Permanently Higher Stock Prices

Last week I offered the idea that stocks may be settling into a little trading range before resuming the rally. Well that lasted all of one day as the bulls continue to press higher to begin the new week. Time and time again this market has punished any and all who dare to hold cash or, heaven forbid, short the market or hedge. As continue writing my year-end report to clients and I review commentary, I realized that for 20 months, the stock market has completely steamrolled almost all of the short-term negative studies as well as the seasonal (calendar) ones. That’s pretty incredible and something without precedent in my 100 year database.

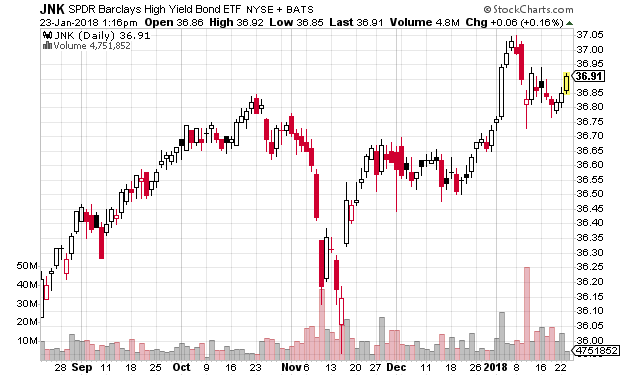

So here we are with all five major stock market indices at all-time highs. There’s not much more to say. Semis, banks and discretionary at new highs. Transports not far behind. NYSE A/D Line at fresh highs. Only junk bonds are lagging, but they look like they could score new highs sooner than later.

2017 was relatively easy for the bulls. 2018 has started off even easier. I am concerned that few others are concerned and people are starting to believe in a new paradigm of permanently higher stock prices. That’s very dangerous. I hear pundits saying that all this won’t end well. While that’s true, no bull market in history has ever ended well or it wouldn’t have ended! Everyone should enjoy what’s going on in the stock market, but realize that this behavior is generational and won’t likely be repeated for a long, long time.

If you would like to be notified by email when a new post is made here, please sign up HERE