***SPECIAL FED UPDATE – Rates Going Up, Powell Still Chasing***

Before I get into my comments about the Fed meeting, let’s start with what the model says for today’s action which seems to be of interest to many people. On every Fed day, the model says plus or minus 0.50% until 2pm. With pre-market action we are looking at well north of that. Post 2pm, we are supposed to rally, however, given the big rally on Tuesday and what looks to be a strong opening and possible morning, the odds diminish and the trend loses much of its edge.

Now, onto the comments.

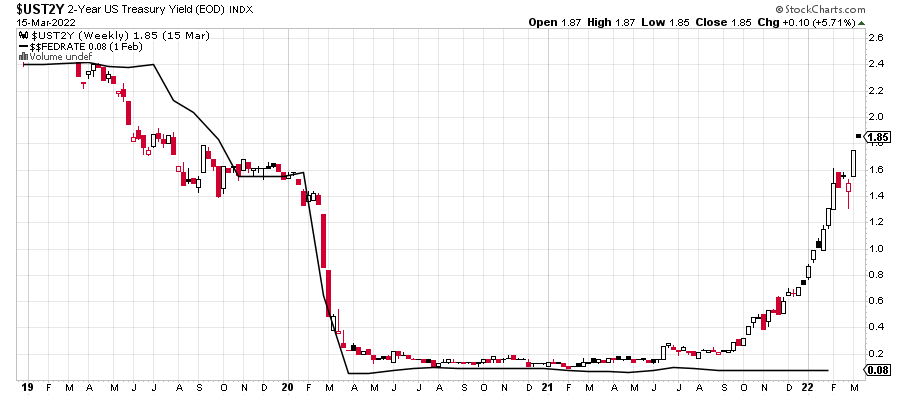

Here we go. the single most expected launching of a new interest rate hike cycle begins at 2pm today. Even my mom knows that Powell is hiking by 1/4% today. And that’s saying something! The Fed follows the market, contrary to popular opinion. Below is a chart of the Fed Funds Rate (in black) which is what the Fed controls against the 2-year treasury note which the market controls. Typically, the Fed follows what the 2-year note says should be the interest rate. Right now, the market says the rate should be 1.75% which is one reason we have so much inflation. It’s not perfect, but it’s quick and easy. Credit to my friend, Tom McClellan @mcclellanosc, for sharing with me.

You can see in Q1 2020, the Fed was spot on and did a fantastic job of providing a tsunami of liquidity for which I have credit them numerous times.

The big issues for the markets are any clues to a more dovish Fed in 2022. That’s unlikely here, even with the situation in Ukraine. And second, investors will be all ears on whether Jay Powell offers any hints into the Fed’s plan to begin selling bonds from its unfathomable $9 trillion balance sheet. I don’t see a bullish path for stocks if Powell does begin to discuss this, unless he somehow reverses course and says that asset sales are off the table in 2022. Don’t bet on it.

The Fed is in a box. They screwed up the tapering of asset purchases. They screwed up beginning to raise rates. Jay Powell further embarrassed himself and the Fed when he testified before Congress several times that inflation was first very much needed. Then it was transitory (short-lived) and finally that they all got it wrong. Come on folks. You can’t get it that wrong yet again.

Whether you like my approach or comments is irrelevant (and thanks to those who say I am too tough on the Fed). I don’t really care. People around that Fed table are supposed to be among the brightest on earth and the sharpest bankers. Yet, time and time again, they are so far behind the curve; they are forced to play catch up in a compressed fashion which is like chasing the markets. Not all the time, but most. I get it wrong, plenty of times. I get something wrong every day. It’s okay to be wrong. It’s not okay to stay wrong. Be accountable, fix the mistake quickly and move on.

In August 2020, I started to sound the alarm about inflation. I warned about food price skyrocketing. Q3 2020 was the opportune time for the Fed to begin to address the asset purchases. They could have started a gentle glide path to reduce the buying. Then they could have paused for a quarter before started to raise rates in the summer of 2021. And by now, they could begin to slowly sell assets. Sorry, but it’s not rocket science. If I understand it, that’s clearly the case. Just another mess created by the Fed. Remember when Ben Bernanke proclaimed that the sub prime mortgage crisis in 2007 would not lead to contagion elsewhere in the financial system?

The Fed’s mandate is price stability and maximum employment. Nowhere in there does it state anything about the stock market. The Fed needs to stop using its heavy hand (and arms and legs) and let the markets function. Playing catch up with compressed action leads to massive booms and busts.

I was in Stop & Shop last night, my first visit since April 2020. Two people stopped me to ask about the stock market and the Fed. They wanted to understand why inflation was so bad, how it got this way and when stocks would rally again. When I get stopped by random people, that topic has usually been played out and time to move in the other direction.

I had high conviction that Q1 would see a stock market decline, due mostly to the Fed and not geopolitical events. The magnitude was greater than I thought. I felt strongly that the January 24th bottom was the internal or momentum low. That has held true. The February 24th low looked like a decent secondary low. That has held, so far. For over a month, I kept writing that I just wanted to get to this week. That would align time and price and offer an opportunity for stocks to rally out of a low rather than into a low.

While there could be one more bout of weakness after the Fed meeting, stocks are supposed to rally, especially in Q2. It won’t be a straight line. While I question whether new highs are in order, I do think at least 50-75% of the losses will be recovered by June. The initial rally should be dominated by the sectors and stocks that went down the most. Then real leadership should emerge. That will likely determine the magnitude of the rally and duration.

Remember, we do have some good analogs from past rate hike cycles. 1994, 2015-2016 and 2018. I will devote a future blog to those.

On Tuesday we bought levered NDX and levered inverse S&P 500. We sold PCAR and levered, inverse NDX.