Small Cap Trade Needs Rest- Junk, Semis and Banks Says Full Steam Ahead

It seems like all I hear now is about the broadening rally and the outperformance of the small caps. For months and months, pundits disavowed and hated that theme. Now, all of a sudden, the masses are on board. What could it be that made them change? As you know we have been positioned for the trade since Q2 2025. Good thing the trade hasn’t gone vertical or anything. Oh. Wait. Scratch that. Now, I think it’s time for some mean reversion, meaning the trade goes the other way. And that could mean the AI is front and center again.

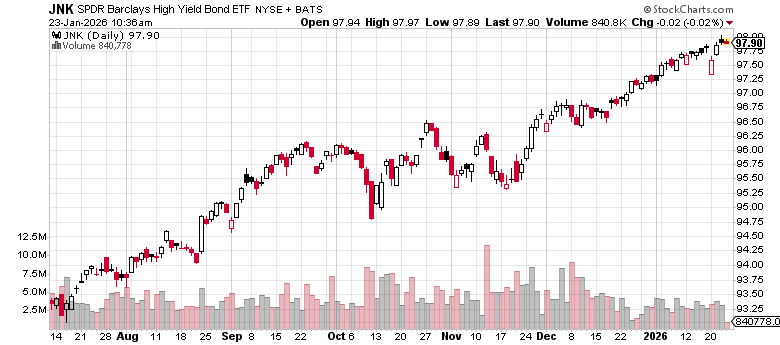

The other day I started listing all the reasons why a bear market or large decline is not imminent although in my 2026 Fearless Forecast, I did predict a 10%+ correction in Q2 and Q3. Besides epic participation, we have excellent behavior in credit. Look at the JNK high yield bond ETF below. It’s yet another instrument at all-time highs. Guess what folks? Large declines do not begin when junk bonds are soaring.

How about leadership?

Anyone want to argue with semiconductors?

How about banks?

Do you know what all this continues to tell me?

Buy weakness.

Mother Nature looks to be unleashing her wrath this weekend. Frigid temps with a nor’easter to boot. Bring it on baby! Just let’s get the snow totals higher up north please. If the forecast changes, D and I will be storm chasing come Sunday, hoping for some super light and sweet fresh powder in Vermont. If not I am sure I will survive in CT. Stay warm. Stay dry. Be safe.

On Tuesday we sold EMB. On Wednesday we bought SNTH, PCY, EMB, more VEOEF, more BMY and more IBIT. We sold some NEM. On Thursday we bought SMR. We sold XLU and some CF.