New Week, Month, Quarter & Half Start w/ Bulls Still Celebrating

Welcome back and I hope had a great 4th of July and/or long weekend! Just a reminder that my quarterly client webinar will take place tomorrow (Thursday) at 8pm EDT where we will cover the events of Q2, performance of our strategies and a sneak peak at what lies ahead in Q3. Of course, please bring any and all questions!

Monday was the first day of the week, month, quarter and 2nd half of the year. Over 80% of the time we see an up day. While July 3rd did close higher, it was only marginal and nothing to write home about. And after a beautiful run into the end of June and Q2 overall, I can’t say I am disappointed at all. Additionally, with the strength into month-end, a momentum study says more upside is coming. As I have already mentioned, the strongest period of the summer is right here and ends in a little over a week. The start to this trend has been nice so far. So, overall, the seasonal trends say the wind remains at the backs of the bulls.

We also know that July is usually a good month when in an uptrend like now. Longer-term studies sometimes point to a summer peak this month with a few thunderstorms through September. I sense that likelihood is stronger than usual with some very good gains already seen. As I continue to mention, I do not believe now is the time to take cash and throw it into higher risk assets from the bomb shelter. Just accept that you missed a great opportunity and wait for the next one.

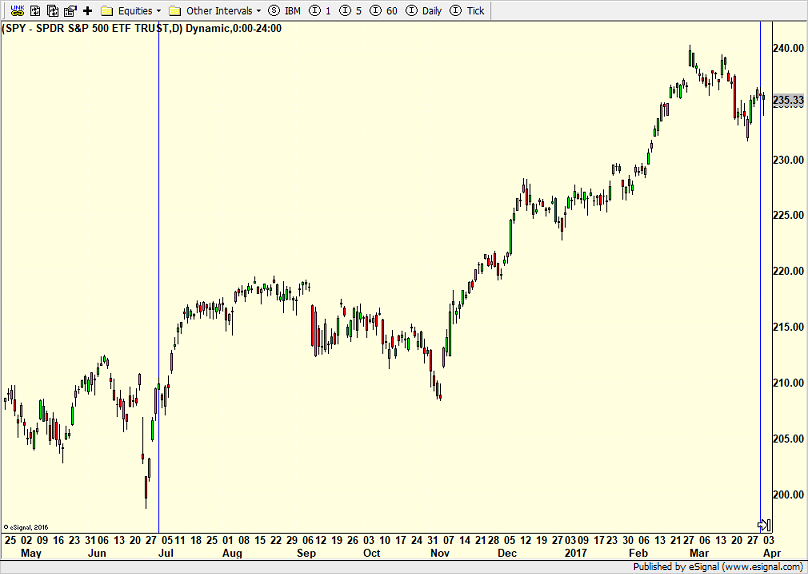

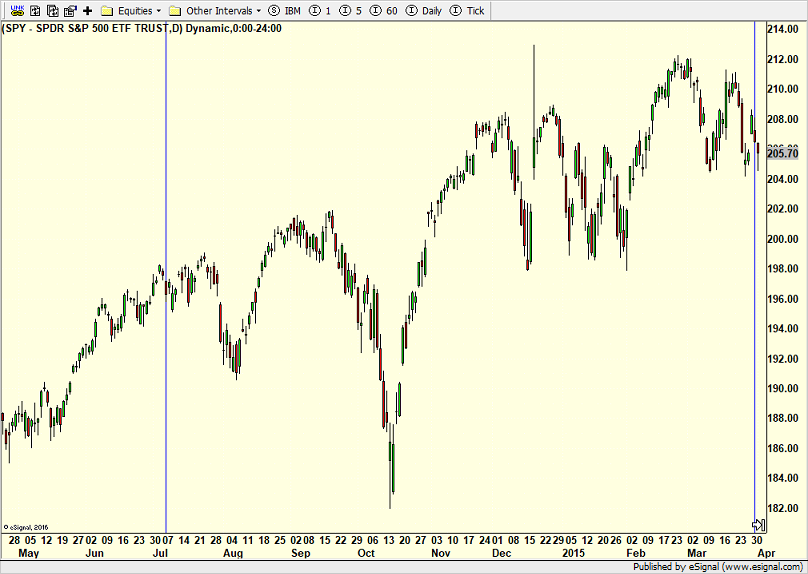

April, May and June all closed higher this year which is not exactly usual. In recent memory this occurred in 2020, 2018, 2017, 2016, 2014 and 2009. See charts below. 9 months later, the S&P 500 was up every time. That’s pretty powerful except you did have to endure a 19% decline in Q4 2018.

On Friday we bought FREL, FSTA, NUGT, PMPIX and more USHY. We sold EFA and PCY. On Monday we bought IJJ, WEBL and more XLC. We sold MTUM, IWP, XBI and some SOXL.