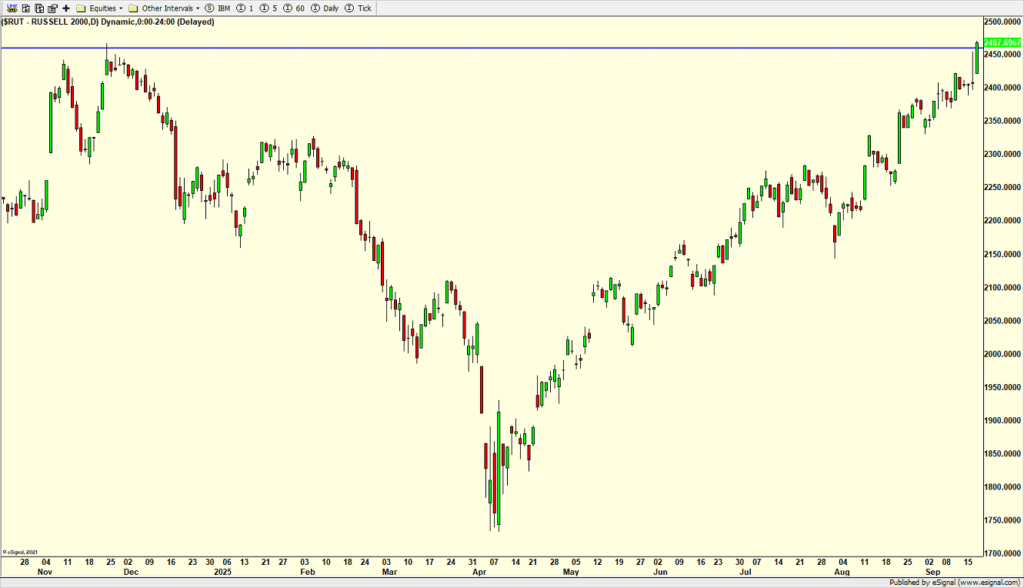

Powell Moves as Expected – Small Caps Continue To Rip

On Wednesday Jay Powell and the FOMC what everyone expected them to do. They cut rates by 1/4% and indicated that more rates reductions were coming. Stocks sold off and then came back. The potential set up for downside did not materialize because there wasn’t a strong upside reaction post-2pm. While the S&P 500 and NASDAQ 100 didn’t do much over the past two days, my favorite index, the Russell 2000, certainly did.

On Fed day, the small caps rallied strongly and then gave it all up. However, they ripped higher on Thursday by a wide margin over all other stock market indices. I have written about it since April and shared all of the small cap ETFs we’re bought. Before you email, the answer is, “I don’t know”. The common question is, “should I still buy the small caps?”

Some or many of you know that our methodology has a tougher time buying something after a sustained rally. That’s just how it is. We are usually early in and early out. This week, we sold small cap value and bought more small cap growth along with small cap momentum. I would continue to buy weakness as I have written about for five months. I sense billions and billions of dollars on the outside wishing they were invested.

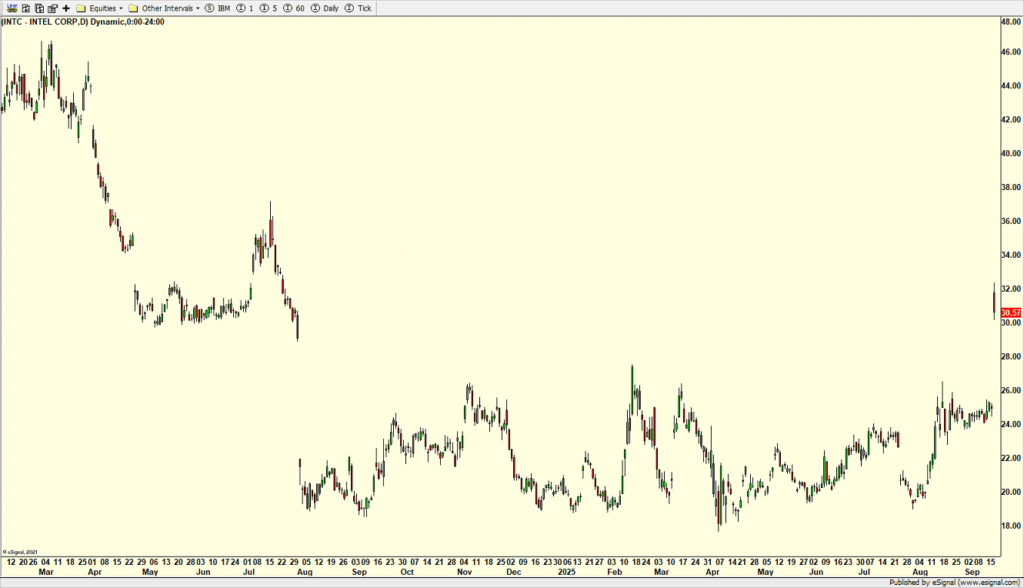

Earlier this year, we bought Intel twice to total 2.5% of the Unloved Gems portfolio. I expected a short-term trade at best. Then the government bought a 10% stake which drove me crazy. I was and am 100% against it. I was looking for strength to reduce our position size. On Thursday Nvidia took a $5 billion stake which is a major deal for Intel and barely a rounding error for Nvidia. That was the first strength to begin to downsize the position back to 2.5%. If it rallies again, I will consider reducing the position further and further. That’s how good, sound portfolio management works.

Hard to believe but four straight weeks of absolutely beautiful weather. Golf and watching D pitch are definitely on tap along with a UCONN cocktail party and dinner with the extended family. Fall is definitely the best time of year in CT. Less than 70 days until ski season.

On Wednesday we bought QLD, SSO and EWY. We sold EPOL. Thursday we bought more QLD. We sold SSO, EMB and some INTC.