Bulls Turn Tide – All-Time Highs – Bitcoin

The first three days of the current rally saw a surge in the number of stocks going versus down, otherwise known as a breadth thrust. Think of it like a rocket ship taking off. The strongest acceleration is from the launch pad to get the rocket going. Then, it has speed and decelerates to lower thrust. That’s how markets work from lows in many situations.

In this case, the thrust was an historic one and that’s because the decline was only 6% in a short amount of time. Not enough people panicked and sold, certainly nowhere near the level we saw during the tariff tantrum in April. Nonetheless, we have some minor thrusts and the major stock market indices are set up for a rally to new highs.

The S&P 500 is above. It has been a straight up move for the bulls. I would not expect that to continue to 2026. There should be some pause and maybe a minor pullback before fresh highs are seen.

Interestingly, we don’t hear any talk right now about an impending private credit crisis which was dominant during the 6% pullback. Stale economic data is weaker but not weak and the Fed will be cutting rates next week.

Below is the Volatility Index or VIX. I intentionally left out the tariff tantrum because VIX exploded higher, making the chart harder to read. VIX got into the high 20s before reversing. That’s normal and healthy for a 6% pullback. And now it’s back to being a teenager which is supportive of more upside. I would to see it under 15 sooner than later.

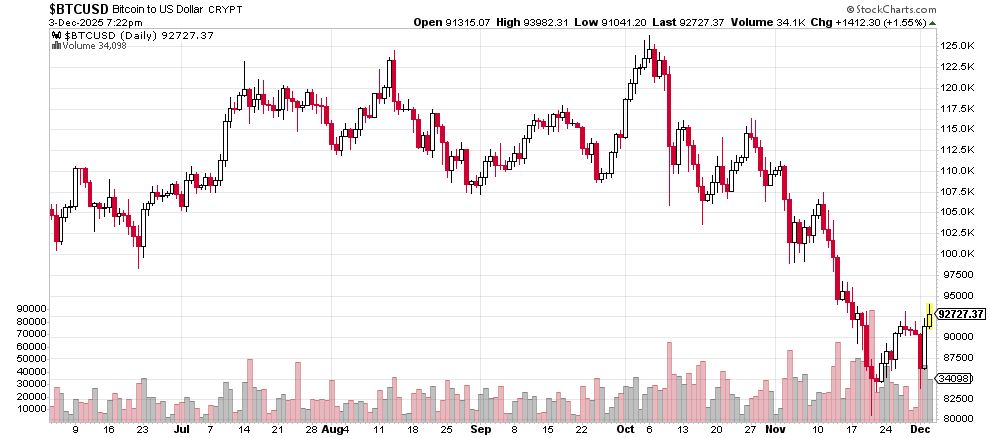

Finally, the set up in Bitcoin that I started writing about at $100,000 took its sweet time, but confirmed in the upper $80s, meaning a long opportunity to own the crypto. My minimum target is $100,000.

On Monday we bought AGG, more CRNX, more XLF, more NJNK, more XOP, more XLE, more OIH, more RSPU, more XLRE, more MQQQ and more XBI. We sold SDS, some PCY, some EMB, some GDX, some SII, some UWM and some MQQQ. On Tuesday we bought more QDEC, more QLD, more SPHB and more FDEC. We sold GDX.