New Highs Up Next With Higher Risk Leading Into Fed Meeting

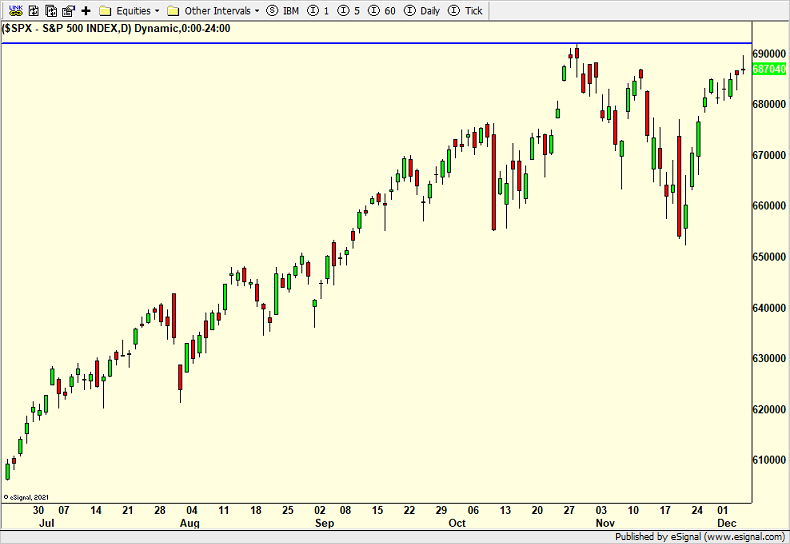

As we have discussed, we know that after the 6% pullback, we have some minor, but strong thrusts off of the recent low. And we know that there is a strong seasonal tailwind into 2026. We also know that the models that had been neutral to negative ahead of the pullback have all flipped back to positive. Friday saw some rejection by the bears as price got close to the old highs. The stock market does not need to fail before new highs. And I do not believe it will.

Next is a chart of high beta versus low beta which sounds wonky. In other words, it is the stocks with higher volatility and risk versus the lower ones. Since the tariff tantrum bottom in April, high beta stocks have clearly led which was one reason I stayed so steadfastly bullish all the way up. When some of our models turned in October and November, risk was still leading which is why I only thought a 5% pullback was likely. I was a bit surprised at how much the riskier stocks went down versus the lower risk ones. However, the past few weeks have seen a return to beta and higher volatility and riskier stocks which is healthy for the rally.

The big catalyst this week is the Fed meeting on Wednesday. Spoiler alert folks. They are cutting rates by 1/4%. I would absolutely love to see stocks pull back into the 2pm announcement. That would set up a higher probability trade coming out of the announcement. It’s unlikely that a trade to the short side can set up post-Fed.

On Friday we bought SDS and PG. We sold SSO, some DG and some WMT.