Models No Longer All Bullish – A Look At The Indices

Last week, a number of our stock market models turned neutral to negative as I wrote in my Fed update post. That creates some crosscurrents given the seasonal tailwind and higher volatility stocks leading lower volatility stocks for most of the rally.

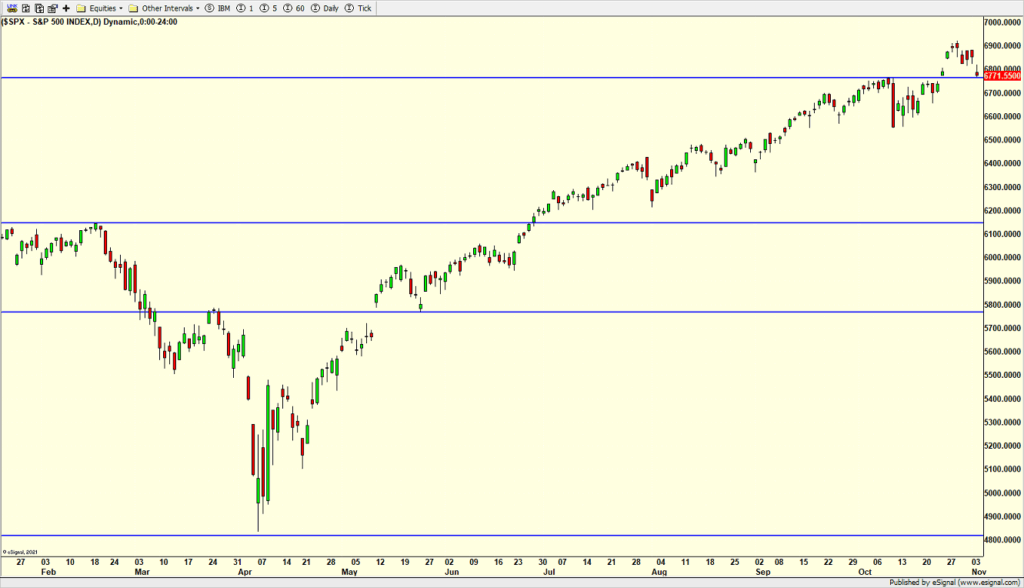

The bull market is not over so folks do not need to ask about that. The best case for the bears is that stocks are entering a period of sideways activity that frustrates everyone. The S&P 500 is first. It has already pulled back to the initial level of what is to be expected and should bounce, even if it goes lower. Even a few hundred points lower would not be out of the question nor break the back of the rally.

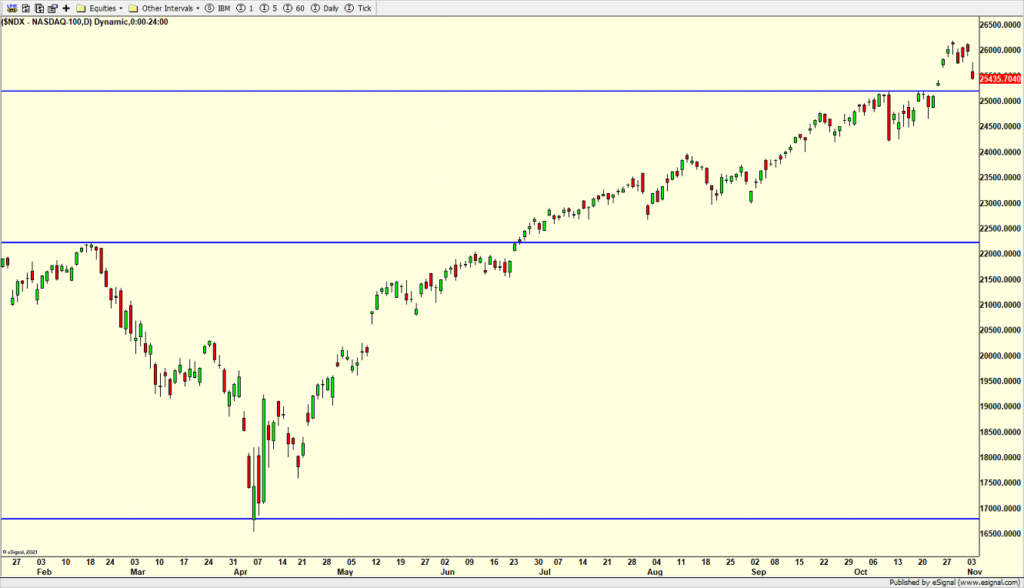

The AI-driven, tech laden NASDAQ 100 is next. It is not quite at the same level as the S&P 500, but could be this morning.

