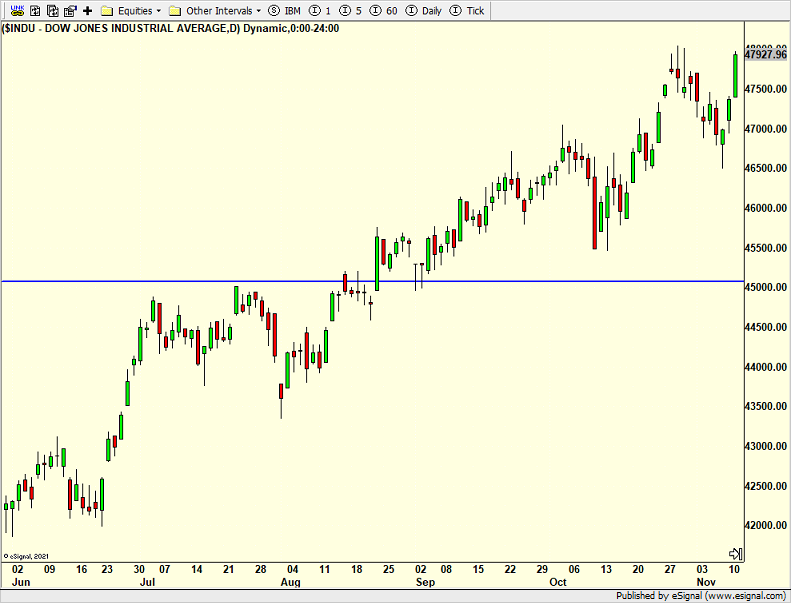

Dow Surges To All-Time Highs – Narrowness Not Totally Narrow

As I tweeted and wrote here, last Friday was not a day to sit on your hands and do nothing. Stocks got down to the -5% pullback line where the healthiest of bull markets like to find buyers. And some of our models replanted cash into some “risk on” areas. The risk/reward looked to be roughly 2/1 to the upside with a close below Friday’s low as the point at which I would know I was wrong.

Somewhat oddly, the Dow Industrials have led since then with the index being the only one to score new highs so far. I would like to see the others follow suit or that will create a glaring divergence.

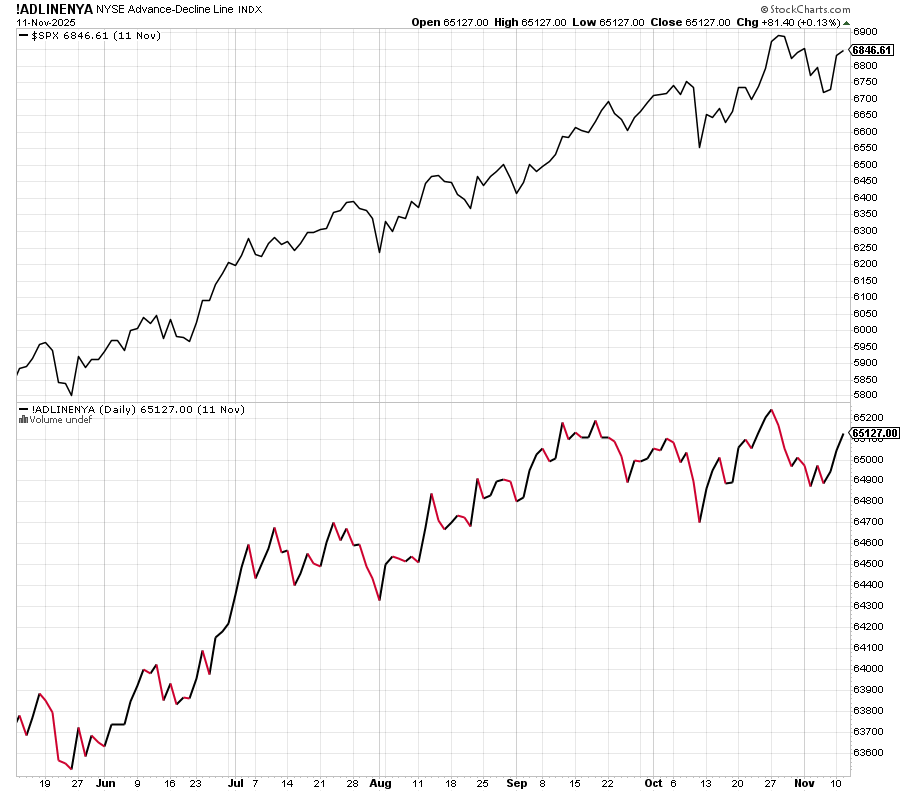

I have been concerned about the growing narrowness of the rally. It’s a fact. There has been less participation than we have seen. However, the NYSE Advance/Decline Line did score a fresh high at the same time as the S&P 500 last month which usually insulates against a bear market or large decline. The lazy and uninformed like to stupidly invoke the Dotcom Bubble. For those who actually have the data and did the work, the NYSE A/D peaked in May 1998. Yes, 1998, 22 months before the stock market finally peaked. This is not late 1999 nor 2000.

On Monday we bought PCY, CARR and more CHWY. We sold some MQQQ. On Tuesday we bought EMB and more SPHB.