Know When to Hold ‘Em, Know When to Fold ‘Em – Media’s Parade of Pundits

So the Fed stood pat. Powell was hawkish and left the door wide open for another rate hike in July. I think they are done. I have said they should have been done before 5% as the 2-Year Note told us. Stocks sold off on the news. And then went straight up to the close and followed through on Thursday. I can’t imagine what the bears thought and did after they finally saw some market weakness on the announcement, only to see a quick reversal and more upside. Those portfolio meetings must be a bundle of joy to sit through. Do we chase and risk buying a peak? Do we sit tight and hope and pray for collapse?

After big market events, I keenly listen to the media’s parade of pundits to sense any tide turning. Laughably, I heard a few comment about the new bull market and the need to now buy stocks. Others who turned negative a year ago when the stock market made its internal low acknowledged the length and strength of the rally, but dug their heels on their bomb shelter mentality. Look, in my 33 years in the business, I have been wrong more times than I can count. And I am going to be wrong many times in the coming years. That’s just the nature of the business. But one of the most important lessons is that while it’s okay to be wrong, it’s not okay to stay wrong. You remember the Kenny Rogers song where he said, “know when to hold ’em, know when to fold ’em”?

As it is Friday before a long holiday weekend, it is very hard for me to find stocks I want to buy. If you follow the blog and the trades I post, you know I have trimming positions that have gone vertical, reducing beta and finding areas that have not enjoyed parabolic gains. An example of this is that I sold 1/3 of our very large and leveraged semiconductor position and bought much less volatile and non-levered positions in REITs, utilities and pharma. Another example is selling a high beta fund and buying the Dow Industrials. Today, I see another emerging opportunity in gold and silver stocks.

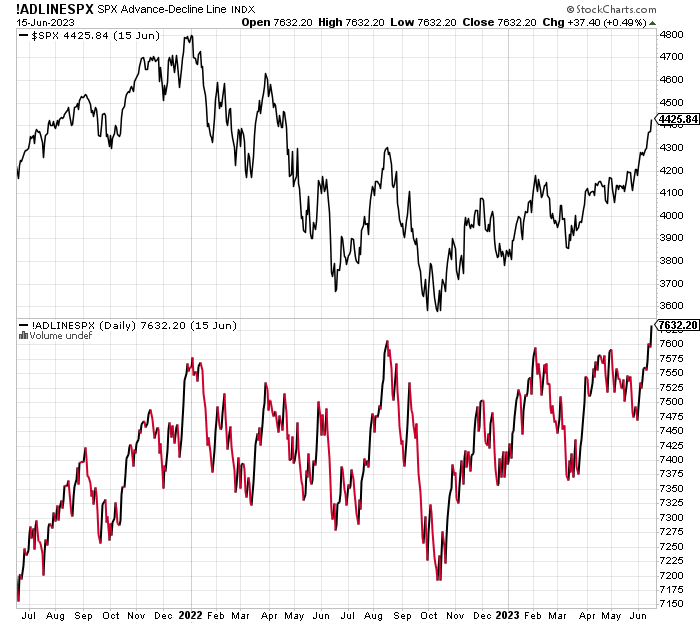

Take a look below. The chart in black is the S&P 500. Below in red is the cumulative advance/decline line of the S&P 500 which is just a fancy name for a line that tracks the number of stocks going up and down on an ongoing basis. Remember how all the bears said the rally was so narrow? And that it had to end in ruin? Well friends, something else happened. The rally broadened and now the S&P 500’s A/D line is scoring an all-time high, signaling a whole lot more than 7 stocks contributing.

Finally, I do certainly agree that stocks have come so far and so fast. They are in desperate need of a pause to refresh or pullback. Stand by for more details on that.

As I finish typing this it is sunny with blue skies out of my window. It looks like a great morning to play golf, something I did earlier this week on Fishers Island to help support L&M Hospital and the great work they do. Fishers is a special place in the Long Island Sound, accessible by boat only. History says that in 1880 after a several hundred year dispute, New York and Connecticut agreed to exchange Fishers Island (to NY) for Greenwich (to CT). There were no losers in that trade!

I am a little miffed at Mother Nature as we have yet to have a nice warm weekend in CT. All I wanted for Father’s Day was a few hours in the sun to socialize, nap and then watch the U.S. Open. Is that too much to ask for? Apparently yes as the forecast for CT stinks.

On Wednesday we sold SPHB, LABU, levered inverse S&P 500, some AMD, some SOXL and some levered NDX. On Thursday we bought TAN, MTUM, DRN, RYEUX, levered inverse S&P 500 and levered NDX. We sold SARK.