about it on TV now. There haven’t been any real pullbacks since April and with Q4 a few weeks away, the great performance chase has begun. Of course, there will be a few seasonal headwinds coming up shortly, but as I have said since April, any and all weakness is a buying opportunity until proven otherwise. Stocks can and may pullback, but the DNA markers normally seen for a large decline are not there now and do not look like they have enough time to appear before 2026.

On Friday we bought SDS. On Monday we bought more MQQQ. We sold SDS. On Tuesday we bought PINK, more IJT and more DWAS. We sold IJS and XLC.