Little For The Bears To Enjoy

I think this will be a short update as I am just back in the office from the “Sunshine State” where we did not see the sun for more than five minutes in four days. The trip was great and I love seeing clients. The weather, Florida can keep. I am also battling the Mount Shasta of migraines and struggling to focus on the screen.

If you haven’t read my 2026 Fearless Forecast Part I, it’s up.

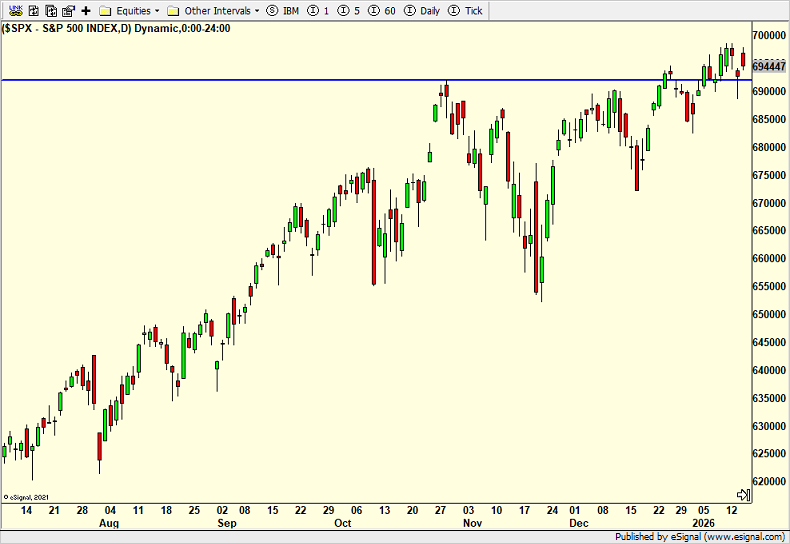

Stocks have been quiet this week. The S&P is teasing new highs. All systems go.

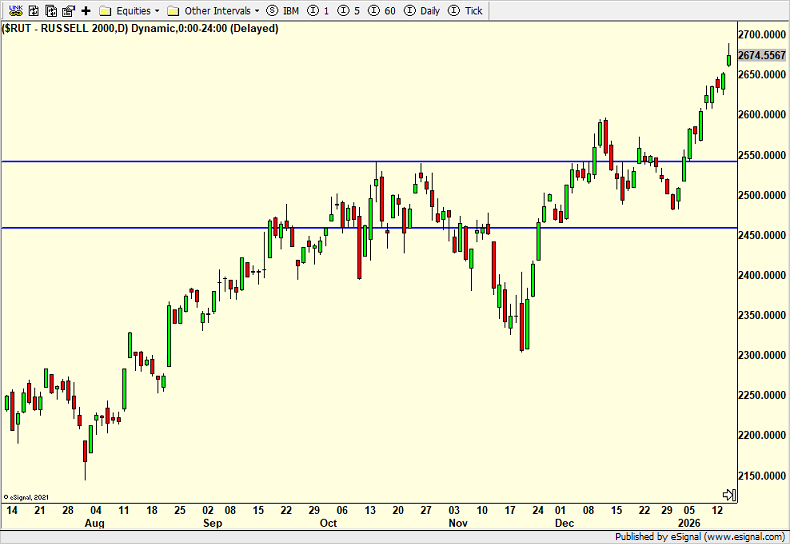

The index I have written about the most has been the Russell, both in absolute terms and relative to the S&P 500. We have had a very large position in various small cap ETFs, both levered and unlevered. The fact that people have stopped chirping me about it has me worried that the trade is getting long in the tooth.

And relative to the S&P 500, the Russell has been super strong of late.

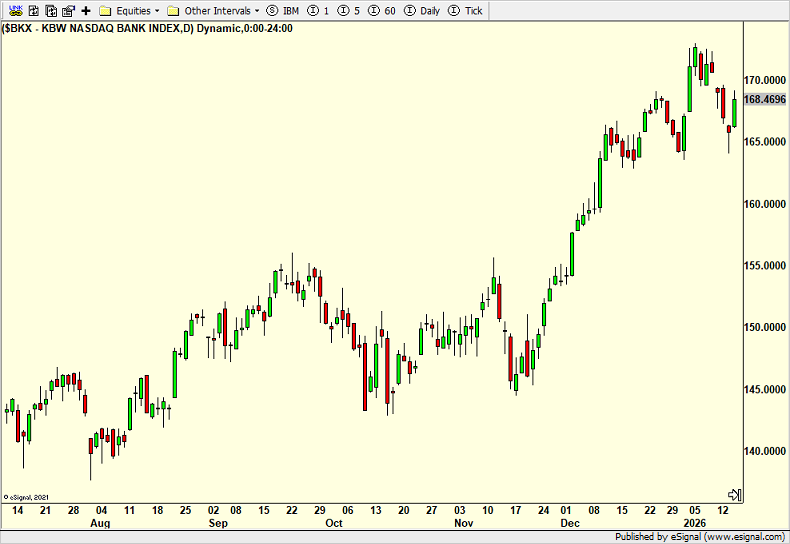

Earnings season is in full swing with the big banks all reporting now. The group rallied hard into earnings so I am certainly not surprised that they have sold the good news. We bought KCE the other day to go along with KRE and XLF which we already own.

And for those bears still hoping and praying for financial Armageddon, I have a chart to share next week that should put you in the fetal position under your desk sucking your thumb.

The long MLK weekend is here. Being on the road this week puts me in the office on Saturday with hopes of heading north to my happy place for Sunday and Monday. Praying for cold, clouds and snow.

On Tuesday we bought SSO. We sold some GOOG. On Wednesday we bought KCE, PCY and EMB. We sold OIH and SSO. On Thursday we bought XLV. We sold XLE.