Stocks Bottom on Schedule Catching Most By Surprise

For the last two weeks, I have written about the bottom I saw coming and how I would favor stocks over bonds. I didn’t write about a 10%+ correction nor a bear market beginning. I was very clear that I thought the stock market was experiencing a routine, normal and healthy bull market pullback that began on May 1 after the last Fed meeting. On May 13 as many of our short-term indicators signaled that the vast majority of the weakness should be over, I was concerned that the decline did not seem complete. I thought we needed to see at least one more move to new lows where the major stock market indices did not close near their lows for the day. We saw that on May 29 and again on June 3 where the pullback appeared to be over.

As I write about all the time, bull markets typically end a certain way. At the peak on May 1, there was not a single indication that the bull market was ending. As the pullback gained steam, there was an ever-growing chorus of gurus calling for the end of the bull market for all of these far fetched reasons like tariffs and recession. The market said otherwise. I was surprised at how investors were reacting to a little ole 6% pullback.

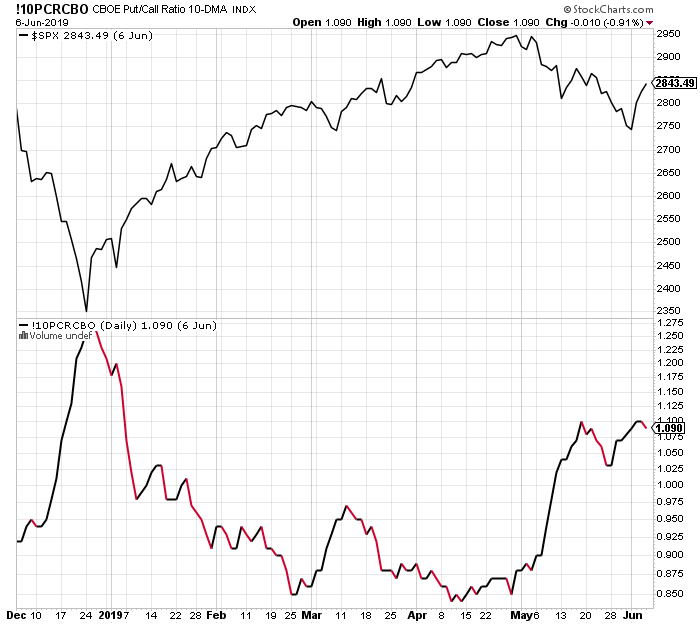

Option traders in the bottom half of the chart below were positioning for much lower prices. As you know, en masse, they are usually wrong. Sentiment surveys were showing a spike in bearishness that is usually seen after at a 10% decline. I don’t what had people so amped up for lower prices, but they were quickly punished.

As stocks bottomed this week, the media scrambled to assign credit for the low. First it was Fed Chair, Jay Powell, who essentially said nothing new. Then it was some mildly weaker economic data followed by hopes that a deal with Mexico would be reached. Today, we hear that stocks are rallying because monthly jobs data was weak and would lead to a rate cut. I also saw the media say that stock are up because Chinese President Xi said he likes President Trump. You just can’t make this stuff up.

As stocks have been rallying, look at the lower chart below which represents the number of stocks making new 52 week highs on the New York Stock Exchange. There is real underlying strength here and clearly no sign of a bear market or major collapse.

Finally, among many things in the media which have been wrong, I found it so beyond “curious” that word leaked out that famed investor Stan Druckenmiller had sold all of his stocks and bought treasury bonds after Trump’s tweet regarding Mexico. What took so long? Why did it come out precisely as stocks had bottomed? The skeptic in me wonders whether the timing coincided with Druckenmiller trying to buy stocks again after they already left the starting line.

It’s amazing how quickly stocks turned on a dime and the news narrative has changed from all of the negative consequences concerning tariffs and the coming recession to the Fed about to begin a rate cutting cycle which would rescue the economy and markets. My tune has never wavered. The bull market remains alive and al-time highs should be seen in Q3.