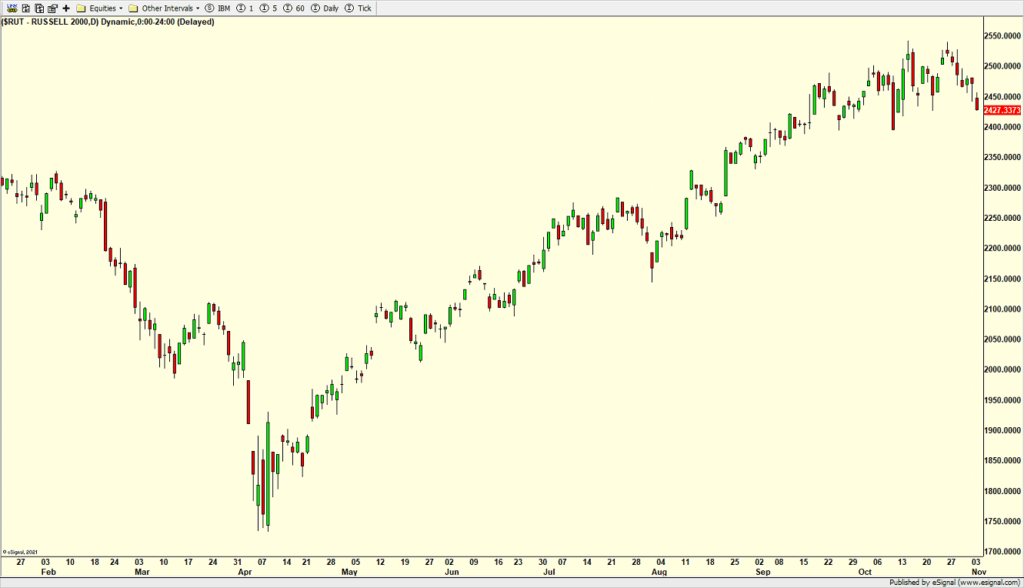

Finally, the small cap Russell 2000 Index is below. It definitely looks a bit different than the first two indices. It has already pulled back, but looks like it can go another 2-3% lower if it wants to without upsetting the apple cart.

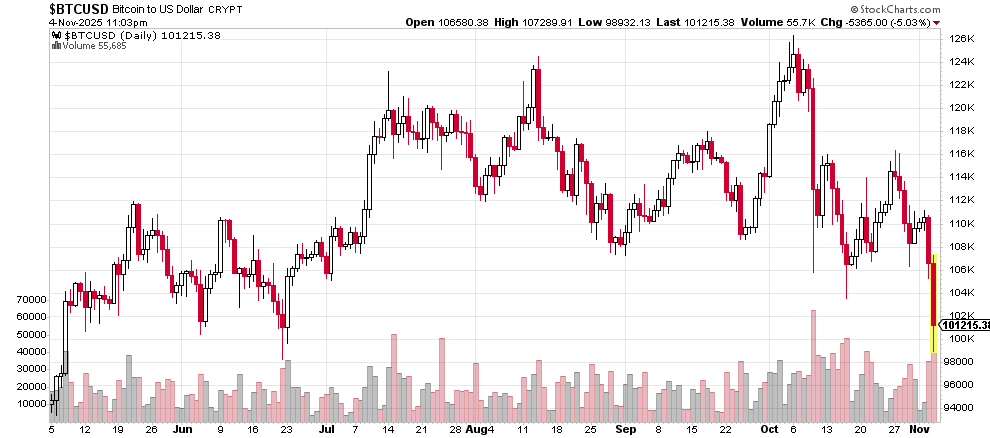

Since “risk on” assets bottomed in April, I have selectively picked on various assets where greed, giddiness and euphoria set in. Bitcoin was the first and it certainly looks like the late comers have been punished in a big way over the past month. I am looking for a low to set up over the coming week for at least a bounce.

On Monday we bought XLU, more NNOV and more KNOV. On Tuesday we bought SSO, more HD and more DG. We sold EMB, GDX, some AMZN, some AAPL, some GOOG, some MDB and some NJNK.